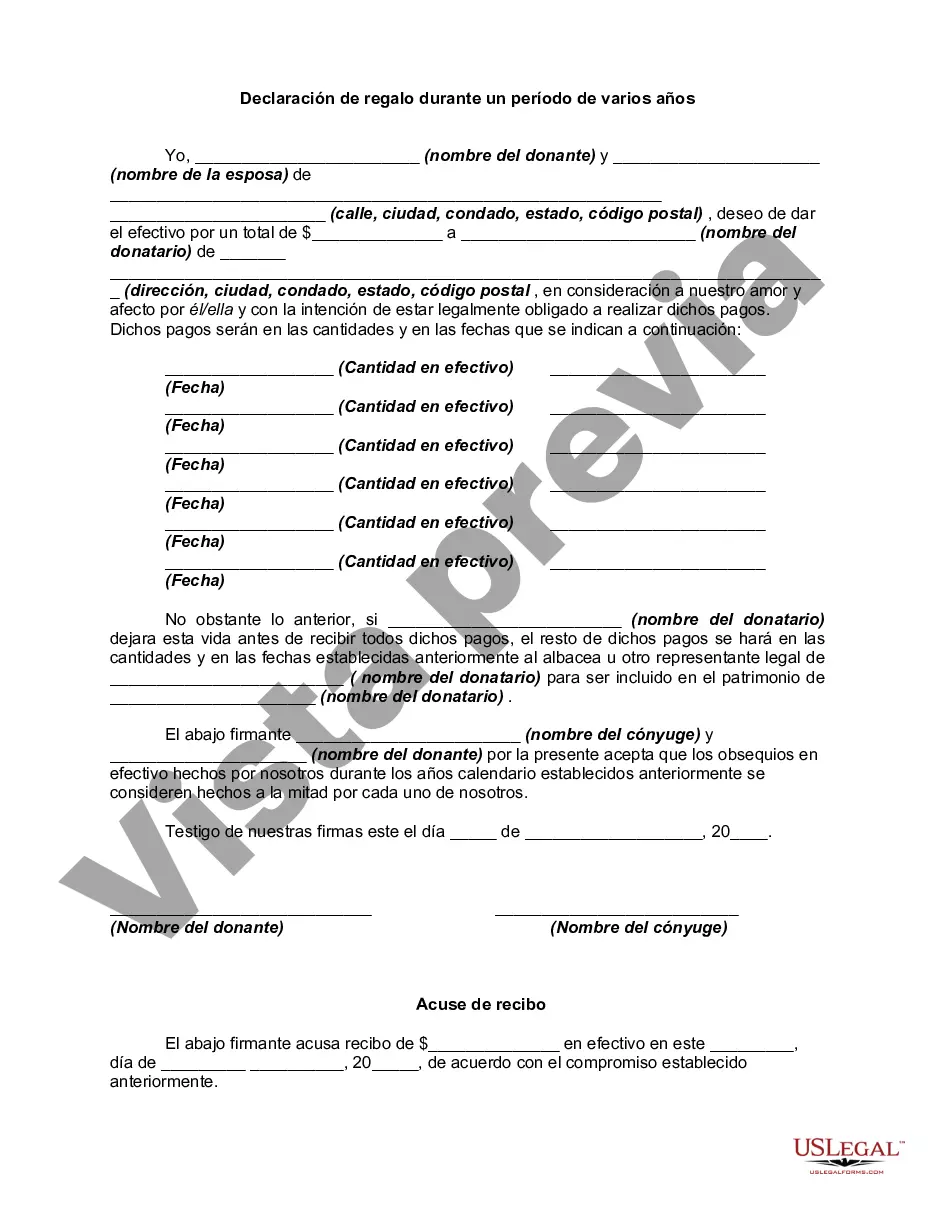

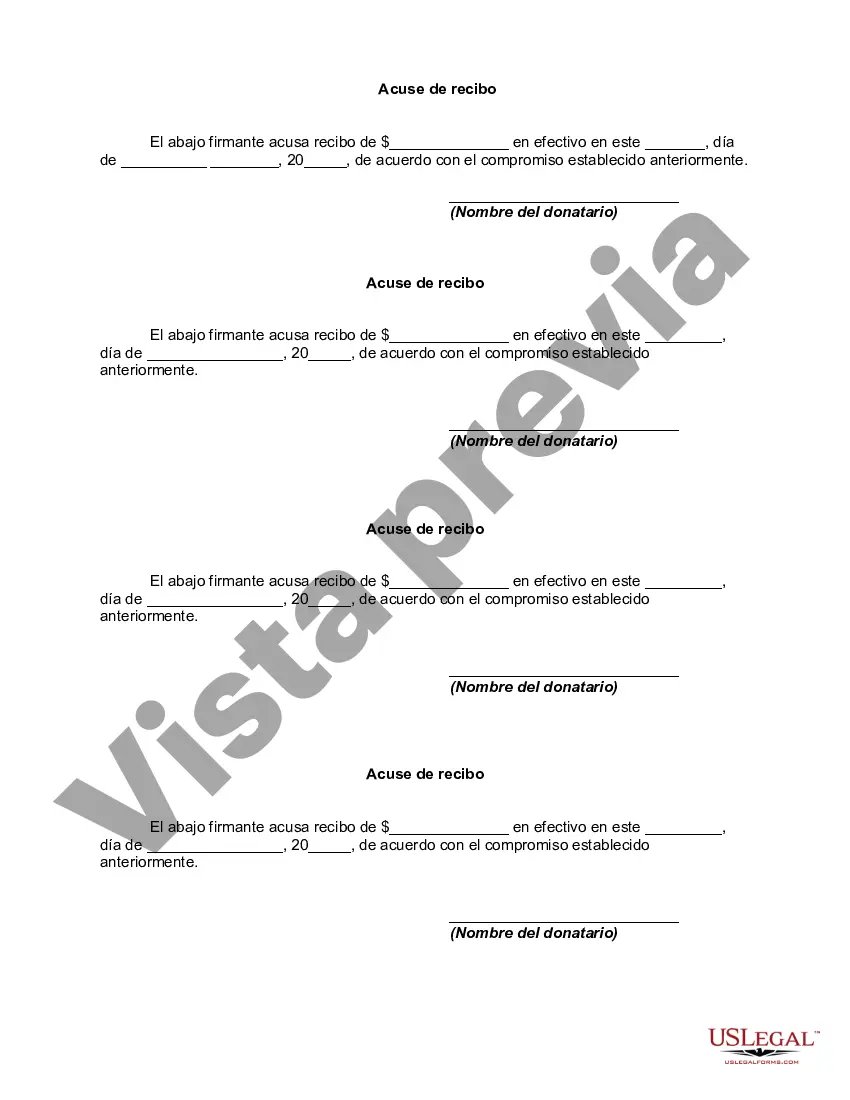

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Wayne Michigan Declaration of Gift Over Several Year periods is a legal document that outlines the transfer of assets or property from one party to another within multiple years. This declaration serves as evidence of the intent and commitment to transfer the gift over a specific period, providing legal protection and clarity for both the donor and recipient. Keywords: Wayne Michigan, Declaration of Gift Over Several Year periods, legal document, transfer of assets, property, evidence, intent, commitment, specific period, legal protection, clarity, donor, recipient. Types of Wayne Michigan Declaration of Gift Over Several Year periods: 1. Real Estate Gift Declaration: This type of declaration specifically deals with the transfer of real estate properties as gifts over several years. It includes detailed information about the property, including its address, legal description, and value. This declaration ensures that the transfer is properly documented and allows for tax planning purposes. 2. Financial Assets Gift Declaration: In cases where financial assets such as stocks, bonds, or mutual funds are being gifted over an extended period, a Financial Assets Gift Declaration is used. This declaration defines the specific assets being transferred, their value, and the timeline for the transfer. It helps both parties adhere to tax regulations and effectively manage the transfer process. 3. Business Gift Declaration: When a business owner intends to gift a portion or whole of their business to another individual or entity over several years, a Business Gift Declaration is required. This declaration outlines the nature of the business, the percentage or value being gifted, and the timeline for the transfer. It ensures that all legal requirements are met and provides a clear framework for the transition of ownership. 4. Estate Gift Declaration: An Estate Gift Declaration is utilized when a person intends to gift a portion of their estate or assets to another party over an extended period, often as part of an estate planning strategy. This declaration encompasses various types of properties, financial assets, and business interests, providing a comprehensive overview of the intended gift. 5. Charitable Gift Declaration: Individuals who plan to make charitable donations over a span of several years can utilize a Charitable Gift Declaration. This document outlines the specific charitable organizations, the amount or value of the gifts, and the timeframe for the donations. It ensures that the donor's philanthropic intentions are well-documented and allows for proper tax planning and deductions. In conclusion, the Wayne Michigan Declaration of Gift Over Several Year periods is a versatile legal document that covers different types of gift transfers, including real estate, financial assets, business interests, estate properties, and charitable donations. It provides clarity, legal protection, and tax planning benefits for both the donor and recipient involved in the transfer process.The Wayne Michigan Declaration of Gift Over Several Year periods is a legal document that outlines the transfer of assets or property from one party to another within multiple years. This declaration serves as evidence of the intent and commitment to transfer the gift over a specific period, providing legal protection and clarity for both the donor and recipient. Keywords: Wayne Michigan, Declaration of Gift Over Several Year periods, legal document, transfer of assets, property, evidence, intent, commitment, specific period, legal protection, clarity, donor, recipient. Types of Wayne Michigan Declaration of Gift Over Several Year periods: 1. Real Estate Gift Declaration: This type of declaration specifically deals with the transfer of real estate properties as gifts over several years. It includes detailed information about the property, including its address, legal description, and value. This declaration ensures that the transfer is properly documented and allows for tax planning purposes. 2. Financial Assets Gift Declaration: In cases where financial assets such as stocks, bonds, or mutual funds are being gifted over an extended period, a Financial Assets Gift Declaration is used. This declaration defines the specific assets being transferred, their value, and the timeline for the transfer. It helps both parties adhere to tax regulations and effectively manage the transfer process. 3. Business Gift Declaration: When a business owner intends to gift a portion or whole of their business to another individual or entity over several years, a Business Gift Declaration is required. This declaration outlines the nature of the business, the percentage or value being gifted, and the timeline for the transfer. It ensures that all legal requirements are met and provides a clear framework for the transition of ownership. 4. Estate Gift Declaration: An Estate Gift Declaration is utilized when a person intends to gift a portion of their estate or assets to another party over an extended period, often as part of an estate planning strategy. This declaration encompasses various types of properties, financial assets, and business interests, providing a comprehensive overview of the intended gift. 5. Charitable Gift Declaration: Individuals who plan to make charitable donations over a span of several years can utilize a Charitable Gift Declaration. This document outlines the specific charitable organizations, the amount or value of the gifts, and the timeframe for the donations. It ensures that the donor's philanthropic intentions are well-documented and allows for proper tax planning and deductions. In conclusion, the Wayne Michigan Declaration of Gift Over Several Year periods is a versatile legal document that covers different types of gift transfers, including real estate, financial assets, business interests, estate properties, and charitable donations. It provides clarity, legal protection, and tax planning benefits for both the donor and recipient involved in the transfer process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.