A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

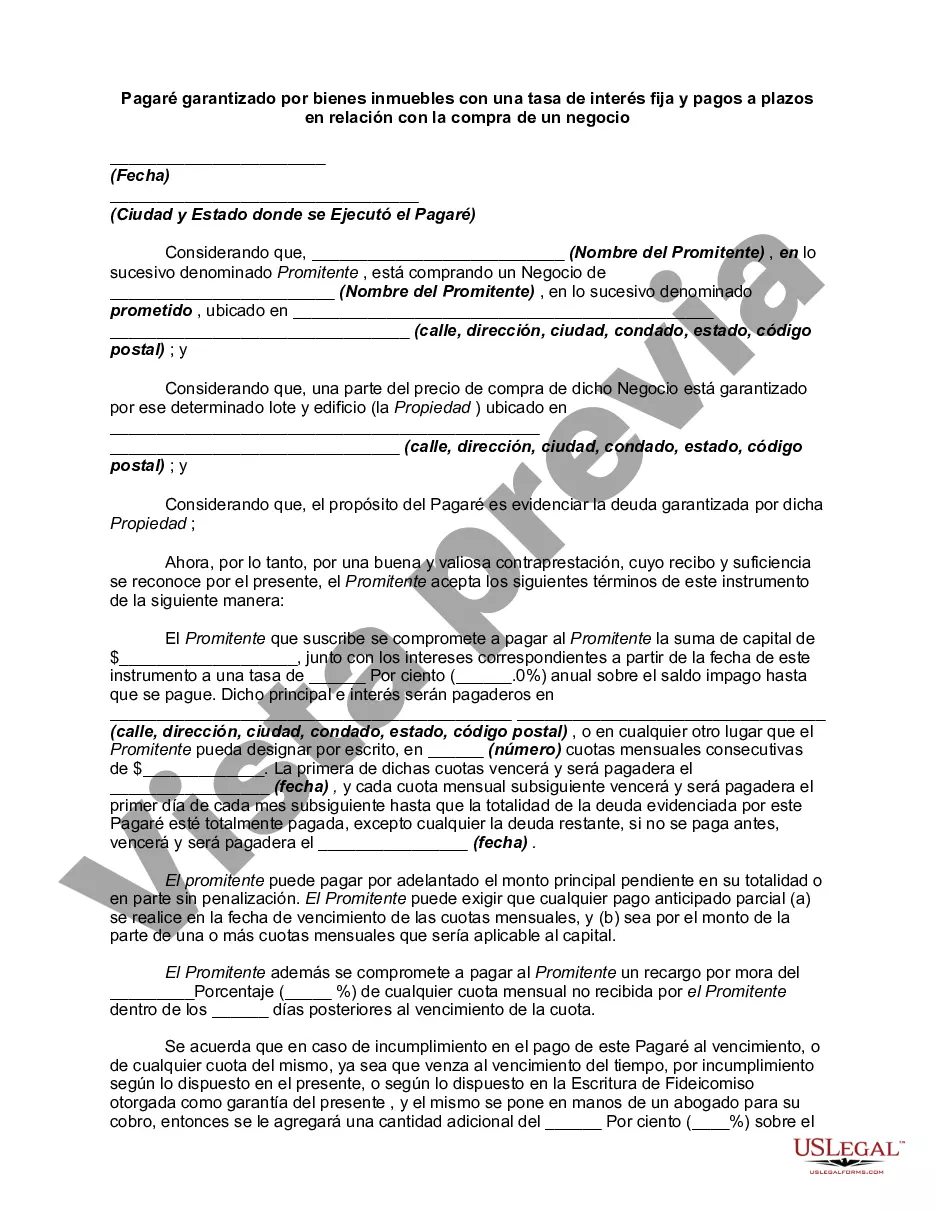

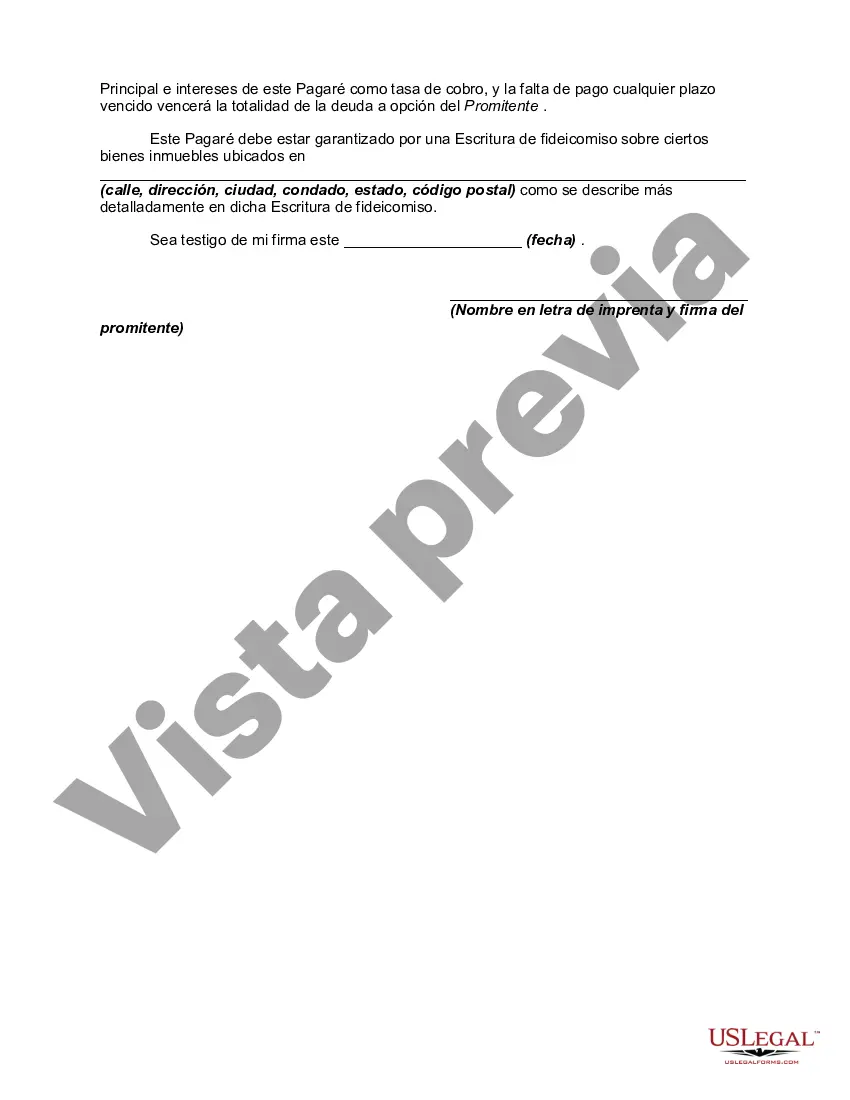

A Salt Lake City, Utah Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal document that outlines the terms of a loan agreement between a buyer and a seller in a business transaction. This specific type of promissory note is used when the buyer agrees to purchase a business and secures the loan using real property as collateral. The promissory note includes important details such as the names of the parties involved, the date of the agreement, and the specific terms of the loan. It specifies the fixed interest rate to be applied to the principal amount, which remains constant throughout the duration of the loan. The interest rate is agreed upon by both the buyer and seller, and it is typically determined based on market rates and the creditworthiness of the buyer. Installment payments are set out in the promissory note, outlining the frequency and amount of the payments to be made. These payments are usually made at regular intervals, such as monthly, quarterly, or annually, until the loan is fully repaid. The payment schedule is agreed upon before the sale of the business is finalized. The promissory note also highlights the consequences of default, including the potential foreclosure of the real property used as collateral. It may include provisions for late fees, penalties, or additional interest charges in the event of non-payment or default. Different types of Salt Lake City, Utah Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business may include variations based on the specific terms agreed upon by the buyer and the seller. For example, the promissory note may contain provisions for prepayment penalties, balloon payments, or adjustable interest rates. These variations depend on the preferences and negotiations between the parties involved. In conclusion, a Salt Lake City, Utah Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legally-binding document that ensures the buyer's repayment of a loan used to purchase a business. By securing the loan with real property and establishing a fixed interest rate with installment payments, this promissory note protects the interests of both the buyer and the seller in the transaction.A Salt Lake City, Utah Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal document that outlines the terms of a loan agreement between a buyer and a seller in a business transaction. This specific type of promissory note is used when the buyer agrees to purchase a business and secures the loan using real property as collateral. The promissory note includes important details such as the names of the parties involved, the date of the agreement, and the specific terms of the loan. It specifies the fixed interest rate to be applied to the principal amount, which remains constant throughout the duration of the loan. The interest rate is agreed upon by both the buyer and seller, and it is typically determined based on market rates and the creditworthiness of the buyer. Installment payments are set out in the promissory note, outlining the frequency and amount of the payments to be made. These payments are usually made at regular intervals, such as monthly, quarterly, or annually, until the loan is fully repaid. The payment schedule is agreed upon before the sale of the business is finalized. The promissory note also highlights the consequences of default, including the potential foreclosure of the real property used as collateral. It may include provisions for late fees, penalties, or additional interest charges in the event of non-payment or default. Different types of Salt Lake City, Utah Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business may include variations based on the specific terms agreed upon by the buyer and the seller. For example, the promissory note may contain provisions for prepayment penalties, balloon payments, or adjustable interest rates. These variations depend on the preferences and negotiations between the parties involved. In conclusion, a Salt Lake City, Utah Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legally-binding document that ensures the buyer's repayment of a loan used to purchase a business. By securing the loan with real property and establishing a fixed interest rate with installment payments, this promissory note protects the interests of both the buyer and the seller in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.