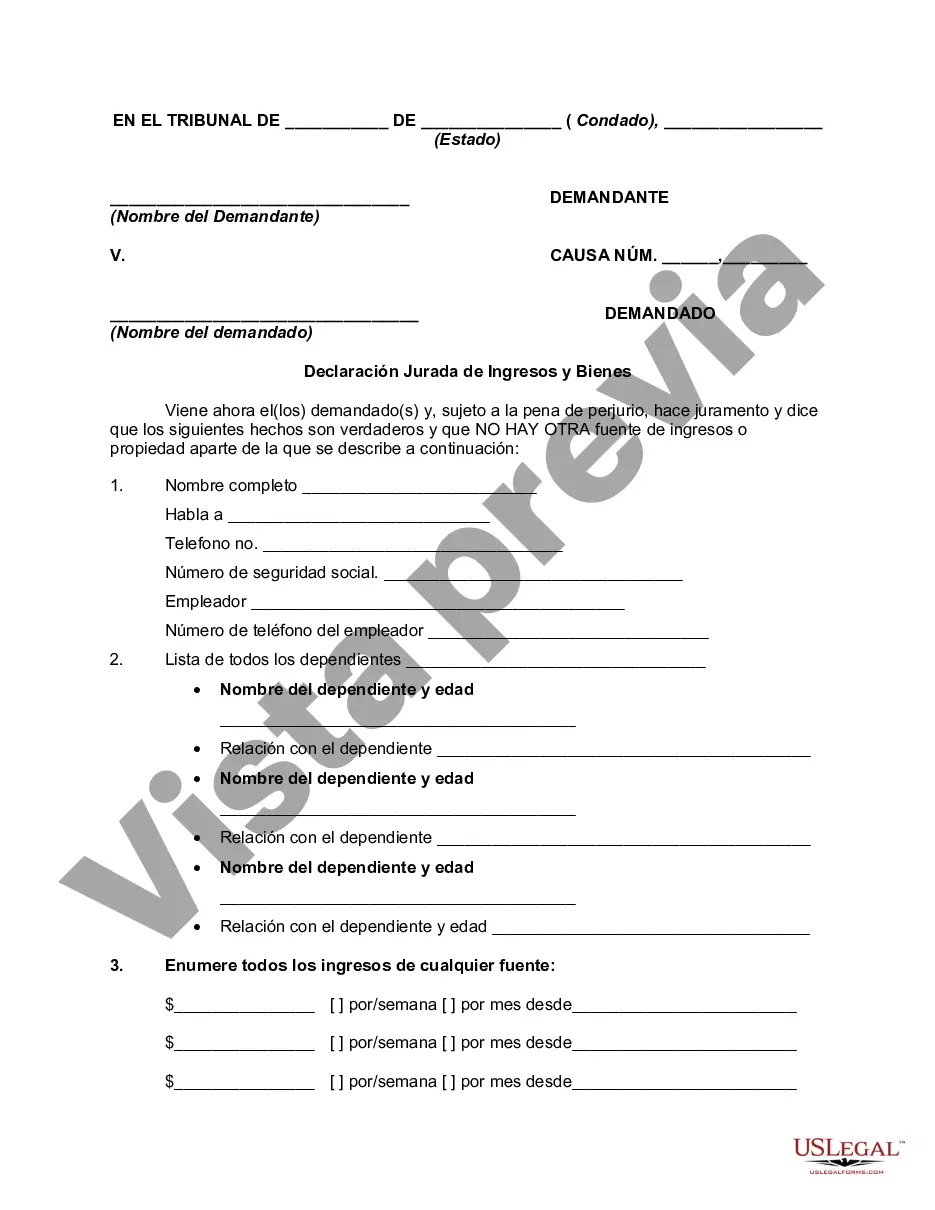

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document used to provide an official declaration of an individual's financial status. It serves as evidence of their income, property, and any debts or liabilities they may have. This affidavit is frequently required in various situations such as loan applications, rental agreements, mortgage arrangements, divorce proceedings, or during legal disputes. The content of a San Jose California Affidavit or Proof of Income and Property — Assets and Liabilities typically includes: 1. Personal Information: The document starts with the personal details of the individual, including their full name, address, phone number, and Social Security number. These details help identify the person being referred to in the affidavit. 2. Income Information: This section outlines the person's sources of income, which may include salaries, wages, investments, rental income, self-employment earnings, government benefits, or any other regular income streams. Each income source is specified along with the corresponding amount earned or received. 3. Property and Assets: Here, the individual lists all their real estate properties, vehicles, stocks, bonds, retirement accounts, savings, checking accounts, and other significant assets. This information is crucial for assessing the person's net worth and determining their financial stability. 4. Debts and Liabilities: In this section, the individual provides details about their outstanding debts or liabilities, such as mortgages, loans, credit card balances, student loans, or any other financial obligations. The amount owed, the monthly payment, and the name of the creditor or lending institution are often included. 5. Declaration and Signatures: The affidavit concludes with a declaration stating that the information provided is true and accurate to the best of the individual's knowledge. The affidavit must be signed and dated in the presence of a notary public or another authorized official who will authenticate the document. Different types of San Jose California Affidavit or Proof of Income and Property — Assets and Liabilities can be categorized based on their specific purpose or the circumstances in which they are used. Some examples include: 1. Loan Affidavit: This type of affidavit is commonly required by financial institutions when assessing an individual's eligibility for a loan. It includes comprehensive details about the person's income, assets, and liabilities to determine their creditworthiness. 2. Rental Affidavit: Landlords and property management companies often request this affidavit to verify the prospective tenant's financial stability and ability to pay rent. It provides a clear picture of their income sources, assets, and outstanding debts. 3. Divorce Affidavit: During divorce proceedings, both parties may be required to submit affidavits detailing their respective incomes, properties, and liabilities. This helps the court determine an equitable distribution of assets and liabilities or calculate child support or alimony payments. 4. Bankruptcy Affidavit: When filing for bankruptcy, an individual must disclose their income, assets, and liabilities through an affidavit. This document assists in assessing the individual's financial situation and determining their eligibility for bankruptcy protection. It is important to note that the specific requirements and format of San Jose California Affidavit or Proof of Income and Property — Assets and Liabilities may vary based on legal jurisdiction and the reasons for its usage. Therefore, it is advisable to consult with an attorney or legal professional to ensure compliance with local regulations and to customize the document as per individual needs.San Jose, California Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document used to provide an official declaration of an individual's financial status. It serves as evidence of their income, property, and any debts or liabilities they may have. This affidavit is frequently required in various situations such as loan applications, rental agreements, mortgage arrangements, divorce proceedings, or during legal disputes. The content of a San Jose California Affidavit or Proof of Income and Property — Assets and Liabilities typically includes: 1. Personal Information: The document starts with the personal details of the individual, including their full name, address, phone number, and Social Security number. These details help identify the person being referred to in the affidavit. 2. Income Information: This section outlines the person's sources of income, which may include salaries, wages, investments, rental income, self-employment earnings, government benefits, or any other regular income streams. Each income source is specified along with the corresponding amount earned or received. 3. Property and Assets: Here, the individual lists all their real estate properties, vehicles, stocks, bonds, retirement accounts, savings, checking accounts, and other significant assets. This information is crucial for assessing the person's net worth and determining their financial stability. 4. Debts and Liabilities: In this section, the individual provides details about their outstanding debts or liabilities, such as mortgages, loans, credit card balances, student loans, or any other financial obligations. The amount owed, the monthly payment, and the name of the creditor or lending institution are often included. 5. Declaration and Signatures: The affidavit concludes with a declaration stating that the information provided is true and accurate to the best of the individual's knowledge. The affidavit must be signed and dated in the presence of a notary public or another authorized official who will authenticate the document. Different types of San Jose California Affidavit or Proof of Income and Property — Assets and Liabilities can be categorized based on their specific purpose or the circumstances in which they are used. Some examples include: 1. Loan Affidavit: This type of affidavit is commonly required by financial institutions when assessing an individual's eligibility for a loan. It includes comprehensive details about the person's income, assets, and liabilities to determine their creditworthiness. 2. Rental Affidavit: Landlords and property management companies often request this affidavit to verify the prospective tenant's financial stability and ability to pay rent. It provides a clear picture of their income sources, assets, and outstanding debts. 3. Divorce Affidavit: During divorce proceedings, both parties may be required to submit affidavits detailing their respective incomes, properties, and liabilities. This helps the court determine an equitable distribution of assets and liabilities or calculate child support or alimony payments. 4. Bankruptcy Affidavit: When filing for bankruptcy, an individual must disclose their income, assets, and liabilities through an affidavit. This document assists in assessing the individual's financial situation and determining their eligibility for bankruptcy protection. It is important to note that the specific requirements and format of San Jose California Affidavit or Proof of Income and Property — Assets and Liabilities may vary based on legal jurisdiction and the reasons for its usage. Therefore, it is advisable to consult with an attorney or legal professional to ensure compliance with local regulations and to customize the document as per individual needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.