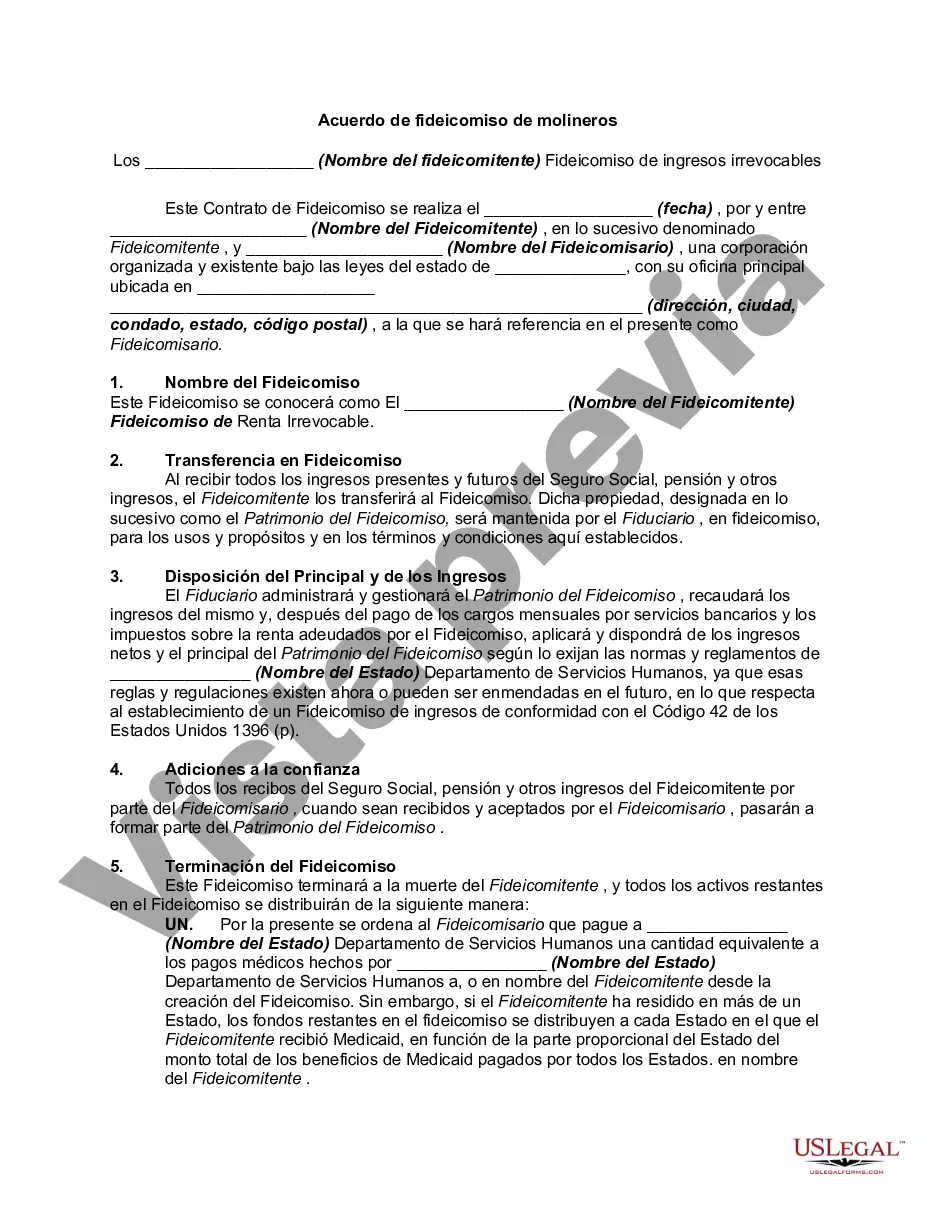

Franklin Ohio Miller Trust Forms for Assisted Living are legal documents designed to help Medicaid applicants qualify for long-term care benefits while still protecting their income. These forms allow individuals with excess income to deposit it into a special trust account, called a Miller Trust, which is then used to pay for their assisted living expenses. The Miller Trust is named after a landmark court case, Miller v. Ibarra, which established the legal framework for creating these trusts. They are particularly relevant in Franklin, Ohio, where seniors often rely on Medicaid to cover the costs of their assisted living services. There are different types of Franklin Ohio Miller Trust Forms for Assisted Living, each tailored to meet specific needs: 1. Medicaid Miller Trust Form: This is the most common type of Miller Trust form used in Franklin, Ohio. It allows individuals above the Medicaid income threshold to transfer their excess income into the trust, thereby making them eligible for Medicaid benefits. 2. Spousal Miller Trust Form: This form is specifically designed for married couples where one spouse requires to be assisted living services. It permits the community spouse, whose income may exceed the Medicaid limit, to transfer excess income into the trust for the benefit of the spouse needing care. 3. Irrevocable Miller Trust Form: This form ensures that the trust assets cannot be accessed or changed once the trust is established. It helps protect the funds from Medicaid recovery efforts after the individual's demise. 4. Revocable Miller Trust Form: Unlike the irrevocable trust form, this form allows the granter to modify or revoke the trust during their lifetime. Although revocable trusts are subject to Medicaid's income limitations, they still offer some level of control and flexibility. The Franklin Ohio Miller Trust Forms for Assisted Living aim to assist seniors in qualifying for Medicaid benefits without having to exhaust their savings on assisted living expenses. By utilizing these forms appropriately, individuals can ensure the affordability of their long-term care while still complying with the Medicaid regulations. It is recommended to consult with an experienced elder law attorney or Medicaid planner to understand the specific requirements and nuances of these forms for Assisted Living in Franklin, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Formularios de confianza de Miller para vida asistida - Miller Trust Forms for Assisted Living

Description

How to fill out Franklin Ohio Formularios De Confianza De Miller Para Vida Asistida?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any individual or business objective utilized in your region, including the Franklin Miller Trust Forms for Assisted Living.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Franklin Miller Trust Forms for Assisted Living will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Franklin Miller Trust Forms for Assisted Living:

- Ensure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Franklin Miller Trust Forms for Assisted Living on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!