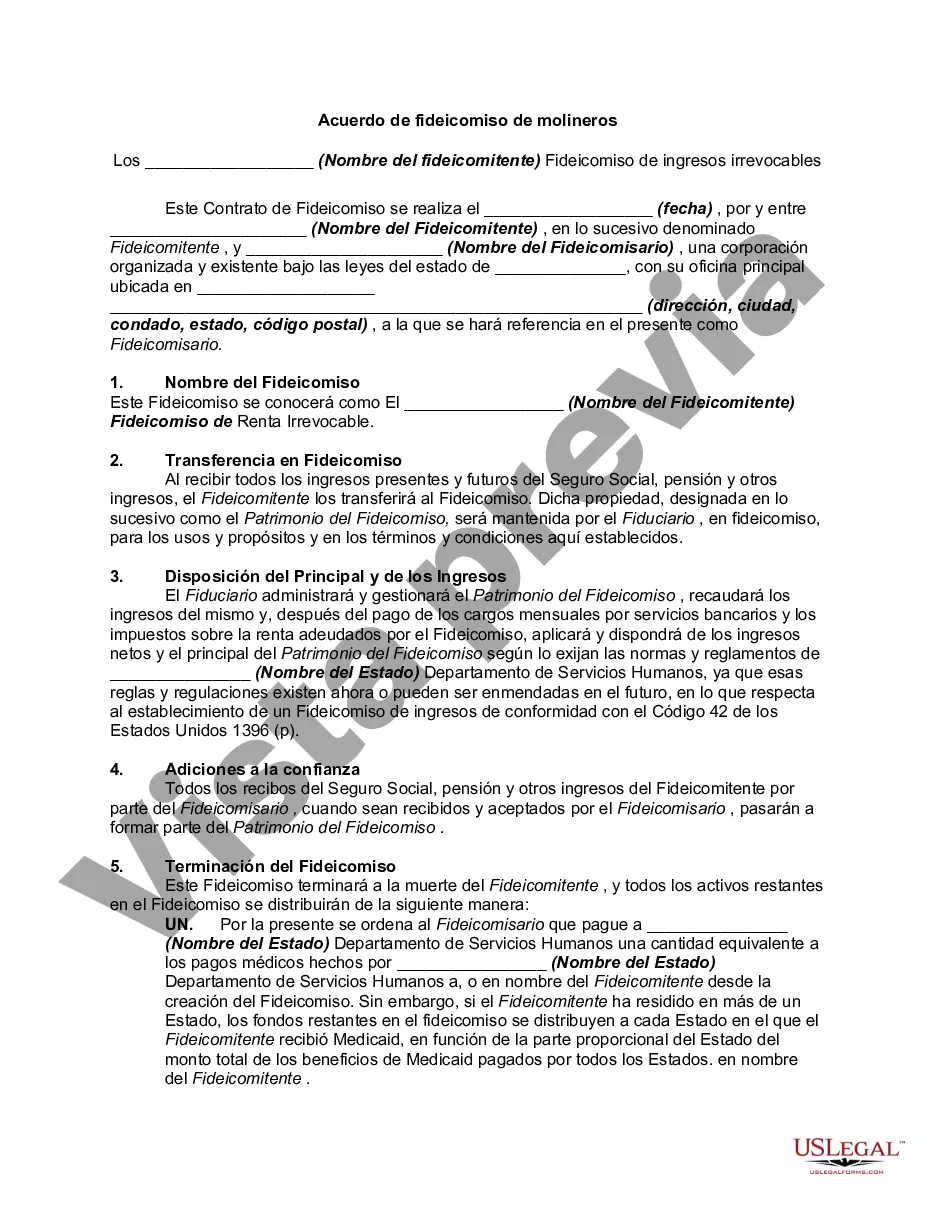

Cook Illinois Miller Trust Forms for Assisted Living are legal documents designed to help individuals residing in assisted living facilities in Cook County, Illinois, to secure Medicaid benefits for long-term care services. These forms are specifically tailored to meet the requirements set forth by the Illinois Department of Healthcare and Family Services. By establishing a Miller Trust, individuals can potentially qualify for Medicaid while still having access to their income. The Cook Illinois Miller Trust Forms for Assisted Living consists of several important documents that need to be completed accurately. These forms include the Trust Agreement, Personal Service Contract, and Income Assignment, among others. Each form serves a specific purpose and is crucial in creating a legally compliant and efficient Miller Trust. The Trust Agreement is the core document, which details the establishment and management of the Miller Trust. It outlines the beneficiary's rights, the trustee's responsibilities, and the terms and conditions governing the trust. This document ensures that all income received by the beneficiary is properly deposited into the trust account to satisfy Medicaid's income eligibility requirements. The Personal Service Contract is another important form that may be required in certain cases. This contract formalizes an agreement between the beneficiary and a caregiver, typically a family member, who assists with various personal services. The contract specifies the services to be provided and the compensation for those services. Including a personal service contract can help ensure that income is appropriately allocated, adhering to Medicaid guidelines. Lastly, the Income Assignment form directs the income sources, such as pension or Social Security, to be automatically deposited into the Miller Trust account. This form must be signed by the beneficiary and submitted to the appropriate income source parties to ensure proper routing of income. It's worth noting that while the forms mentioned above represent the main components of Cook Illinois Miller Trusts for Assisted Living, there may be variations in the forms depending on individual circumstances and requirements. For instance, additional documentation may be needed for individuals with complex financial situations or unique sources of income. In conclusion, Cook Illinois Miller Trust Forms for Assisted Living play a significant role in helping individuals seeking Medicaid benefits while residing in assisted living facilities in Cook County, Illinois. These forms, including the Trust Agreement, Personal Service Contract, and Income Assignment, among others, are essential in establishing a legally compliant Miller Trust and ensuring that income is managed properly to meet Medicaid eligibility guidelines.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formularios de confianza de Miller para vida asistida - Miller Trust Forms for Assisted Living

Description

How to fill out Cook Illinois Formularios De Confianza De Miller Para Vida Asistida?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Cook Miller Trust Forms for Assisted Living, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the Cook Miller Trust Forms for Assisted Living, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cook Miller Trust Forms for Assisted Living:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Cook Miller Trust Forms for Assisted Living and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!