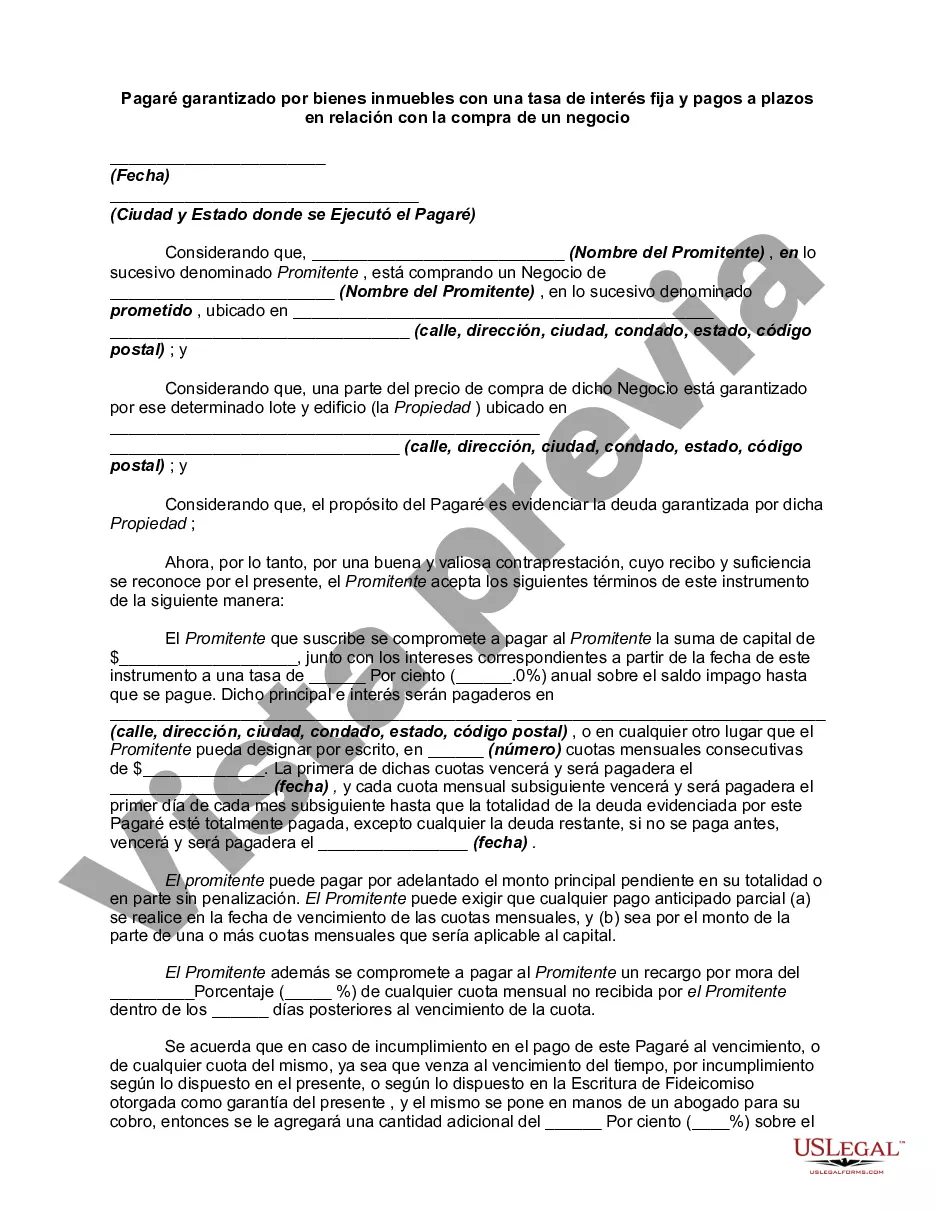

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

A Nassau New York Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legally binding document that outlines the terms and conditions of a loan used to finance the acquisition of a business property in Nassau County, New York. This type of promissory note provides security to the lender by using the purchased real property as collateral. The fixed interest rate ensures that the borrower pays a consistent rate of interest over the loan term, providing predictability for both parties involved. Additionally, the installment payments structure allows the borrower to repay the loan in predetermined amounts over a specified period, often monthly or quarterly. There can be variations in the Nassau New York Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business, depending on the specific details and negotiated terms between the buyer and the lender. Some possible types of such promissory notes may include: 1. Commercial Real Estate Promissory Note: This type of promissory note specifically pertains to loans made for the purchase of commercial properties, such as retail spaces, offices, or industrial buildings. 2. Residential Real Estate Promissory Note: This variation of the promissory note is intended for loans secured by residential properties, such as houses or apartments, that are being used for business purposes. 3. Business Asset Purchase Promissory Note: In some cases, the promissory note might be used to secure a loan for the acquisition of business assets, such as equipment, vehicles, or inventory, rather than solely for real property. However, the note would still be secured by real property as collateral. 4. Promissory Note with Balloon Payment: This variant includes a larger final payment, known as a balloon payment, which is due at the end of the loan term. The regular installment payments made throughout the loan period are usually smaller, with the expectation that the borrower will refinance or pay off the balance in full when the balloon payment becomes due. It is crucial for both the borrower and the lender to carefully review and understand the terms and conditions of the specific promissory note they enter into. Seeking legal advice or assistance in drafting or reviewing the detailed agreement is recommended to ensure compliance with all applicable laws and protect the interests of both parties involved.A Nassau New York Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legally binding document that outlines the terms and conditions of a loan used to finance the acquisition of a business property in Nassau County, New York. This type of promissory note provides security to the lender by using the purchased real property as collateral. The fixed interest rate ensures that the borrower pays a consistent rate of interest over the loan term, providing predictability for both parties involved. Additionally, the installment payments structure allows the borrower to repay the loan in predetermined amounts over a specified period, often monthly or quarterly. There can be variations in the Nassau New York Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business, depending on the specific details and negotiated terms between the buyer and the lender. Some possible types of such promissory notes may include: 1. Commercial Real Estate Promissory Note: This type of promissory note specifically pertains to loans made for the purchase of commercial properties, such as retail spaces, offices, or industrial buildings. 2. Residential Real Estate Promissory Note: This variation of the promissory note is intended for loans secured by residential properties, such as houses or apartments, that are being used for business purposes. 3. Business Asset Purchase Promissory Note: In some cases, the promissory note might be used to secure a loan for the acquisition of business assets, such as equipment, vehicles, or inventory, rather than solely for real property. However, the note would still be secured by real property as collateral. 4. Promissory Note with Balloon Payment: This variant includes a larger final payment, known as a balloon payment, which is due at the end of the loan term. The regular installment payments made throughout the loan period are usually smaller, with the expectation that the borrower will refinance or pay off the balance in full when the balloon payment becomes due. It is crucial for both the borrower and the lender to carefully review and understand the terms and conditions of the specific promissory note they enter into. Seeking legal advice or assistance in drafting or reviewing the detailed agreement is recommended to ensure compliance with all applicable laws and protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.