A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

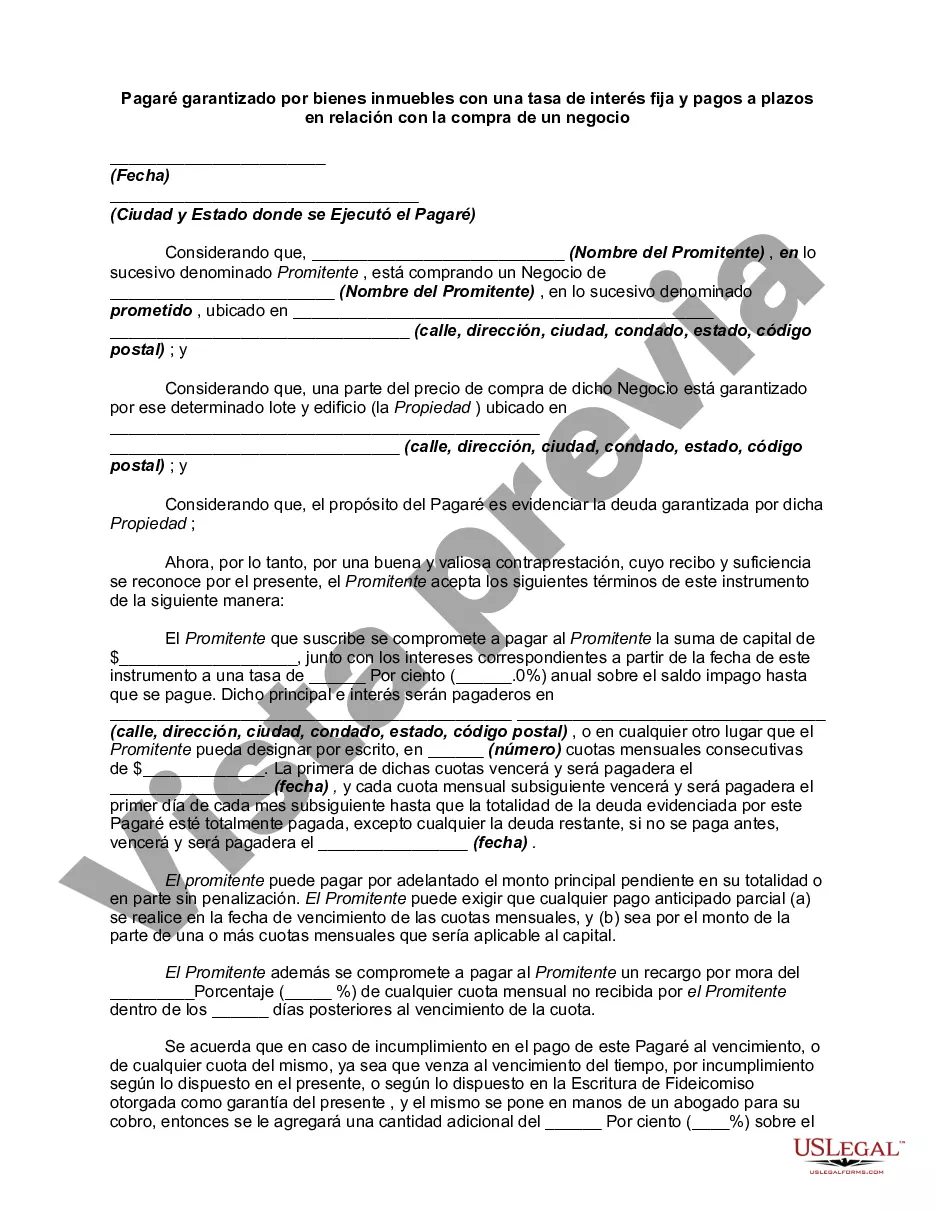

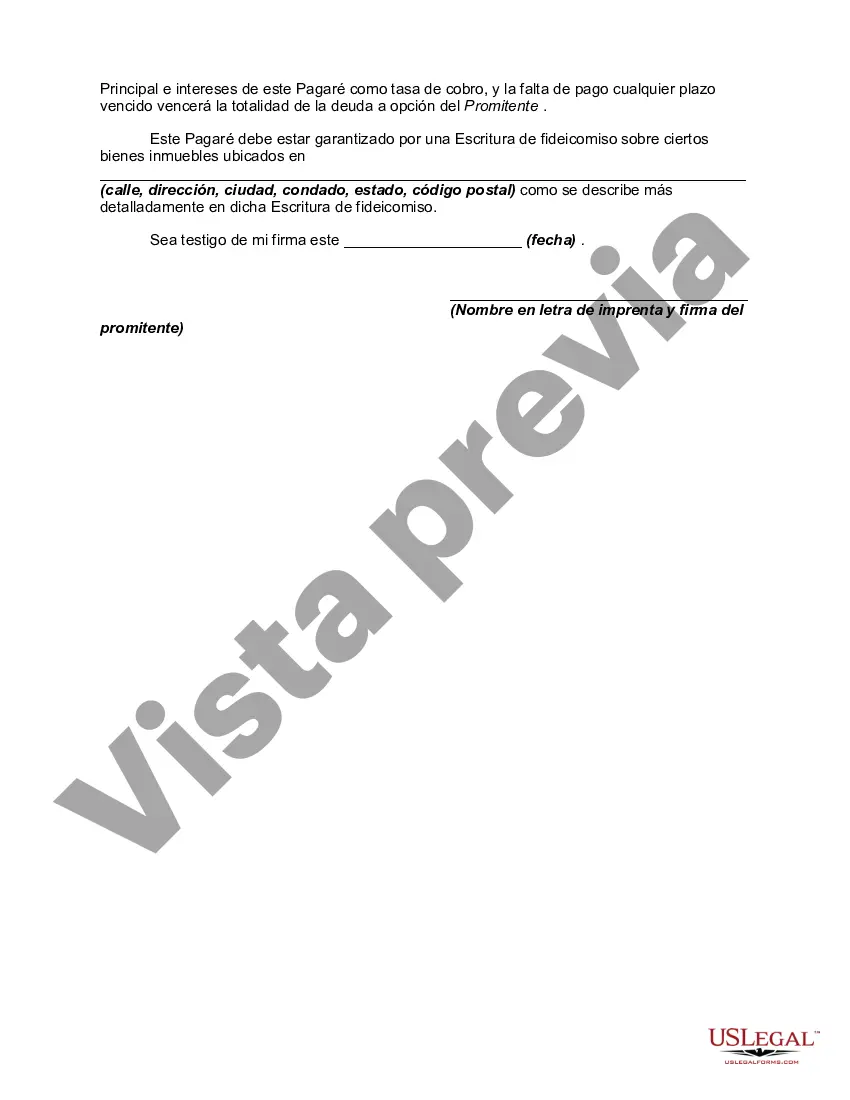

A Franklin Ohio Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal instrument that outlines the terms and conditions of a loan granted by a lender to a borrower in the context of acquiring a business. This type of promissory note is backed by real property as collateral, providing the lender with a security interest in the property in case of default. With a fixed interest rate, the borrower and lender agree upon a specific percentage that will remain consistent throughout the term of the loan. This ensures predictability in the borrower's monthly installment payments, allowing them to budget and plan accordingly. Standard provisions found in a Franklin Ohio Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business typically include: 1. Loan Amount and Interest Rate: The note specifies the principal amount being borrowed and the predetermined interest rate that will be charged by the lender. For example, a $500,000 loan with an interest rate of 4% per annum. 2. Repayment Terms: The note outlines the installment payments required by the borrower, including the frequency (monthly, quarterly, annual) and the due date of each payment. For instance, monthly payments of $5,000 due on the first of each month. 3. Maturity Date: The note specifies the final date by which the loan must be fully repaid. It's important for the borrower to adhere to this deadline to avoid defaulting on the loan. 4. Consequences of Default: The note details the penalties or remedies that will be enforced in case of default, granting the lender the right to foreclose on the real property securing the loan. Potential consequences may include late fees, acceleration of the loan, or even legal action by the lender. 5. Collateral Description: The note includes a detailed description of the real property being used as collateral, including its address, legal description, and any existing liens or encumbrances on the property. Additional types of Franklin Ohio Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business may include variations based on the duration of the loan, specific terms for interest calculations or payments, or other unique conditions agreed upon by both parties. Nonetheless, the fundamental elements mentioned above generally form the core components of such promissory notes.A Franklin Ohio Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal instrument that outlines the terms and conditions of a loan granted by a lender to a borrower in the context of acquiring a business. This type of promissory note is backed by real property as collateral, providing the lender with a security interest in the property in case of default. With a fixed interest rate, the borrower and lender agree upon a specific percentage that will remain consistent throughout the term of the loan. This ensures predictability in the borrower's monthly installment payments, allowing them to budget and plan accordingly. Standard provisions found in a Franklin Ohio Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business typically include: 1. Loan Amount and Interest Rate: The note specifies the principal amount being borrowed and the predetermined interest rate that will be charged by the lender. For example, a $500,000 loan with an interest rate of 4% per annum. 2. Repayment Terms: The note outlines the installment payments required by the borrower, including the frequency (monthly, quarterly, annual) and the due date of each payment. For instance, monthly payments of $5,000 due on the first of each month. 3. Maturity Date: The note specifies the final date by which the loan must be fully repaid. It's important for the borrower to adhere to this deadline to avoid defaulting on the loan. 4. Consequences of Default: The note details the penalties or remedies that will be enforced in case of default, granting the lender the right to foreclose on the real property securing the loan. Potential consequences may include late fees, acceleration of the loan, or even legal action by the lender. 5. Collateral Description: The note includes a detailed description of the real property being used as collateral, including its address, legal description, and any existing liens or encumbrances on the property. Additional types of Franklin Ohio Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business may include variations based on the duration of the loan, specific terms for interest calculations or payments, or other unique conditions agreed upon by both parties. Nonetheless, the fundamental elements mentioned above generally form the core components of such promissory notes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.