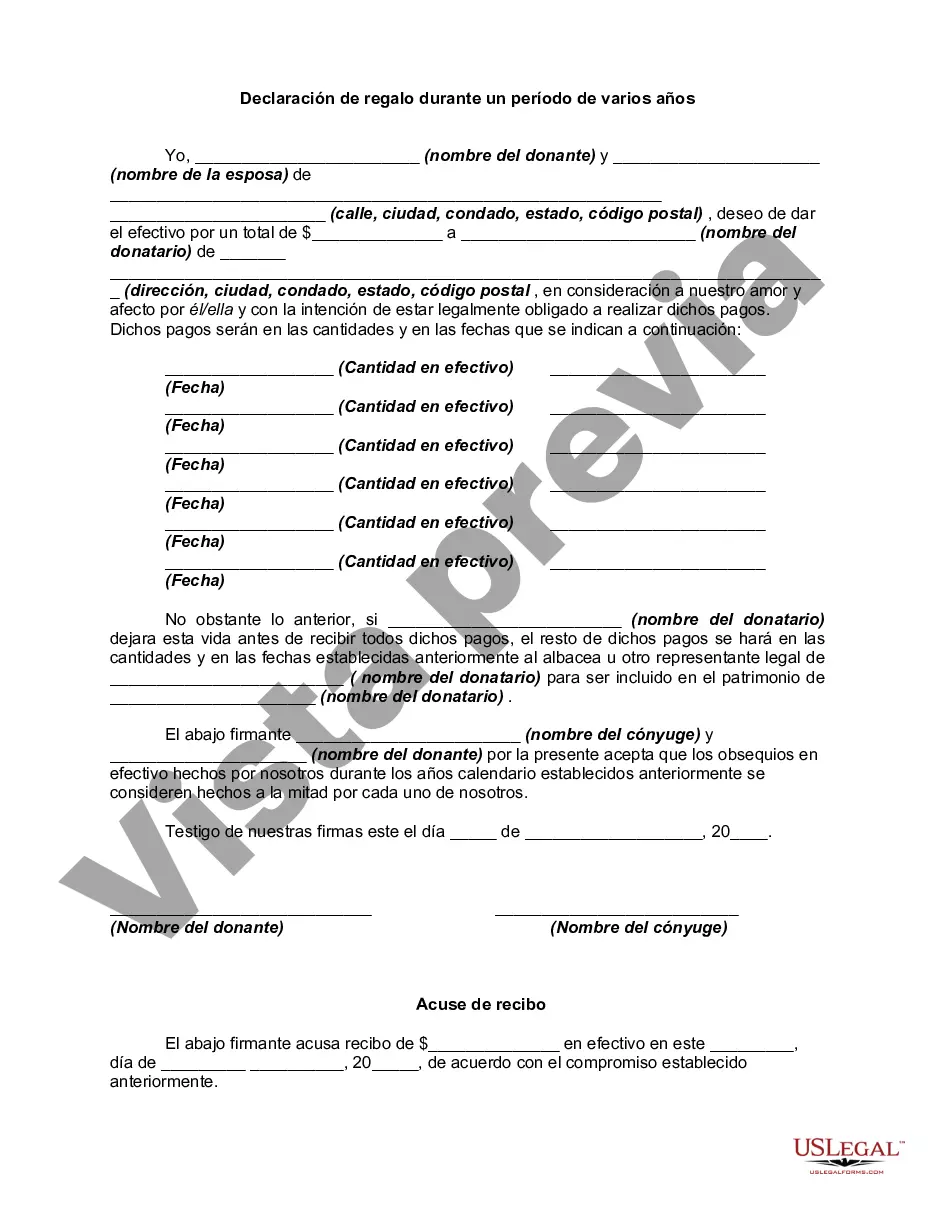

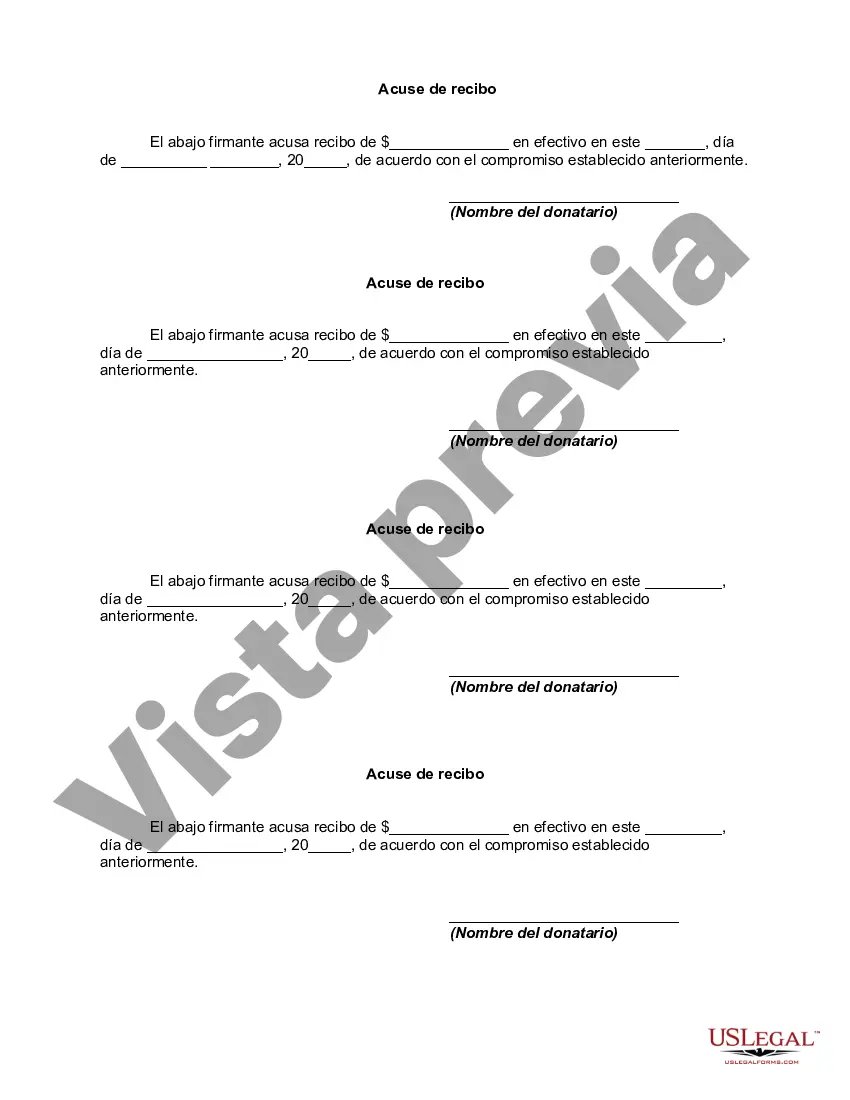

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Santa Clara California Declaration of Gift Over Several Year periods is a legal document that outlines the process and details of gifting assets or properties over multiple years. This declaration is used to ensure compliance with state laws and regulations regarding the transfer of gifts. Keywords: Santa Clara California, Declaration of Gift, Several Year periods, legal document, gifting assets, properties, compliance, gift transfer. There might be different types of Santa Clara California Declarations of Gift Over Several Year periods, based on the nature and purpose of the gifts being transferred. Some variants may include: 1. Real Estate Declaration of Gift Over Several Year periods: This type of declaration specifically deals with the gifting of real estate properties, such as houses, land, or commercial buildings, over a span of several years. It outlines the terms and conditions of the transfer and may include necessary documentation related to the properties. 2. Financial Assets Declaration of Gift Over Several Year periods: This particular declaration pertains to the gifting of financial assets, such as stocks, bonds, or mutual funds, over a specified period. It highlights the procedures, timelines, and legal requirements for transferring these assets as gifts. 3. Estate Declaration of Gift Over Several Year periods: This type of declaration caters to individuals who want to distribute their estate as gifts to beneficiaries over several years. It encompasses various assets, including real estate, financial investments, personal items, and other valuables. 4. Charitable Declaration of Gift Over Several Year periods: This variant focuses on individuals or organizations wishing to make charitable contributions over a period of multiple years. It outlines the terms, conditions, and beneficiaries of the gifts, ensuring compliance with tax laws and regulations related to charitable donations. By establishing a Santa Clara California Declaration of Gift Over Several years Period, individuals can carefully plan and execute the transfer of their assets over time, ensuring the gifts are legally recorded and properly handled according to the specific requirements of Santa Clara County in California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.