A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

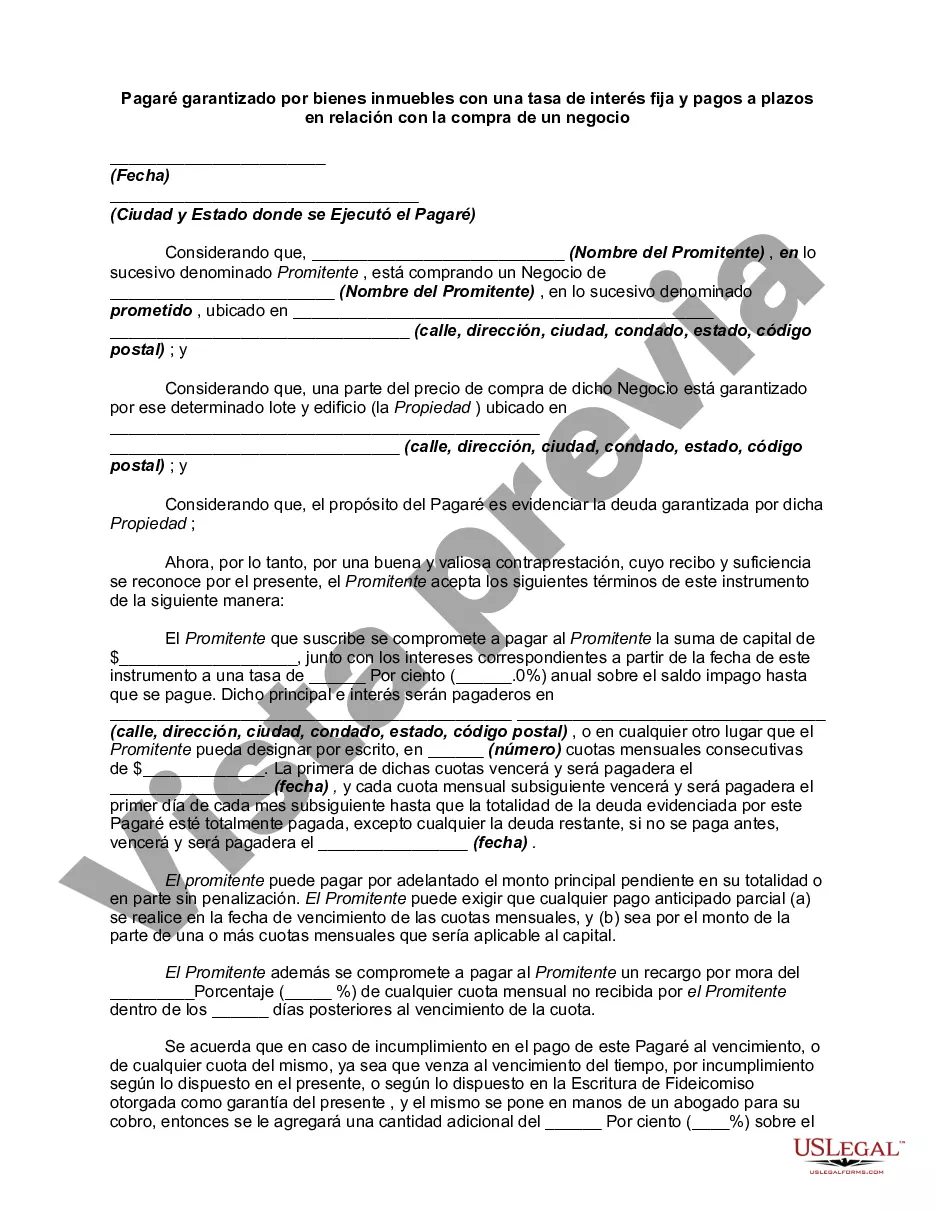

The Alameda, California Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal document that establishes a financial agreement between a buyer and a seller when purchasing a business. This type of promissory note is commonly used in the Alameda County, California area to outline the terms and conditions of the purchase, including payment details, interest rate, and securing the note with real property. The primary purpose of this promissory note is to provide financial protection to the seller, as well as clarify the terms of the purchase agreement. By securing the note with real property, such as a commercial building or land, the seller ensures that in the event of default or non-payment, they have a claim on the property to recover their investment. The note typically includes details such as the names and contact information of both parties, the agreed-upon purchase price, the amount of the down payment, the fixed interest rate, and the schedule of installment payments. The interest rate remains constant throughout the specified term of the note, ensuring that the buyer is aware of their repayment obligations. In Alameda, California, there might be different types of Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business. Some possible variations include: 1. Commercial Property Promissory Note: This type of note is specifically tailored for buying a business that operates from a commercial property, such as a retail store, office building, or restaurant. 2. Residential Property Promissory Note: If the business being purchased includes a residential property, such as a bed and breakfast or a motel, this type of note would be used to secure the purchase. 3. Mixed-Use Property Promissory Note: When buying a business that combines both residential and commercial spaces, like a live-work property or a mixed-use building, a mixed-use property promissory note is appropriate. It is crucial to consult with a legal professional experienced in Alameda, California real estate and business law to ensure the promissory note accurately reflects the parties' intentions and complies with local regulations. This detailed description provides a general overview of an Alameda, California Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business, utilizing relevant keywords.The Alameda, California Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal document that establishes a financial agreement between a buyer and a seller when purchasing a business. This type of promissory note is commonly used in the Alameda County, California area to outline the terms and conditions of the purchase, including payment details, interest rate, and securing the note with real property. The primary purpose of this promissory note is to provide financial protection to the seller, as well as clarify the terms of the purchase agreement. By securing the note with real property, such as a commercial building or land, the seller ensures that in the event of default or non-payment, they have a claim on the property to recover their investment. The note typically includes details such as the names and contact information of both parties, the agreed-upon purchase price, the amount of the down payment, the fixed interest rate, and the schedule of installment payments. The interest rate remains constant throughout the specified term of the note, ensuring that the buyer is aware of their repayment obligations. In Alameda, California, there might be different types of Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business. Some possible variations include: 1. Commercial Property Promissory Note: This type of note is specifically tailored for buying a business that operates from a commercial property, such as a retail store, office building, or restaurant. 2. Residential Property Promissory Note: If the business being purchased includes a residential property, such as a bed and breakfast or a motel, this type of note would be used to secure the purchase. 3. Mixed-Use Property Promissory Note: When buying a business that combines both residential and commercial spaces, like a live-work property or a mixed-use building, a mixed-use property promissory note is appropriate. It is crucial to consult with a legal professional experienced in Alameda, California real estate and business law to ensure the promissory note accurately reflects the parties' intentions and complies with local regulations. This detailed description provides a general overview of an Alameda, California Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business, utilizing relevant keywords.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.