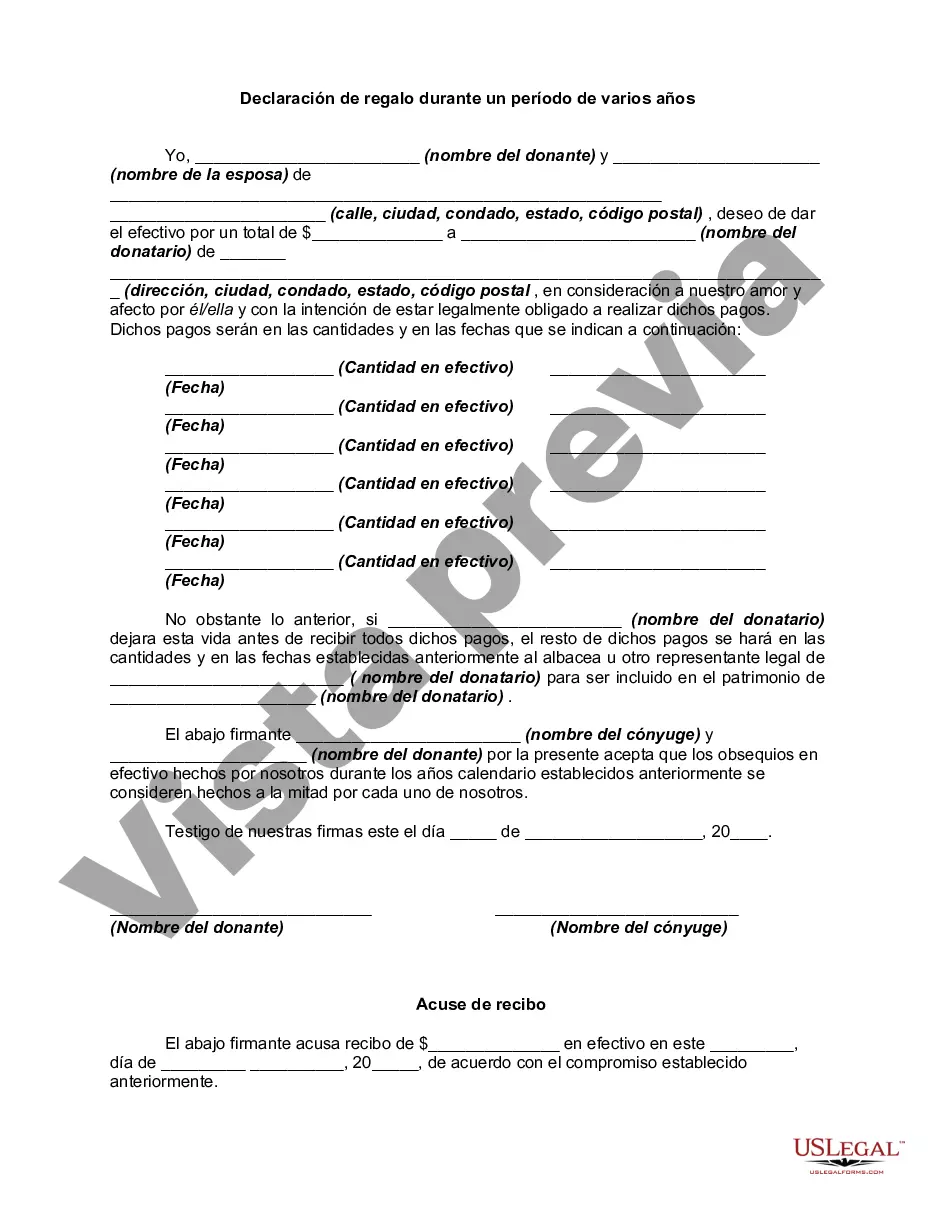

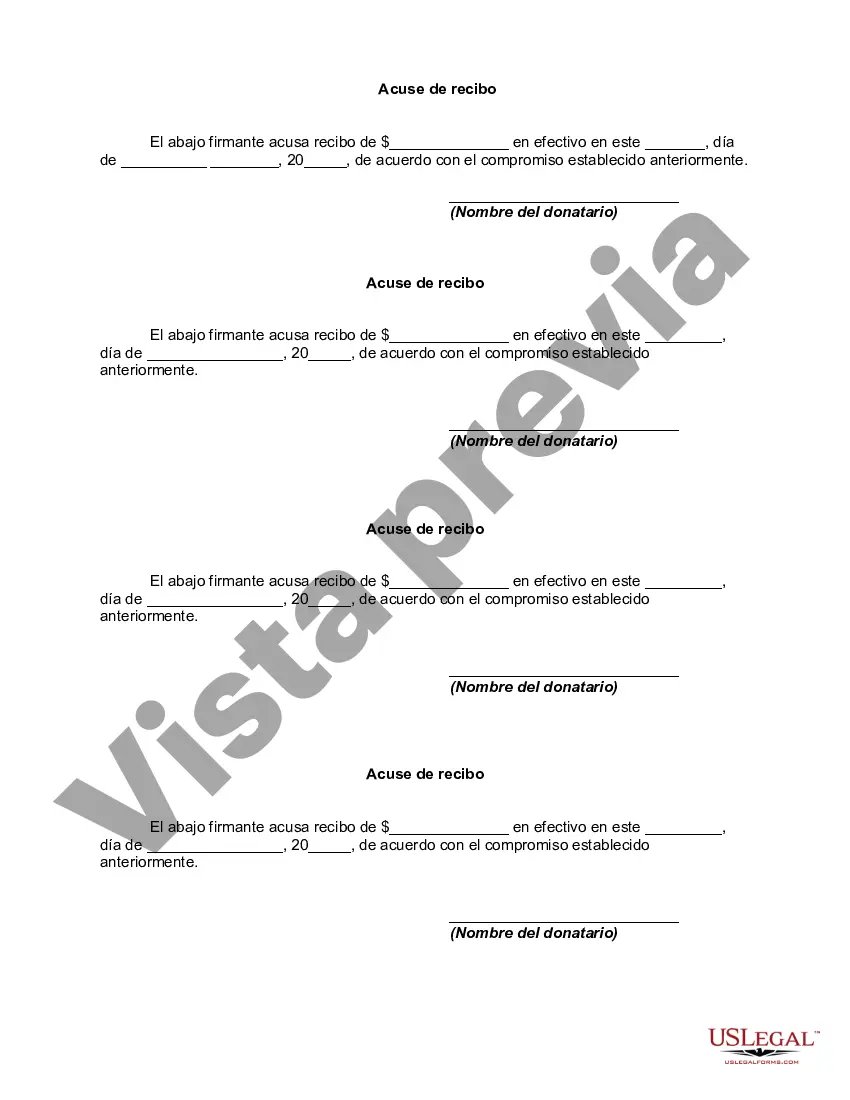

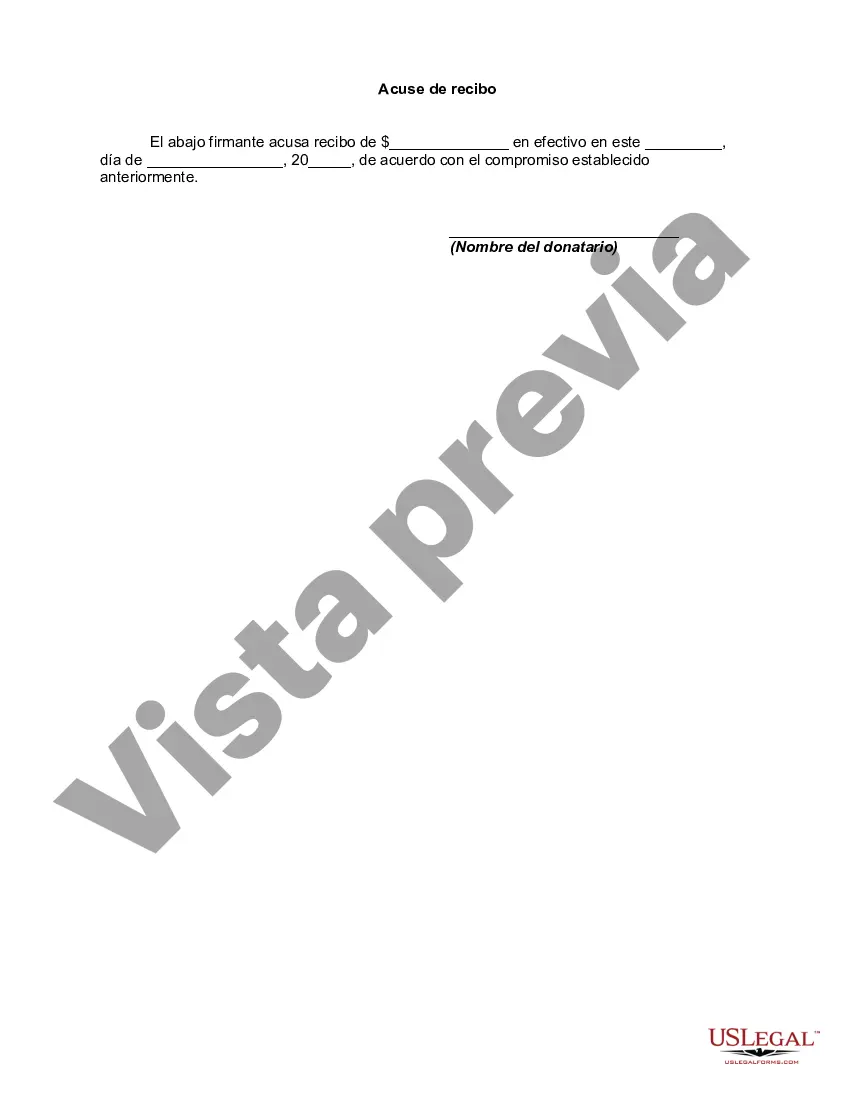

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose California Declaration of Gift Over Several Year periods is a legal document used to record the transfer of property or assets from one party to another over a period of several years. This declaration outlines the terms and conditions of the gift, as well as the responsibilities of the parties involved. The San Jose California Declaration of Gift Over Several Year Period serves as proof of the intent to gift and helps safeguard the rights of both the donor and the recipient. It ensures that the transfer of assets or property is done in a transparent and lawful manner. There are various types of San Jose California Declaration of Gift Over Several years Period, each designed to cater to specific situations: 1. Real Estate Declaration of Gift Over Several Year periods: This type of declaration pertains to the transfer of real estate properties over a period of several years. It includes details such as property description, valuation, annual transfer amounts, and other relevant terms. 2. Financial Assets Declaration of Gift Over Several Year periods: This declaration covers the gifting of financial assets, such as stocks, bonds, or mutual funds, over an extended period. It includes information about the type of asset, their valuation, transfer schedule, and any applicable tax implications. 3. Personal Property Declaration of Gift Over Several Year periods: This type of declaration applies to the transfer of personal property, such as artwork, jewelry, or vehicles, over several years. It outlines the specifics of the items being gifted, their value, transfer schedule, and any conditions attached to the gift. 4. Charitable Declaration of Gift Over Several Year periods: This declaration is used when making donations to charitable organizations or foundations over several years. It documents the donor's intent to gift a specific amount or asset annually, along with any stipulations or restrictions on the use of the gift. In all types of San Jose California Declaration of Gift Over Several years Period, it is important to include essential details such as the names and contact information of the parties involved, the gift's purpose, the duration of the gifting period, and any conditions or contingencies associated with the gift. When drafting a San Jose California Declaration of Gift Over Several years Period, it is recommended to consult with a legal professional or estate planner to ensure compliance with relevant state laws and regulations.San Jose California Declaration of Gift Over Several Year periods is a legal document used to record the transfer of property or assets from one party to another over a period of several years. This declaration outlines the terms and conditions of the gift, as well as the responsibilities of the parties involved. The San Jose California Declaration of Gift Over Several Year Period serves as proof of the intent to gift and helps safeguard the rights of both the donor and the recipient. It ensures that the transfer of assets or property is done in a transparent and lawful manner. There are various types of San Jose California Declaration of Gift Over Several years Period, each designed to cater to specific situations: 1. Real Estate Declaration of Gift Over Several Year periods: This type of declaration pertains to the transfer of real estate properties over a period of several years. It includes details such as property description, valuation, annual transfer amounts, and other relevant terms. 2. Financial Assets Declaration of Gift Over Several Year periods: This declaration covers the gifting of financial assets, such as stocks, bonds, or mutual funds, over an extended period. It includes information about the type of asset, their valuation, transfer schedule, and any applicable tax implications. 3. Personal Property Declaration of Gift Over Several Year periods: This type of declaration applies to the transfer of personal property, such as artwork, jewelry, or vehicles, over several years. It outlines the specifics of the items being gifted, their value, transfer schedule, and any conditions attached to the gift. 4. Charitable Declaration of Gift Over Several Year periods: This declaration is used when making donations to charitable organizations or foundations over several years. It documents the donor's intent to gift a specific amount or asset annually, along with any stipulations or restrictions on the use of the gift. In all types of San Jose California Declaration of Gift Over Several years Period, it is important to include essential details such as the names and contact information of the parties involved, the gift's purpose, the duration of the gifting period, and any conditions or contingencies associated with the gift. When drafting a San Jose California Declaration of Gift Over Several years Period, it is recommended to consult with a legal professional or estate planner to ensure compliance with relevant state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.