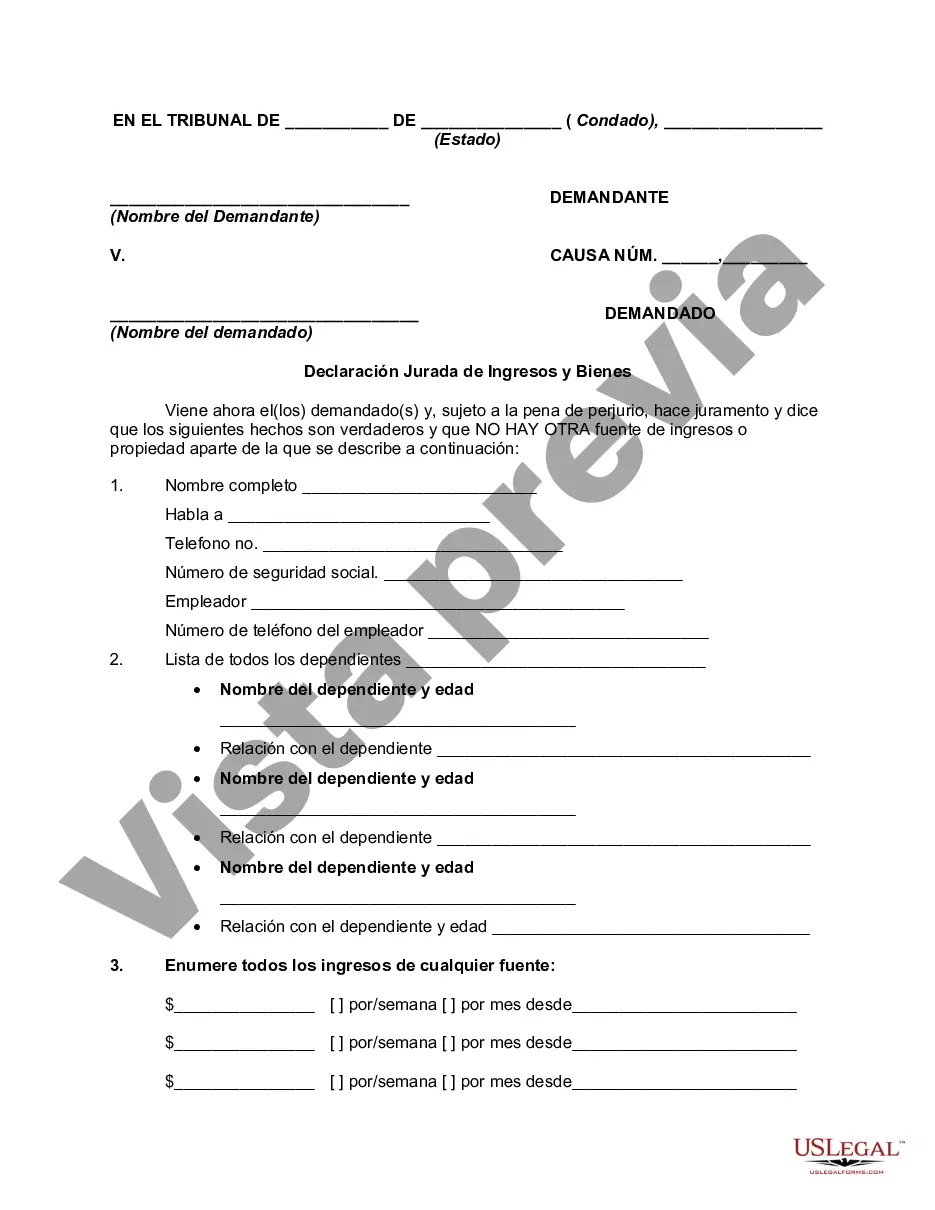

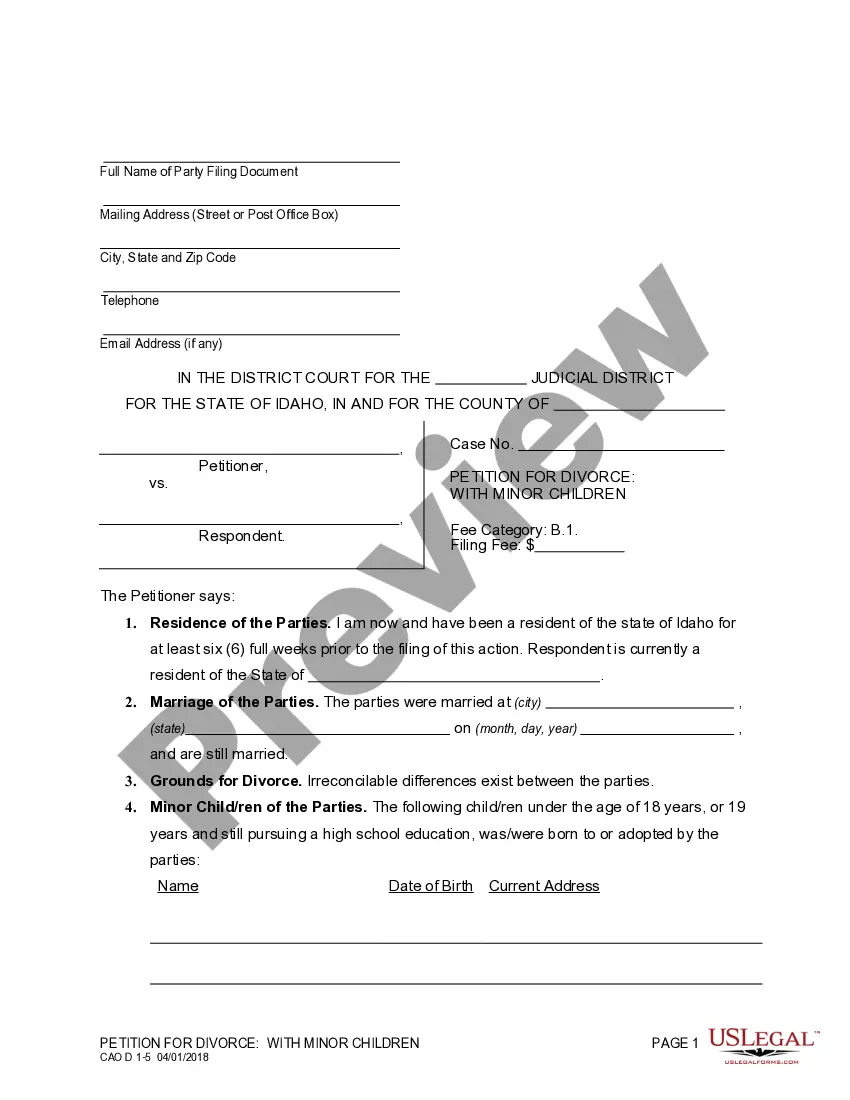

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hennepin County, located in Minnesota, requires individuals to submit an Affidavit or Proof of Income and Property — Assets and Liabilities as part of certain legal or financial processes. This document serves as evidence of an individual's financial standing, providing information on their income, property, assets, and liabilities. It plays a crucial role in various situations such as loan applications, divorce proceedings, bankruptcy cases, or eligibility for government assistance. The Hennepin Minnesota Affidavit or Proof of Income and Property — Assets and Liabilities contains essential details concerning an individual's financial portfolio. Key information includes income sources, such as employment wages, investments, retirement benefits, or rental income. It also encompasses a comprehensive list of properties owned or co-owned, including real estate, vehicles, bank accounts, stocks, bonds, or any other valuable assets. Additionally, the document requires disclosure of liabilities, such as mortgages, loans, credit card debts, or any outstanding financial obligations. In Hennepin County, there are several types of Affidavit or Proof of Income and Property — Assets and Liabilities that are specific to certain circumstances. These variations include: 1. Divorce/Family Law Affidavit: In divorce proceedings, spouses may be required to submit an Affidavit or Proof of Income and Property — Assets and Liabilities to ensure transparency regarding their financial resources. This document helps determine division of assets, child support, spousal maintenance, or property settlements. 2. Bankruptcy Affidavit: Individuals filing for bankruptcy in Hennepin County must provide an Affidavit or Proof of Income and Property — Assets and Liabilities to demonstrate their financial status. It aids in assessing the individual's ability to meet financial obligations and determines the type of bankruptcy filing suitable for their situation. 3. Loan/Financing Affidavit: When applying for a loan or financing in Hennepin County, individuals may need to provide an Affidavit or Proof of Income and Property — Assets and Liabilities. Lenders use this document to evaluate the borrower's ability to repay the loan and to ensure the loan amount aligns with their financial capacity. Individuals residing in Hennepin County must carefully complete the Affidavit or Proof of Income and Property — Assets and Liabilities, ensuring accurate and honest information is provided. It is crucial to consult with legal or financial professionals to understand specific requirements and implications associated with this document.Hennepin County, located in Minnesota, requires individuals to submit an Affidavit or Proof of Income and Property — Assets and Liabilities as part of certain legal or financial processes. This document serves as evidence of an individual's financial standing, providing information on their income, property, assets, and liabilities. It plays a crucial role in various situations such as loan applications, divorce proceedings, bankruptcy cases, or eligibility for government assistance. The Hennepin Minnesota Affidavit or Proof of Income and Property — Assets and Liabilities contains essential details concerning an individual's financial portfolio. Key information includes income sources, such as employment wages, investments, retirement benefits, or rental income. It also encompasses a comprehensive list of properties owned or co-owned, including real estate, vehicles, bank accounts, stocks, bonds, or any other valuable assets. Additionally, the document requires disclosure of liabilities, such as mortgages, loans, credit card debts, or any outstanding financial obligations. In Hennepin County, there are several types of Affidavit or Proof of Income and Property — Assets and Liabilities that are specific to certain circumstances. These variations include: 1. Divorce/Family Law Affidavit: In divorce proceedings, spouses may be required to submit an Affidavit or Proof of Income and Property — Assets and Liabilities to ensure transparency regarding their financial resources. This document helps determine division of assets, child support, spousal maintenance, or property settlements. 2. Bankruptcy Affidavit: Individuals filing for bankruptcy in Hennepin County must provide an Affidavit or Proof of Income and Property — Assets and Liabilities to demonstrate their financial status. It aids in assessing the individual's ability to meet financial obligations and determines the type of bankruptcy filing suitable for their situation. 3. Loan/Financing Affidavit: When applying for a loan or financing in Hennepin County, individuals may need to provide an Affidavit or Proof of Income and Property — Assets and Liabilities. Lenders use this document to evaluate the borrower's ability to repay the loan and to ensure the loan amount aligns with their financial capacity. Individuals residing in Hennepin County must carefully complete the Affidavit or Proof of Income and Property — Assets and Liabilities, ensuring accurate and honest information is provided. It is crucial to consult with legal or financial professionals to understand specific requirements and implications associated with this document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.