Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

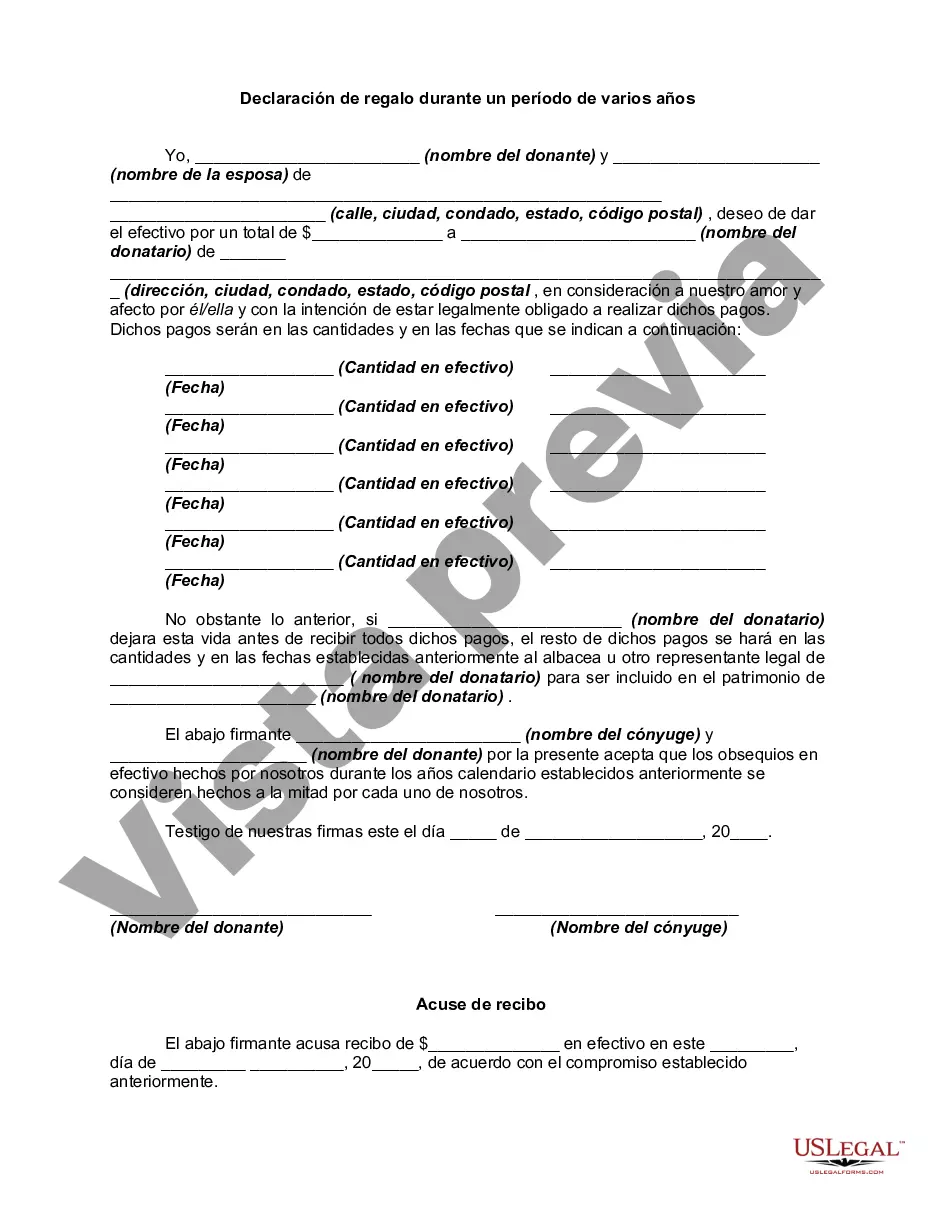

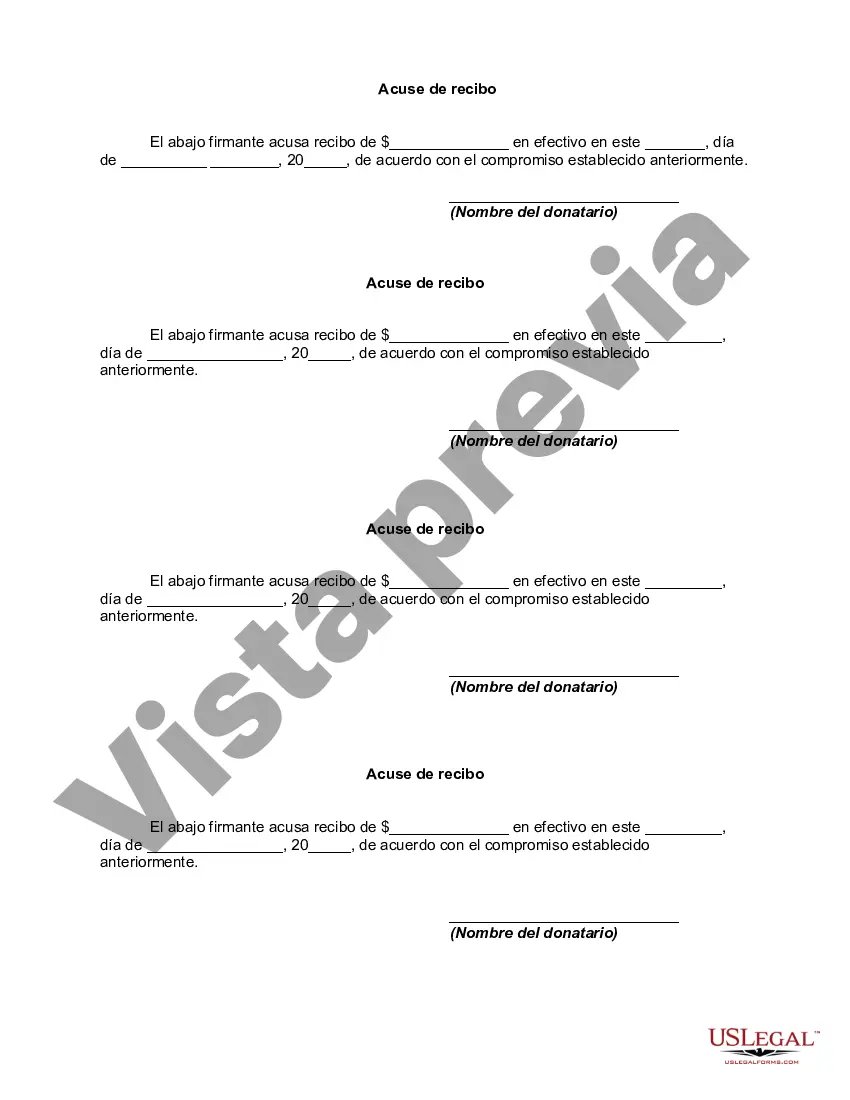

The Phoenix Arizona Declaration of Gift Over Several Year periods is a legal document that outlines the transfer of property or assets from one party to another over multiple years. This comprehensive agreement ensures that all parties involved are aware of the terms and conditions of the gift, and serves as proof of the transfer for legal purposes. The declaration includes various sections that cover the specific details of the gift, such as the date of the initial transfer, the description of the property or assets being gifted, and the estimated value of the gift. It also outlines the schedule of additional transfers that will occur over subsequent years, including the dates and specific details of each transfer. One of the key components of the Phoenix Arizona Declaration of Gift Over Several Year periods is the provision for taxes and potential liabilities. The document specifies whether the donor or the recipient will be responsible for any taxes or fees associated with the gift. This provision ensures that both parties are aware of their financial obligations and can plan accordingly. In addition to the standard declaration of gift, there may be different types of Phoenix Arizona Declaration of Gift Over Several Year periods that are designed to meet specific circumstances. Some of these variations include: 1. Phoenix Arizona Declaration of Monetary Gift Over Several Year periods: This type of declaration is used when the gift involves transferring a specific amount of money over several years. It outlines the details of the monetary gift, such as the initial amount, installment amounts, and payment schedule. 2. Phoenix Arizona Declaration of Real Estate Gift Over Several years Period: When the gift involves real estate property, this type of declaration is utilized. It includes information about the property, such as the address, legal description, and any conditions or restrictions associated with the gift. 3. Phoenix Arizona Declaration of Business Asset Gift Over Several Year periods: This variation of the declaration is used when the gift involves transferring business assets, such as equipment, inventory, or intellectual property. It details the specific assets being gifted, their value, and any related agreements or contracts. Overall, the Phoenix Arizona Declaration of Gift Over Several Year periods provides a transparent and legally-binding framework for the transfer of property or assets. Whether it's a monetary gift, real estate, or business assets, this document ensures that the transfer is conducted smoothly and protects the rights and responsibilities of all parties involved.The Phoenix Arizona Declaration of Gift Over Several Year periods is a legal document that outlines the transfer of property or assets from one party to another over multiple years. This comprehensive agreement ensures that all parties involved are aware of the terms and conditions of the gift, and serves as proof of the transfer for legal purposes. The declaration includes various sections that cover the specific details of the gift, such as the date of the initial transfer, the description of the property or assets being gifted, and the estimated value of the gift. It also outlines the schedule of additional transfers that will occur over subsequent years, including the dates and specific details of each transfer. One of the key components of the Phoenix Arizona Declaration of Gift Over Several Year periods is the provision for taxes and potential liabilities. The document specifies whether the donor or the recipient will be responsible for any taxes or fees associated with the gift. This provision ensures that both parties are aware of their financial obligations and can plan accordingly. In addition to the standard declaration of gift, there may be different types of Phoenix Arizona Declaration of Gift Over Several Year periods that are designed to meet specific circumstances. Some of these variations include: 1. Phoenix Arizona Declaration of Monetary Gift Over Several Year periods: This type of declaration is used when the gift involves transferring a specific amount of money over several years. It outlines the details of the monetary gift, such as the initial amount, installment amounts, and payment schedule. 2. Phoenix Arizona Declaration of Real Estate Gift Over Several years Period: When the gift involves real estate property, this type of declaration is utilized. It includes information about the property, such as the address, legal description, and any conditions or restrictions associated with the gift. 3. Phoenix Arizona Declaration of Business Asset Gift Over Several Year periods: This variation of the declaration is used when the gift involves transferring business assets, such as equipment, inventory, or intellectual property. It details the specific assets being gifted, their value, and any related agreements or contracts. Overall, the Phoenix Arizona Declaration of Gift Over Several Year periods provides a transparent and legally-binding framework for the transfer of property or assets. Whether it's a monetary gift, real estate, or business assets, this document ensures that the transfer is conducted smoothly and protects the rights and responsibilities of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.