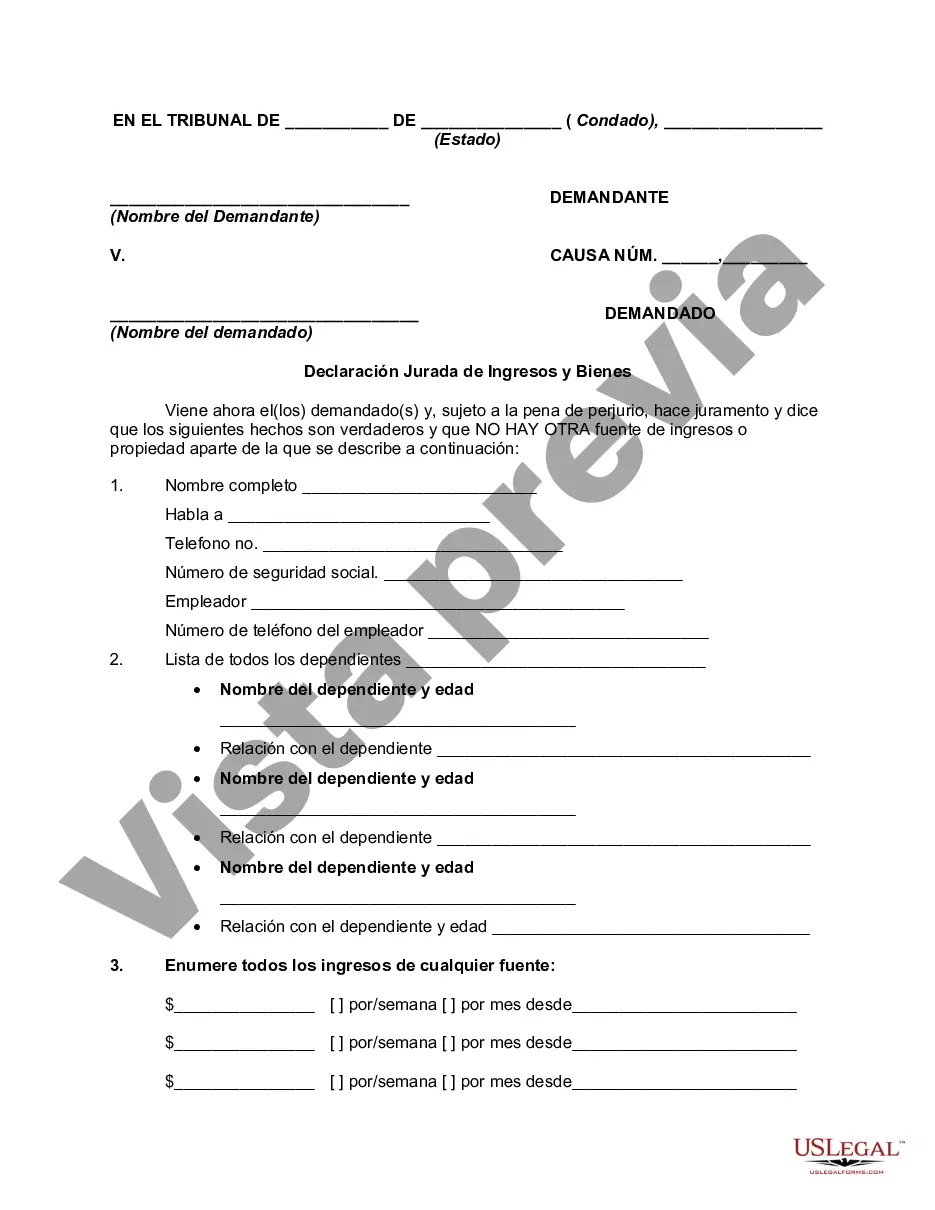

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

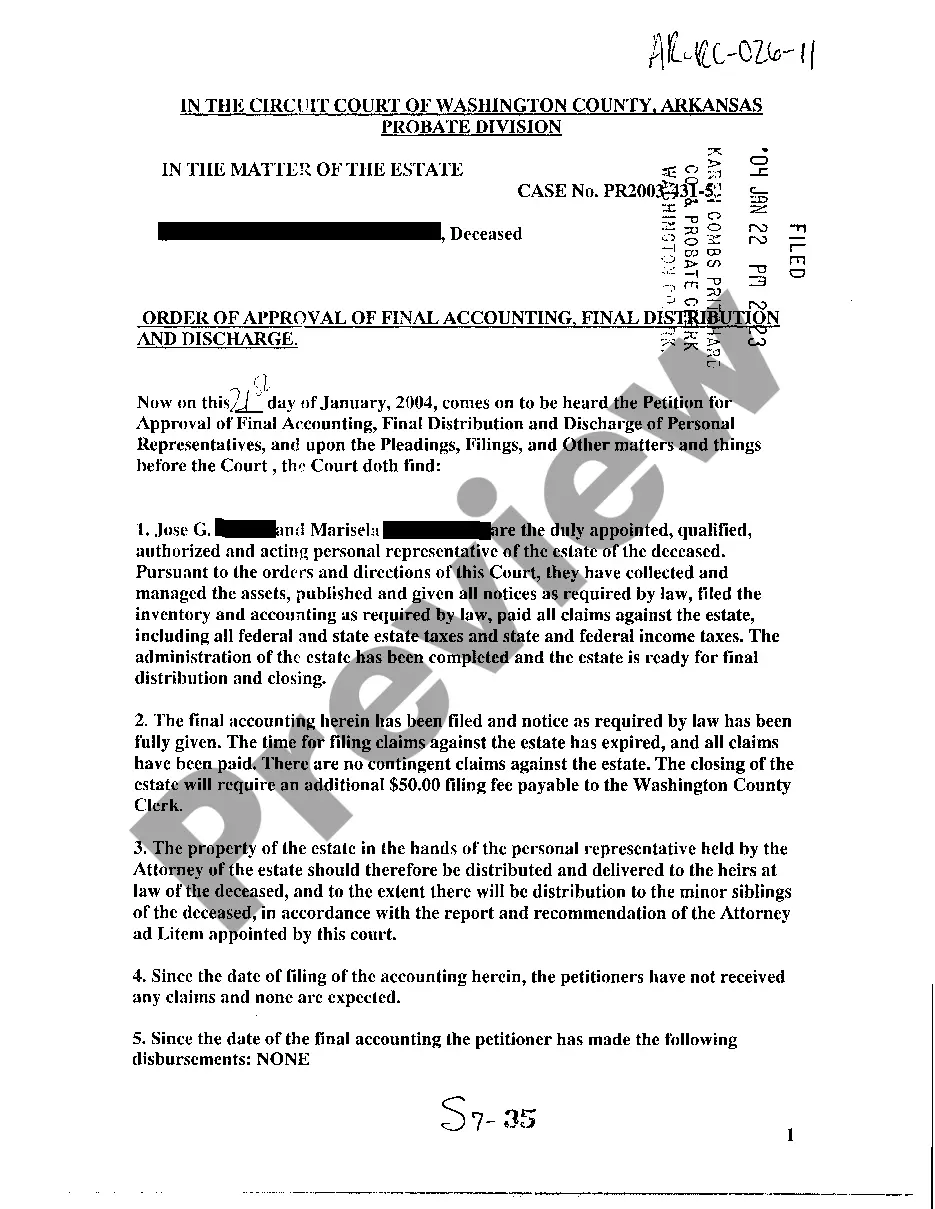

Broward County, Florida Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document that individuals in Broward County may need to complete in various situations. This affidavit serves as evidence of an individual's financial standing, including their income, property, assets, and liabilities. It is commonly required during legal proceedings such as divorce, adoption, probate, or during the application for government assistance programs or loans. Below, you will find a breakdown of the different types of affidavits or proofs relating to income, property, assets, and liabilities in Broward County, Florida: 1. Broward County Affidavit of Income: This document verifies an individual's income, including wages, salaries, commissions, bonuses, rental income, investment income, and any other sources of revenue. It provides a comprehensive overview of one's financial capacity and is often used to determine eligibility for various grants, loans, or public assistance programs. 2. Broward County Proof of Property: This proof is used to identify and document the ownership of properties, real estate, or any tangible assets an individual possesses within Broward County. It includes details such as property addresses, ownership titles, mortgage information, and any encumbrances on the property. 3. Broward County Affidavit of Assets: This affidavit highlights an individual's financial holdings, such as bank accounts, retirement plans, investments, stocks, bonds, or any other valuable assets. It helps determine an individual's net worth and financial stability. 4. Broward County Affidavit of Liabilities: This affidavit itemizes an individual's debts, obligations, and financial liabilities. It covers various types of debts, such as mortgage loans, credit card debts, student loans, personal loans, outstanding bills, or any financial obligations the individual may have. Completing these affidavits or proofs accurately is crucial, as they are legally binding documents. The information provided must be detailed, organized, and supported by relevant documentation to ensure its authenticity and credibility. Falsifying information on these affidavits can have serious legal consequences. Therefore, it is advisable to seek guidance from legal professionals or consult the specific legal requirements outlined by Broward County, Florida, to ensure compliance with local regulations.Broward County, Florida Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document that individuals in Broward County may need to complete in various situations. This affidavit serves as evidence of an individual's financial standing, including their income, property, assets, and liabilities. It is commonly required during legal proceedings such as divorce, adoption, probate, or during the application for government assistance programs or loans. Below, you will find a breakdown of the different types of affidavits or proofs relating to income, property, assets, and liabilities in Broward County, Florida: 1. Broward County Affidavit of Income: This document verifies an individual's income, including wages, salaries, commissions, bonuses, rental income, investment income, and any other sources of revenue. It provides a comprehensive overview of one's financial capacity and is often used to determine eligibility for various grants, loans, or public assistance programs. 2. Broward County Proof of Property: This proof is used to identify and document the ownership of properties, real estate, or any tangible assets an individual possesses within Broward County. It includes details such as property addresses, ownership titles, mortgage information, and any encumbrances on the property. 3. Broward County Affidavit of Assets: This affidavit highlights an individual's financial holdings, such as bank accounts, retirement plans, investments, stocks, bonds, or any other valuable assets. It helps determine an individual's net worth and financial stability. 4. Broward County Affidavit of Liabilities: This affidavit itemizes an individual's debts, obligations, and financial liabilities. It covers various types of debts, such as mortgage loans, credit card debts, student loans, personal loans, outstanding bills, or any financial obligations the individual may have. Completing these affidavits or proofs accurately is crucial, as they are legally binding documents. The information provided must be detailed, organized, and supported by relevant documentation to ensure its authenticity and credibility. Falsifying information on these affidavits can have serious legal consequences. Therefore, it is advisable to seek guidance from legal professionals or consult the specific legal requirements outlined by Broward County, Florida, to ensure compliance with local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.