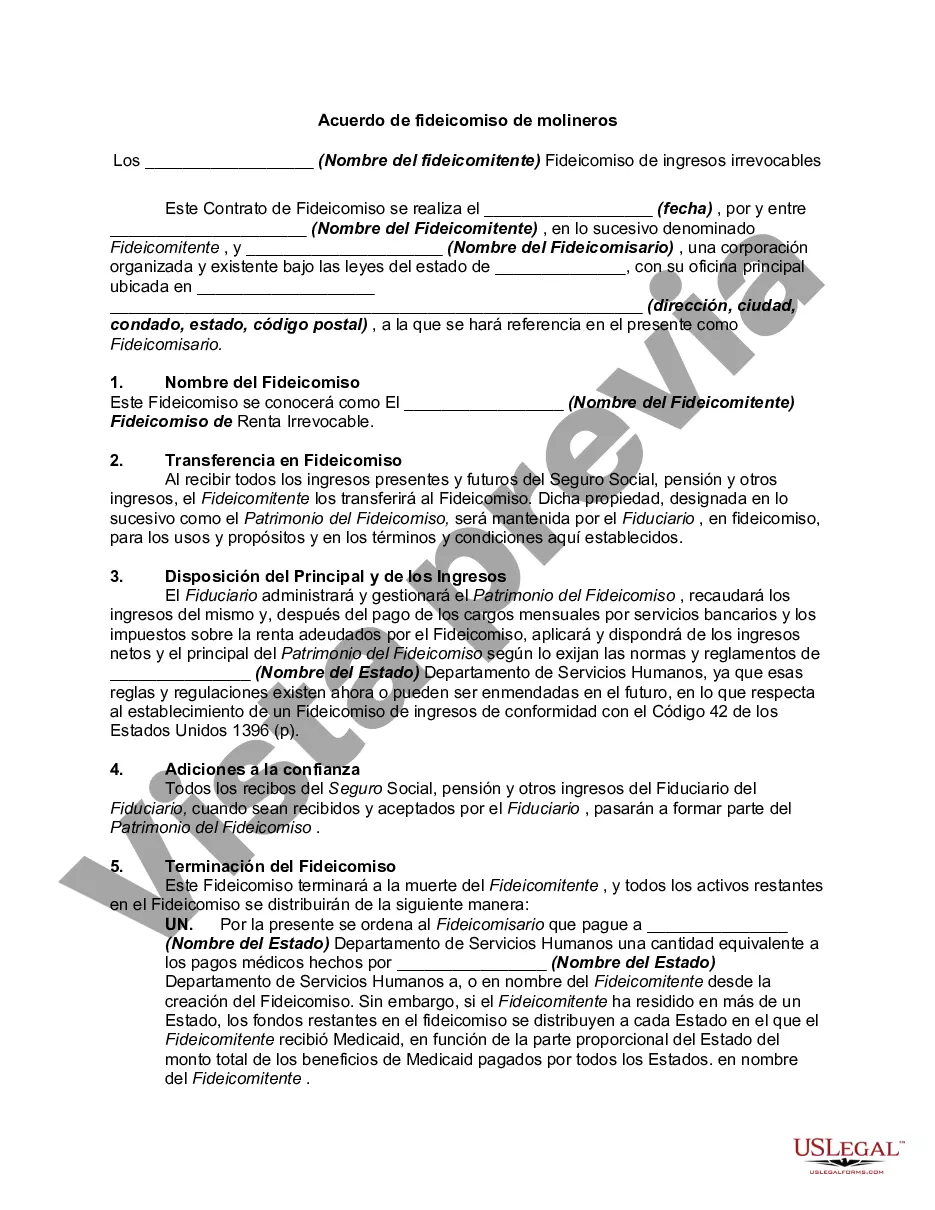

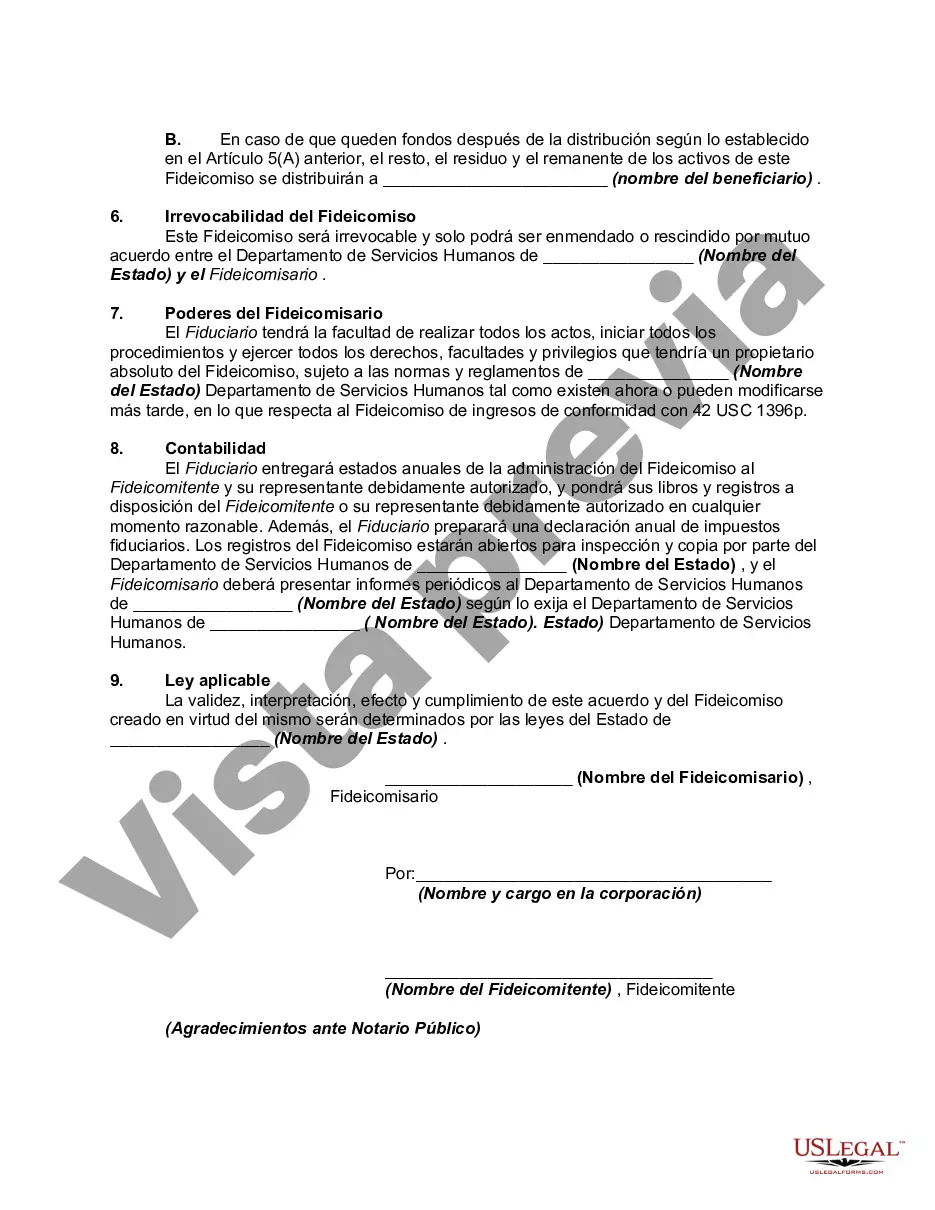

Kings New York Miller Trust Forms for Medicaid are legal documents designed to help individuals in Kings County, New York, meet the income requirements for Medicaid eligibility when they have income exceeding the allowable limits. The purpose of the Kings New York Miller Trust Forms is to establish a specialized trust that holds excess income. This enables individuals with incomes above the Medicaid threshold to still qualify for Medicaid long-term care services. The Miller Trust, also known as a Qualified Income Trust (QIT), is a specific type of trust which redirects the excess income into the trust account. The funds in the trust can then be used to pay for medical expenses, including long-term care costs, without impacting Medicaid eligibility. There are different types of Kings New York Miller Trust Forms for Medicaid: 1. Standard Miller Trust Forms: This type of form is used when an individual's income exceeds the income limit set by Medicaid. It allows them to deposit their excess income into the trust, which is then used to cover their medical expenses. 2. Medicaid Spend-Down/Share of Cost Trust Forms: These forms cater to individuals who have income exceeding the Medicaid income limits but still wish to qualify for Medicaid. With this form, individuals can use the trust funds to reduce their income by paying for medical expenses, thereby meeting the "spend-down" requirement. 3. Miller Trust Amendment Forms: These forms are used when making changes or amendments to an existing Miller Trust. Amendments may be necessary due to changes in income, finances, or Medicaid regulations. 4. Miller Trust Termination Forms: If an individual no longer needs the Miller Trust, these forms are used to terminate the trust and withdraw any remaining funds. This might occur if the individual's income falls below the Medicaid income limits or their circumstances change, and Medicaid is no longer required. It is crucial to consult with an experienced attorney specializing in Medicaid and elder law when preparing Kings New York Miller Trust Forms. The attorney can guide individuals through the process, ensuring compliance with all legal requirements and maximizing Medicaid eligibility while protecting assets and resources.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Formularios Miller Trust para Medicaid - Miller Trust Forms for Medicaid

Description

How to fill out Kings New York Formularios Miller Trust Para Medicaid?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Kings Miller Trust Forms for Medicaid, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any tasks related to document completion straightforward.

Here's how you can find and download Kings Miller Trust Forms for Medicaid.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some records.

- Examine the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Kings Miller Trust Forms for Medicaid.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Kings Miller Trust Forms for Medicaid, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you need to cope with an exceptionally difficult case, we advise using the services of an attorney to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant documents with ease!