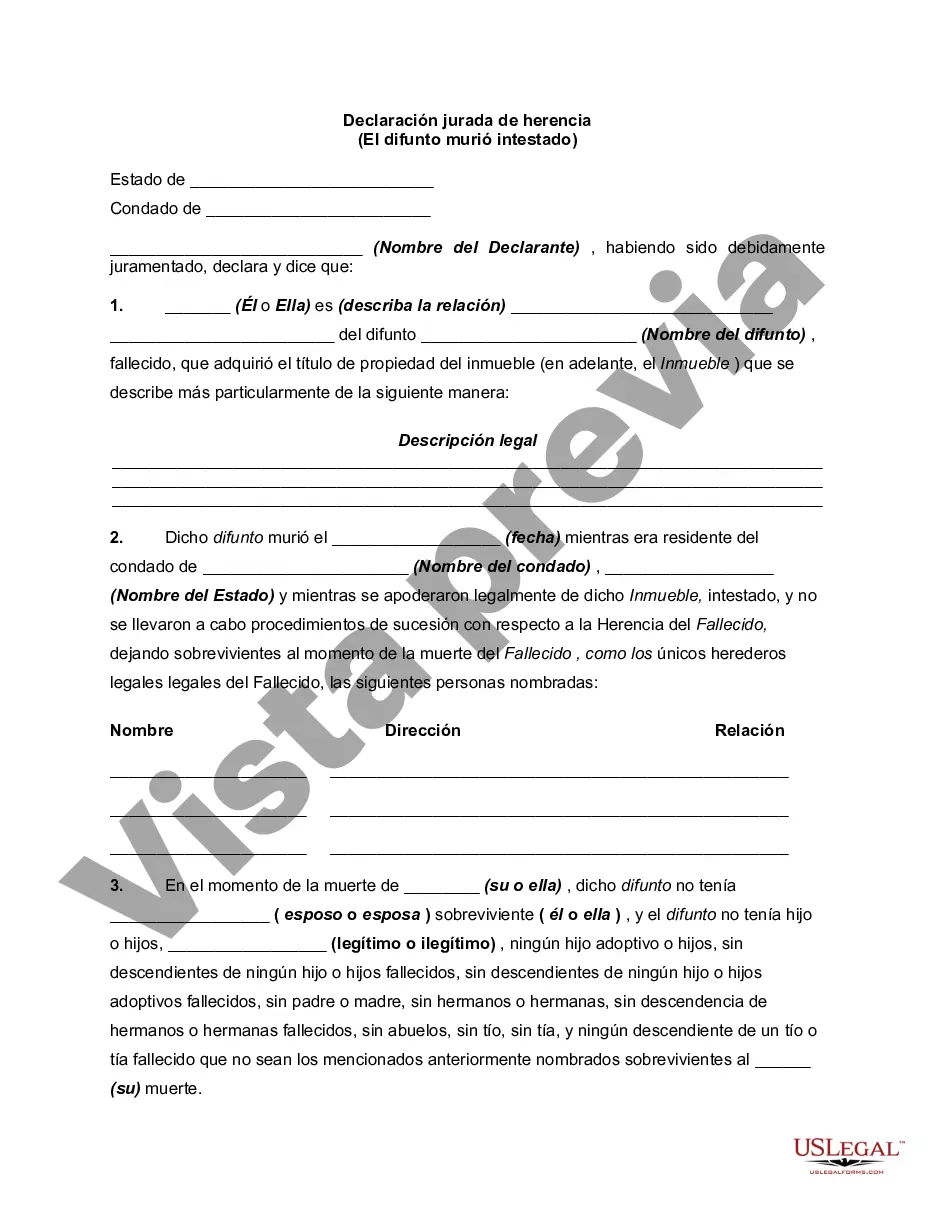

An heirship affidavit is used to state the heirs of a deceased person. It is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate. The affidavit of heirship must also be signed by a notary public.

San Antonio, Texas Affidavit of Warship, Next of Kin or Descent — Decedent Died Intestate is a legal document used to establish the rightful heirs and distribute the assets of a person who passed away without leaving a will. This affidavit is crucial in cases where the deceased passed away without a valid will, known as intestate. The San Antonio, Texas Affidavit of Warship, Next of Kin or Descent is utilized when there are no appointed beneficiaries or named heirs, and it helps to determine who is entitled to inherit the decedent's property or assets. This legal process is administered in accordance with Texas probate laws. Here are some key points to understand about the San Antonio, Texas Affidavit of Warship, Next of Kin or Descent — Decedent Died Intestate: 1. Purpose: This document serves to establish the identity of the deceased person's heirs and their respective rights to inherit the estate. 2. Required Information: The affidavit must include detailed information about the decedent, including their full name, date of death, and last known address. It should also provide information about the decedent's family members, such as spouses, children, parents, and siblings. The document may require additional details, such as the relationship of the heirs and any known debts or liabilities of the deceased. 3. Witnesses: The affidavit must be signed by two disinterested witnesses who have personal knowledge of the deceased person's family, heirs, and relationships. These witnesses should have no financial interest in the estate. 4. Notarization: The affidavit typically needs to be notarized to ensure its authenticity and legal validity. 5. Assets Distribution: Once the affidavit has been accepted by the appropriate court, the assets of the decedent can be distributed among the rightful heirs as determined by Texas law. The distribution may include real estate, personal property, bank accounts, or other assets owned by the deceased. Types of San Antonio, Texas Affidavit of Warship, Next of Kin or Descent — Decedent Died Intestate: 1. Basic Affidavit of Warship: This affidavit is the most common type and contains essential information about the decedent and their potential heirs. 2. Complex Affidavit of Warship: In more complex cases, where the decedent has a large estate or multiple generations, a complex affidavit may be necessary. This type of affidavit requires more detailed information about the decedent's relatives and their relationships. 3. Affidavit of Warship for Real Estate: Specifically focused on determining the heirs entitled to inherited real estate owned by the decedent. 4. Affidavit of Warship for Personal Property: Used to identify heirs entitled to receive personal property owned by the decedent, such as bank accounts, vehicles, or valuable assets. Note: It is recommended to consult with an experienced attorney who specializes in probate or estate law to ensure the correct preparation and execution of the San Antonio, Texas Affidavit of Warship, Next of Kin or Descent — Decedent Died Intestate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.