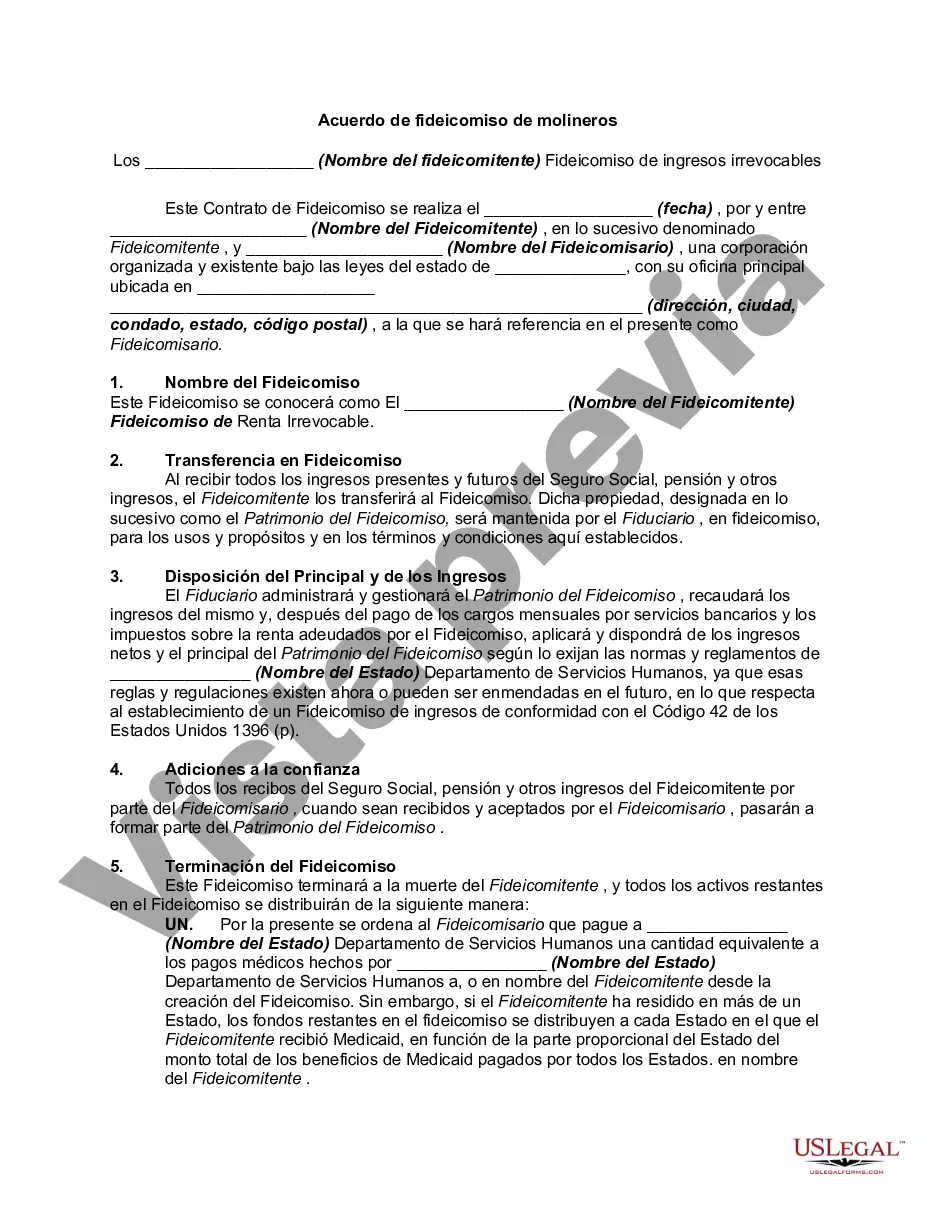

Oakland Michigan Miller Trust Forms for Assisted Living provide an essential legal solution for seniors who require assistance with long-term care costs. A Miller Trust, also known as a Qualified Income Trust or Income Cap Trust, is a specialized legal document designed to help individuals qualify for Medicaid benefits while maintaining their eligibility for assisted living services in Oakland, Michigan. The main purpose of a Miller Trust is to address the income limit requirements set by Medicaid for assisted living facilities. In order to qualify for Medicaid, an individual's income must fall below a certain threshold. However, if an individual's income exceeds this limit, they may still be able to obtain Medicaid benefits by setting up a Miller Trust. There are different types of Oakland Michigan Miller Trust Forms for Assisted Living, each serving specific purposes tailored to the individual's unique financial situation. Some common types include: 1. Irrevocable Miller Trust: This type of trust cannot be modified or terminated once it is established. It ensures that the individual's excess income is placed into the trust, allowing them to meet the Medicaid income requirements and qualify for assisted living benefits. 2. Revocable Miller Trust: Unlike the irrevocable trust, a revocable Miller Trust can be modified or terminated at any time. This type of trust provides more flexibility for individuals who may need to make changes to their financial arrangements in the future. 3. Pooled Income Trust: A pooled income trust is an alternative option specifically designed for individuals who do not have a family member or spouse available to act as the trustee for their Miller Trust. In a pooled income trust, the excess income of multiple individuals is pooled together, managed by a non-profit organization, and used to pay for their care expenses in assisted living facilities. Regardless of the type, Oakland Michigan Miller Trust Forms for Assisted Living are critical documents that ensure seniors can access the necessary funds for their care while still maintaining Medicaid eligibility. Legal assistance from an experienced professional is highly recommended when setting up a Miller Trust, as the process involves complex rules and regulations that must be followed precisely to achieve the desired financial outcomes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Formularios de confianza de Miller para vida asistida - Miller Trust Forms for Assisted Living

Description

How to fill out Oakland Michigan Formularios De Confianza De Miller Para Vida Asistida?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the Oakland Miller Trust Forms for Assisted Living.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Oakland Miller Trust Forms for Assisted Living will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Oakland Miller Trust Forms for Assisted Living:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Oakland Miller Trust Forms for Assisted Living on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

More info

Programs for women and children; b.d. education, training and technical support for the laity. As the city celebrates its 175th anniversary, “Pittsburgh has a deep and special place in my life,” stated Archbishop Joseph Kurtz. “When we think about what Pittsburgh means to most people, it is the arts and music. The Pittsburgh Symphony and Pittsburgh Opera, Carnegie Science Center, the Pittsburgh Museum of Art, the Pittsburgh Zoo, and the museums and cultural facilities around the City are examples of what it is to grow a city and make it a place of creativity, art and cultural richness. Pittsburgh is the city best known for its strong commitment to the arts. It is a model of excellence, creativity and community.” “Pittsburgh's legacy is not just its architecture, which continues to be a marvel of engineering,” said Archbishop Kurtz. “Pittsburgh's economic, cultural and educational strengths, as well as its commitment to innovation, are a tremendous asset to the world.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.