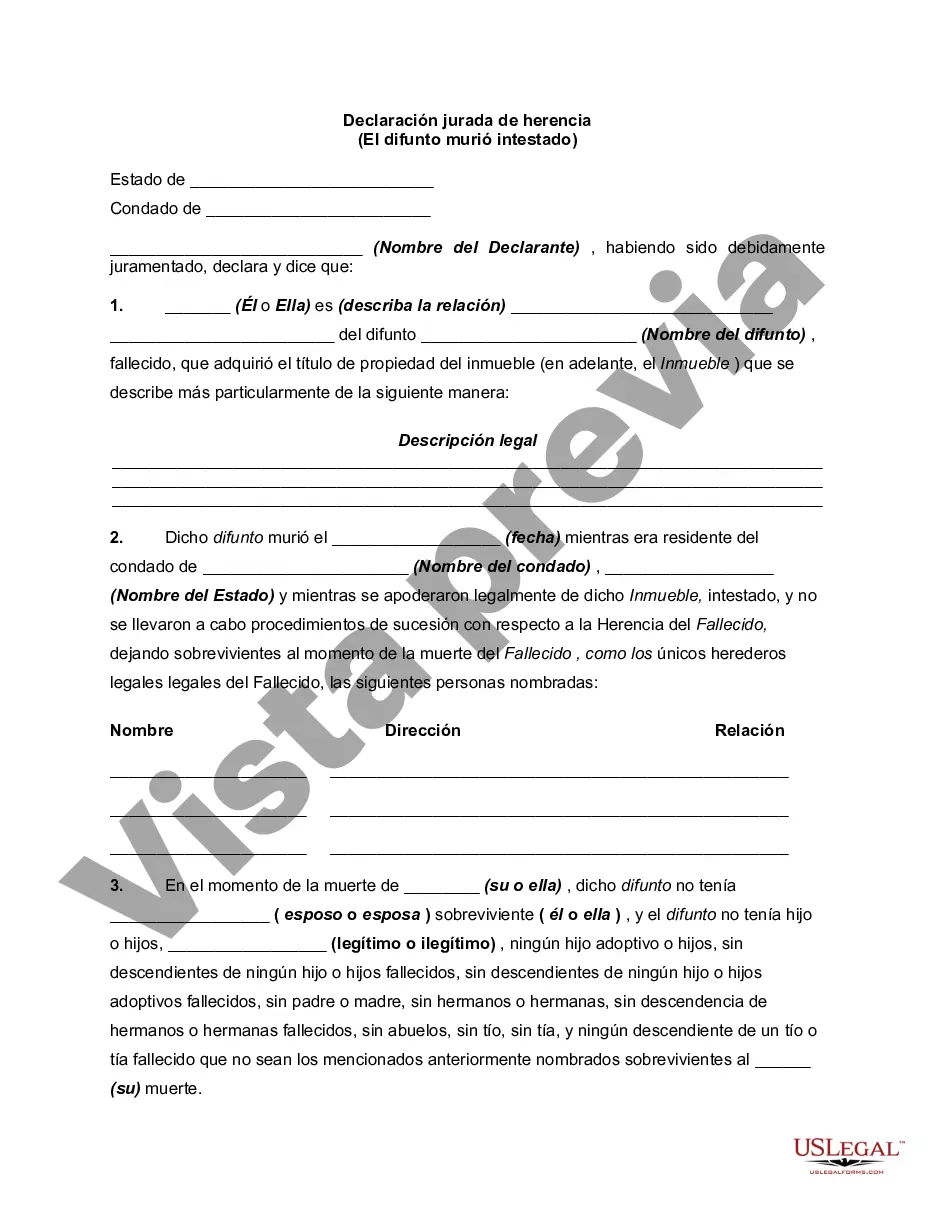

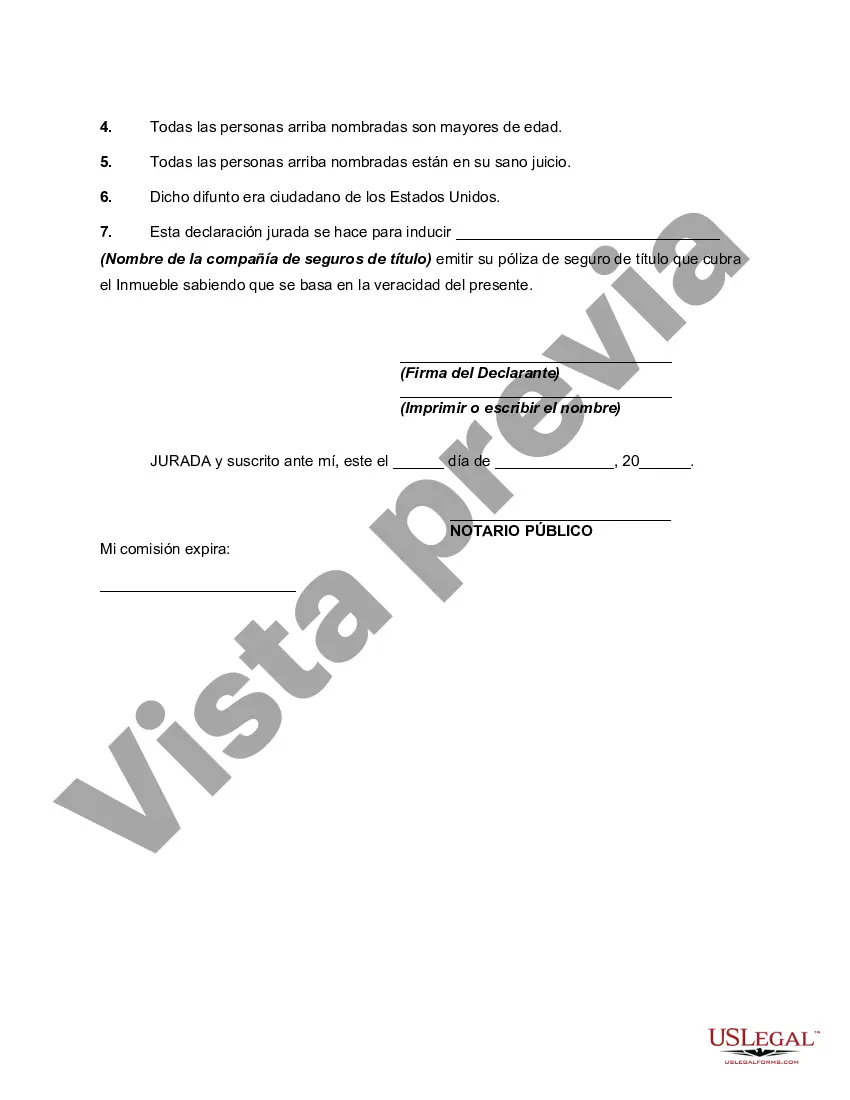

An heirship affidavit is used to state the heirs of a deceased person. It is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate. The affidavit of heirship must also be signed by a notary public.

Los Angeles, California Affidavit of Warship, Next of Kin, or Descent — Decedent Died Intestate An Affidavit of Warship, Next of Kin, or Descent is a legal document used in the state of California when a person passes away without leaving a valid will. In such cases, the decedent is said to have died intestate. The Affidavit of Warship serves as a declaration of the deceased's family members, heirs, or next of kin, and their respective rights to any assets or property left behind. In Los Angeles, California, there are different types of Affidavits of Warship, Next of Kin, or Descent that can be filed depending on the circumstances of the deceased's estate. Some of these variations include: 1. Small Estate Affidavit: This affidavit is used when the total value of the deceased person's estate falls under a certain threshold set by California law. It allows for a simplified probate process and can be utilized if the net value of the estate, excluding liens and encumbrances, is less than $166,250. 2. General Affidavit of Warship: This type of affidavit is typically used when there is no will and the deceased person's estate has a higher value than what is allowed for a small estate affidavit. It provides a detailed account of the decedent's family members, heirs, or next of kin, establishing their relationship and respective rights to the estate. 3. Affidavit of Warship for Real Property: When the deceased person owned real estate in Los Angeles, California, this specific affidavit is used to establish the rightful heirs and their interests in the property. It is crucial for transferring ownership or selling the real property. 4. Probate Affidavit for Real Property: Similar to the Affidavit of Warship for Real Property, this affidavit is utilized when the deceased person's estate is subject to probate proceedings. It involves a court-supervised administration of the estate and requires the affidavit to be filed with the court as part of the probate process. The filing of these affidavits is an essential step in determining the rightful distribution of the deceased person's assets and establishing legal ownership. It is advisable to consult with an experienced attorney specializing in probate and estate law to ensure the correct affidavit is being filed and to guide you through the process. In summary, the Los Angeles, California Affidavit of Warship, Next of Kin, or Descent — Decedent Died Intestate provides a legal means to establish the heirs or next of kin of a deceased person who did not leave a valid will. The various types of affidavits cater to different scenarios, including small estate matters, general property distribution, and probate proceedings. Seeking legal assistance is crucial to navigate through the complex probate process and ensure the correct affidavit is filed for a smooth transfer of assets and property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.