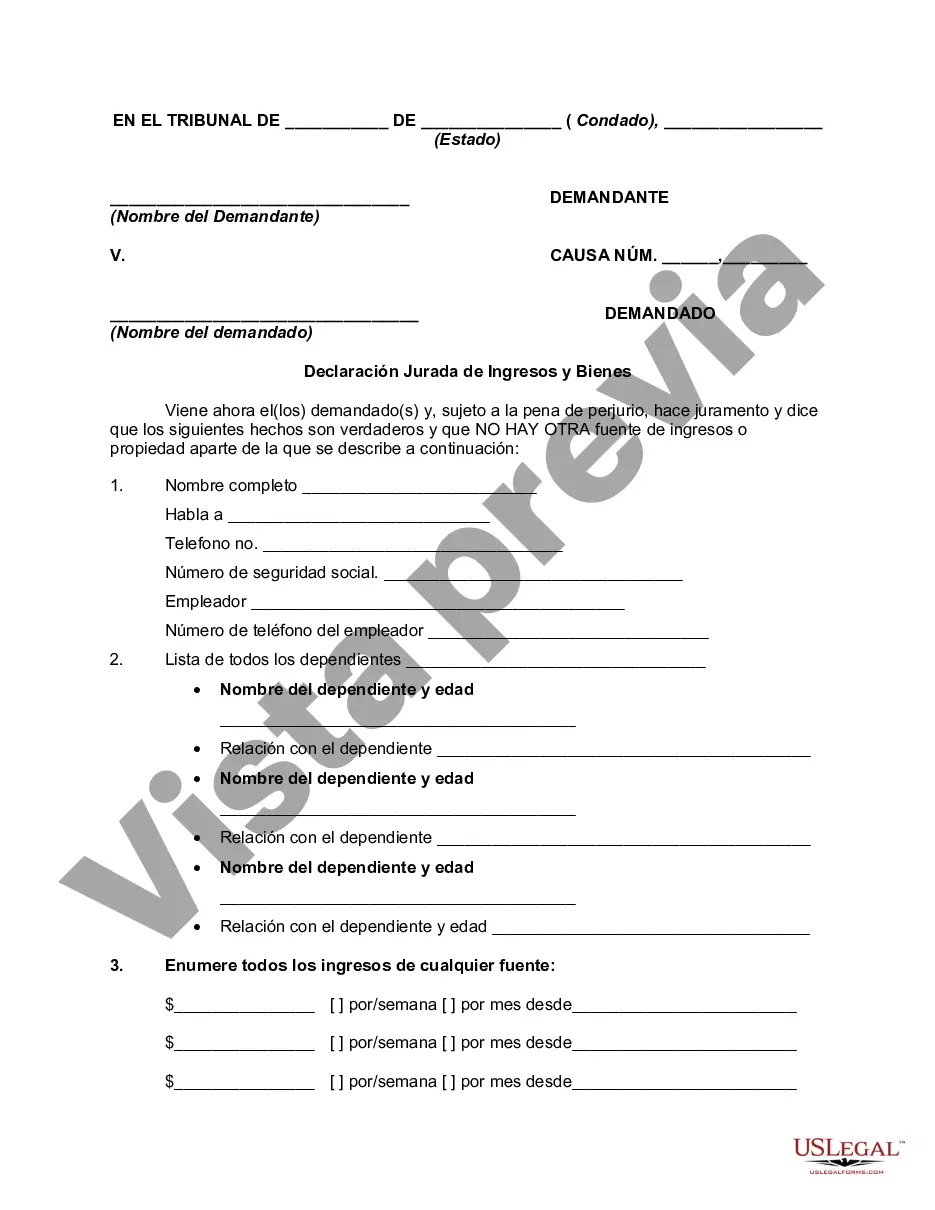

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In San Diego, California, an Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document often required in various situations, such as applying for loans, mortgages, renting property, or during divorce or child support proceedings. This document serves as a comprehensive declaration of an individual's financial situation, providing detailed information regarding their income, assets, liabilities, and overall worth. The affidavit aims to ensure transparency and assist parties involved in making informed decisions based on accurate financial data. Some relevant keywords associated with San Diego California Affidavit or Proof of Income and Property — Assets and Liabilities include: 1. Income statement: This section entails providing a detailed breakdown of all sources of income, including employment wages, self-employment earnings, rental income, investment dividends, and any other relevant financial inflows. 2. Tax returns: Supporting documents such as recent tax returns are typically required to authenticate the income declared in the affidavit. These documents offer a comprehensive view of an individual's financial situation and aid in verifying the accuracy of their income statement. 3. Employment verification: Affidavits may require individuals to submit employment verification letters, pay stubs, or statements from employers to establish their current job position, salary, and stability of income. 4. Asset declaration: This section requires individuals to disclose all their assets, including but not limited to real estate properties, vehicles, valuable possessions, savings accounts, investment portfolios, stocks, bonds, and retirement accounts. 5. Liabilities and debts: Individuals must provide a thorough overview of their outstanding debts, loans, credit card balances, mortgage payments, car loans, student loans, and any other financial obligations. 6. Bank statements: Recent bank statements are often required to corroborate the information provided, ensuring accuracy and consistency between the assets and liabilities declared. 7. Property evaluation: Depending on the circumstances, individuals may need to include property evaluations or appraisals by professionals to determine the market value of their real estate assets. While specific types of San Diego California Affidavit or Proof of Income and Property — Assets and Liabilities may vary depending on the purpose for which they are required, these keywords encompass the key elements typically included in such documents. It is important to consult with a legal professional or financial advisor to ensure accurate completion of the affidavit based on individual circumstances and requirements.In San Diego, California, an Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document often required in various situations, such as applying for loans, mortgages, renting property, or during divorce or child support proceedings. This document serves as a comprehensive declaration of an individual's financial situation, providing detailed information regarding their income, assets, liabilities, and overall worth. The affidavit aims to ensure transparency and assist parties involved in making informed decisions based on accurate financial data. Some relevant keywords associated with San Diego California Affidavit or Proof of Income and Property — Assets and Liabilities include: 1. Income statement: This section entails providing a detailed breakdown of all sources of income, including employment wages, self-employment earnings, rental income, investment dividends, and any other relevant financial inflows. 2. Tax returns: Supporting documents such as recent tax returns are typically required to authenticate the income declared in the affidavit. These documents offer a comprehensive view of an individual's financial situation and aid in verifying the accuracy of their income statement. 3. Employment verification: Affidavits may require individuals to submit employment verification letters, pay stubs, or statements from employers to establish their current job position, salary, and stability of income. 4. Asset declaration: This section requires individuals to disclose all their assets, including but not limited to real estate properties, vehicles, valuable possessions, savings accounts, investment portfolios, stocks, bonds, and retirement accounts. 5. Liabilities and debts: Individuals must provide a thorough overview of their outstanding debts, loans, credit card balances, mortgage payments, car loans, student loans, and any other financial obligations. 6. Bank statements: Recent bank statements are often required to corroborate the information provided, ensuring accuracy and consistency between the assets and liabilities declared. 7. Property evaluation: Depending on the circumstances, individuals may need to include property evaluations or appraisals by professionals to determine the market value of their real estate assets. While specific types of San Diego California Affidavit or Proof of Income and Property — Assets and Liabilities may vary depending on the purpose for which they are required, these keywords encompass the key elements typically included in such documents. It is important to consult with a legal professional or financial advisor to ensure accurate completion of the affidavit based on individual circumstances and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.