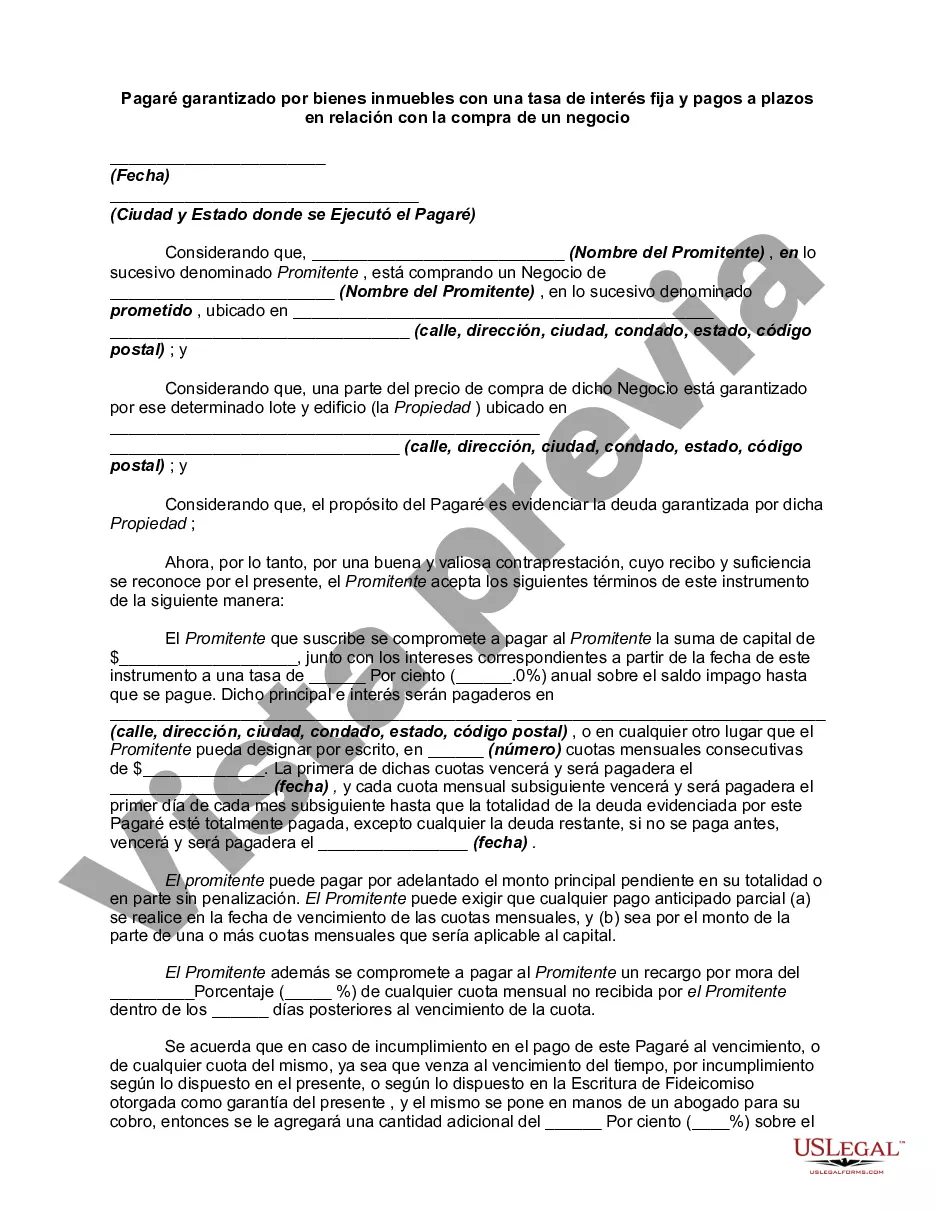

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

A Phoenix Arizona Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments is a legal document that outlines the terms and conditions of a loan used to finance the purchase of a business in Phoenix, Arizona. This type of promissory note serves as a legally binding agreement between the borrower and the lender, setting forth the specific details of the loan transaction. The promissory note is secured by real property, meaning that the borrower pledges a piece of property as collateral to ensure repayment of the loan. This offers security to the lender in case of default. Key elements of a Phoenix Arizona Promissory Note secured by Real Property include the fixed interest rate and the installment payments. The fixed interest rate ensures that both parties know and agree upon the interest rate for the entire duration of the loan, providing stability and predictability for the borrower and lender. The installment payments establish a repayment schedule, with regular payments made over a specified period of time. These payments may include both principal and interest, allowing the borrower to gradually pay off the loan while ensuring the lender receives the agreed-upon interest rate. There may be different types of Phoenix Arizona Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business, which vary based on factors such as loan duration, loan amount, and the specific terms negotiated between the borrower and the lender. Some examples include: 1. Short-term promissory notes: These promissory notes typically have a shorter repayment period, ranging from a few months to a couple of years. They are often used for smaller loan amounts or temporary financing needs. 2. Long-term promissory notes: These notes have a longer repayment period, typically spanning multiple years. They are commonly utilized when purchasing larger businesses or when a borrower requires an extended period for loan repayment. 3. Balloon promissory notes: In a balloon note, the borrower makes regular, smaller payments for a predetermined period of time, after which a larger final payment (the balloon payment) is due. These notes may be suitable for borrowers who expect a significant cash flow or financial gain in the future. 4. Adjustable-rate promissory notes: Instead of a fixed interest rate, these notes have an interest rate that is subject to change over time. The adjustments are typically based on an index, such as the prime rate. These notes offer the potential for lower interest rates initially but come with uncertainty as the interest rate can fluctuate. It is important for both parties involved in a purchase of a business to thoroughly review the terms and conditions outlined in the Phoenix Arizona Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments. Seeking legal advice and conducting due diligence can ensure that the agreement reflects the intentions of both the borrower and the lender and provides the necessary legal protection.A Phoenix Arizona Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments is a legal document that outlines the terms and conditions of a loan used to finance the purchase of a business in Phoenix, Arizona. This type of promissory note serves as a legally binding agreement between the borrower and the lender, setting forth the specific details of the loan transaction. The promissory note is secured by real property, meaning that the borrower pledges a piece of property as collateral to ensure repayment of the loan. This offers security to the lender in case of default. Key elements of a Phoenix Arizona Promissory Note secured by Real Property include the fixed interest rate and the installment payments. The fixed interest rate ensures that both parties know and agree upon the interest rate for the entire duration of the loan, providing stability and predictability for the borrower and lender. The installment payments establish a repayment schedule, with regular payments made over a specified period of time. These payments may include both principal and interest, allowing the borrower to gradually pay off the loan while ensuring the lender receives the agreed-upon interest rate. There may be different types of Phoenix Arizona Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business, which vary based on factors such as loan duration, loan amount, and the specific terms negotiated between the borrower and the lender. Some examples include: 1. Short-term promissory notes: These promissory notes typically have a shorter repayment period, ranging from a few months to a couple of years. They are often used for smaller loan amounts or temporary financing needs. 2. Long-term promissory notes: These notes have a longer repayment period, typically spanning multiple years. They are commonly utilized when purchasing larger businesses or when a borrower requires an extended period for loan repayment. 3. Balloon promissory notes: In a balloon note, the borrower makes regular, smaller payments for a predetermined period of time, after which a larger final payment (the balloon payment) is due. These notes may be suitable for borrowers who expect a significant cash flow or financial gain in the future. 4. Adjustable-rate promissory notes: Instead of a fixed interest rate, these notes have an interest rate that is subject to change over time. The adjustments are typically based on an index, such as the prime rate. These notes offer the potential for lower interest rates initially but come with uncertainty as the interest rate can fluctuate. It is important for both parties involved in a purchase of a business to thoroughly review the terms and conditions outlined in the Phoenix Arizona Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments. Seeking legal advice and conducting due diligence can ensure that the agreement reflects the intentions of both the borrower and the lender and provides the necessary legal protection.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.