This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Montgomery Maryland Affidavit of Financial Resources and Debt — Assets and Liabilities is a legal document used in Montgomery County, Maryland, to gather detailed information about an individual's financial situation. This affidavit is commonly required during legal proceedings such as divorce, child custody disputes, or bankruptcy cases, where both parties are required to disclose their financial resources, debt, assets, and liabilities. The purpose of the Montgomery Maryland Affidavit of Financial Resources and Debt — Assets and Liabilities is to provide an accurate and comprehensive overview of one's financial condition to assist the court in making fair and informed decisions regarding division of assets, financial support, or debt repayment plans. It provides a clear snapshot of a person's financial standing, allowing the court to evaluate the appropriate allocation of resources or determine child support and alimony amounts. The affidavit typically requires the disclosure of numerous financial aspects, including but not limited to: 1. Income: The affidavit will ask for a detailed breakdown of all income sources, whether it is from employment, self-employment, rental properties, investments, or any other revenue-generating activities. 2. Expenses: Applicants will be required to list their monthly expenses, including housing costs, utilities, transportation, groceries, healthcare, educational expenses, and any other regular financial obligations. 3. Assets: The affidavit will seek comprehensive details about assets, including real estate properties, vehicles, bank accounts, retirement plans, stocks, bonds, businesses, valuable personal property, and any other valuable assets. 4. Liabilities: Applicants must disclose all outstanding debts, such as mortgages, loans, credit card debt, student loans, tax liens, judgments, and any other financial obligations. 5. Financial support obligations: If there are existing obligations such as child support, spousal support, or any other financial responsibilities, these must be disclosed in the affidavit. It is essential to note that there might be different types or variations of the Montgomery Maryland Affidavit of Financial Resources and Debt — Assets and Liabilities, depending on the specific legal context it is being used for, such as divorce or bankruptcy. The structure and content may vary slightly, tailored to the specific requirements of each case. When completing the affidavit, individuals are encouraged to provide accurate and honest information, as any deliberate misrepresentation of financial resources or omission of significant assets or liabilities can lead to legal consequences. Seek guidance from legal professionals to ensure the completion of the affidavit accurately and in compliance with applicable laws.The Montgomery Maryland Affidavit of Financial Resources and Debt — Assets and Liabilities is a legal document used in Montgomery County, Maryland, to gather detailed information about an individual's financial situation. This affidavit is commonly required during legal proceedings such as divorce, child custody disputes, or bankruptcy cases, where both parties are required to disclose their financial resources, debt, assets, and liabilities. The purpose of the Montgomery Maryland Affidavit of Financial Resources and Debt — Assets and Liabilities is to provide an accurate and comprehensive overview of one's financial condition to assist the court in making fair and informed decisions regarding division of assets, financial support, or debt repayment plans. It provides a clear snapshot of a person's financial standing, allowing the court to evaluate the appropriate allocation of resources or determine child support and alimony amounts. The affidavit typically requires the disclosure of numerous financial aspects, including but not limited to: 1. Income: The affidavit will ask for a detailed breakdown of all income sources, whether it is from employment, self-employment, rental properties, investments, or any other revenue-generating activities. 2. Expenses: Applicants will be required to list their monthly expenses, including housing costs, utilities, transportation, groceries, healthcare, educational expenses, and any other regular financial obligations. 3. Assets: The affidavit will seek comprehensive details about assets, including real estate properties, vehicles, bank accounts, retirement plans, stocks, bonds, businesses, valuable personal property, and any other valuable assets. 4. Liabilities: Applicants must disclose all outstanding debts, such as mortgages, loans, credit card debt, student loans, tax liens, judgments, and any other financial obligations. 5. Financial support obligations: If there are existing obligations such as child support, spousal support, or any other financial responsibilities, these must be disclosed in the affidavit. It is essential to note that there might be different types or variations of the Montgomery Maryland Affidavit of Financial Resources and Debt — Assets and Liabilities, depending on the specific legal context it is being used for, such as divorce or bankruptcy. The structure and content may vary slightly, tailored to the specific requirements of each case. When completing the affidavit, individuals are encouraged to provide accurate and honest information, as any deliberate misrepresentation of financial resources or omission of significant assets or liabilities can lead to legal consequences. Seek guidance from legal professionals to ensure the completion of the affidavit accurately and in compliance with applicable laws.

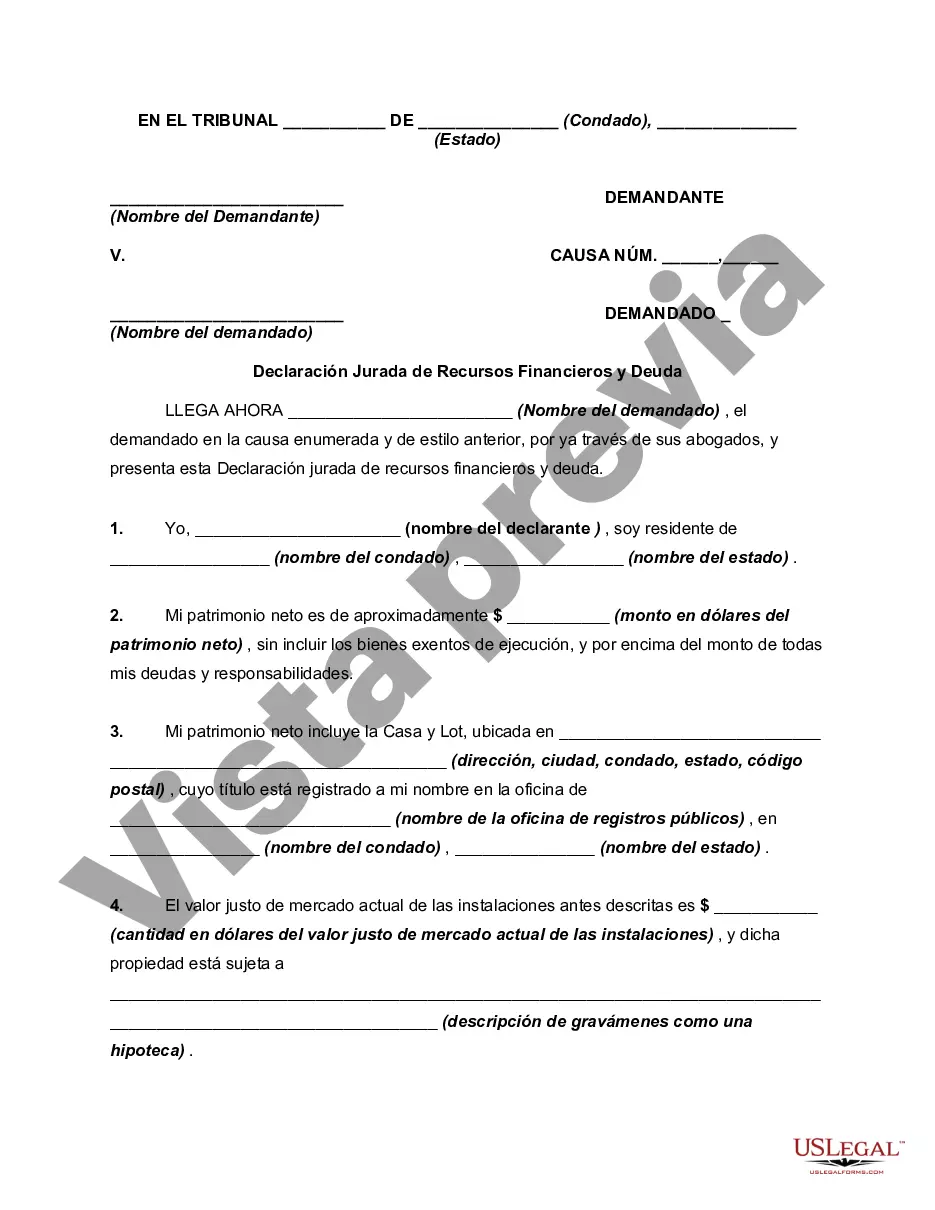

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.