A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

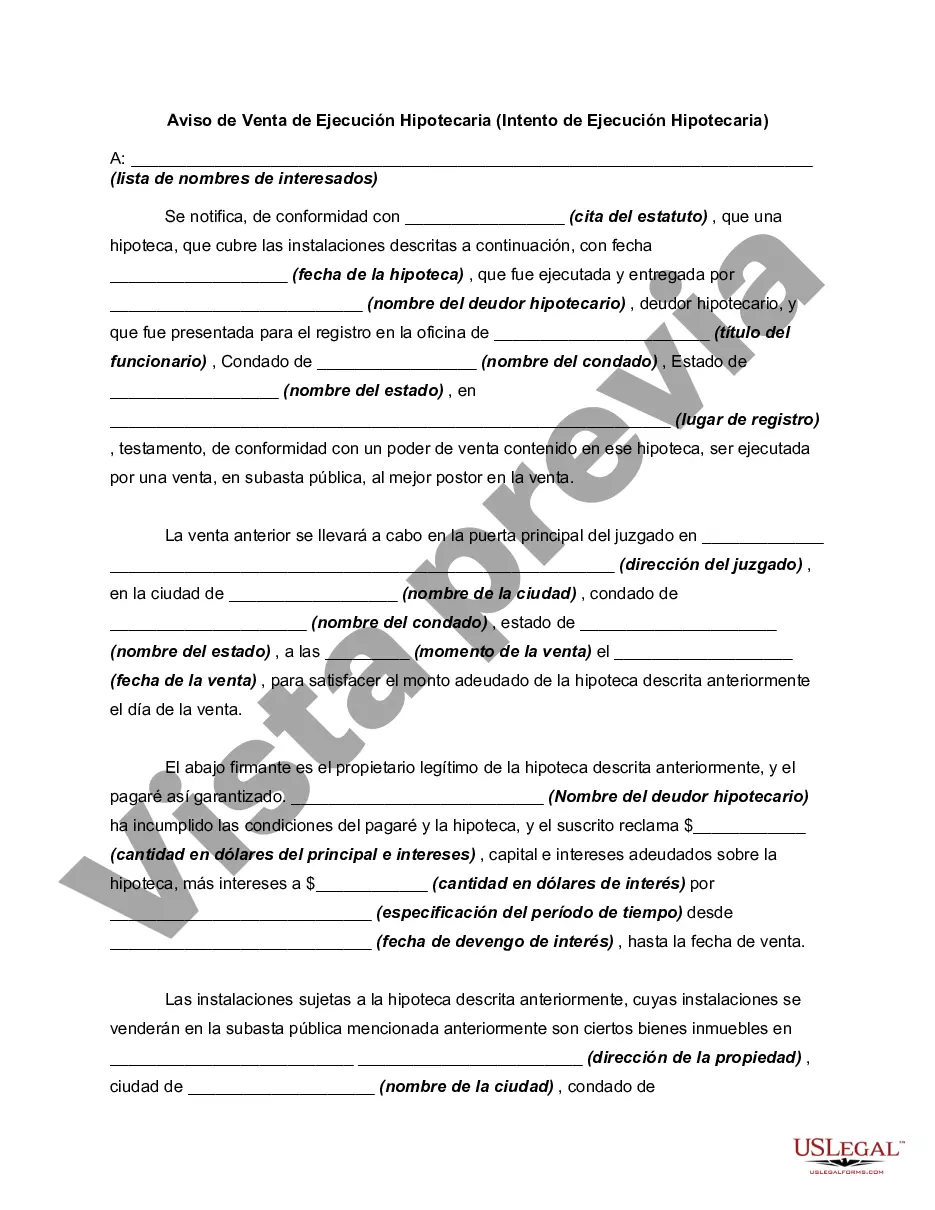

Title: Understanding the Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose Introduction: The Montgomery County, Maryland Notice of Foreclosure Sale — Intent to Foreclose is a legal notice issued by lenders or creditors notifying the property owner of their intention to foreclose on the property due to unpaid debts or mortgage defaults. This crucial document serves to inform homeowners about the pending foreclosure sale and provides an opportunity to take necessary action to address the issue. In Montgomery County, Maryland, foreclosure proceedings typically adhere to strict legal guidelines to protect the rights of both the borrower and the lender. Types of Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose: 1. Judicial Foreclosure: Under this type of foreclosure process, the lender files a lawsuit against the homeowner to initiate the foreclosure process. The Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose in a judicial foreclosure case serves as formal notice to the homeowner that legal proceedings have been initiated, providing them time to respond and potentially challenge the foreclosure action through the court system. 2. Non-Judicial Foreclosure: In contrast to judicial foreclosure, non-judicial foreclosure allows lenders to foreclose on a property without involving the court system. Lenders must strictly follow Maryland state laws and contractual requirements outlined in the mortgage agreement. The Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose in a non-judicial foreclosure case serves as a warning that the lender has initiated the foreclosure process and sets a date for the foreclosure sale to take place. Key Elements of Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose: 1. Identification of Parties: The notice typically includes the names of the borrower, lender, and any other parties involved in the mortgage, such as guarantors or co-borrowers. Identifying each party involved is essential to ensure accuracy and legal compliance. 2. Property Description: A comprehensive description of the property subject to foreclosure is provided, including its address, legal description, and any unique identifiers. This ensures the homeowner is aware of which property is targeted for foreclosure. 3. Outstanding Debt Information: Details regarding the amount owed, outstanding interest, penalties, or fees are included in the notice. This helps the homeowner understand the total debt owed and the potential consequences of failing to address the situation. 4. Foreclosure Sale Date: The notice specifies the date, time, and location of the foreclosure sale. This information allows the homeowner to plan accordingly and potentially explore solutions to prevent the sale. 5. Redemption Period: In some cases, Maryland law may provide a redemption period during which the homeowner can redeem the property by paying off the outstanding balance. The notice should clearly inform the homeowner if such an option exists and outline the specific requirements for exercising this right. Conclusion: Understanding the Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose is crucial for homeowners facing imminent foreclosure. This legal document outlines important details related to the foreclosure sale and serves as a notice for borrowers to take appropriate action. Whether facing a judicial or non-judicial foreclosure, homeowners should carefully review the notice and seek professional advice to explore available options, such as loan modifications, repayment plans, or legal defenses, to potentially save their homes from foreclosure.Title: Understanding the Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose Introduction: The Montgomery County, Maryland Notice of Foreclosure Sale — Intent to Foreclose is a legal notice issued by lenders or creditors notifying the property owner of their intention to foreclose on the property due to unpaid debts or mortgage defaults. This crucial document serves to inform homeowners about the pending foreclosure sale and provides an opportunity to take necessary action to address the issue. In Montgomery County, Maryland, foreclosure proceedings typically adhere to strict legal guidelines to protect the rights of both the borrower and the lender. Types of Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose: 1. Judicial Foreclosure: Under this type of foreclosure process, the lender files a lawsuit against the homeowner to initiate the foreclosure process. The Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose in a judicial foreclosure case serves as formal notice to the homeowner that legal proceedings have been initiated, providing them time to respond and potentially challenge the foreclosure action through the court system. 2. Non-Judicial Foreclosure: In contrast to judicial foreclosure, non-judicial foreclosure allows lenders to foreclose on a property without involving the court system. Lenders must strictly follow Maryland state laws and contractual requirements outlined in the mortgage agreement. The Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose in a non-judicial foreclosure case serves as a warning that the lender has initiated the foreclosure process and sets a date for the foreclosure sale to take place. Key Elements of Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose: 1. Identification of Parties: The notice typically includes the names of the borrower, lender, and any other parties involved in the mortgage, such as guarantors or co-borrowers. Identifying each party involved is essential to ensure accuracy and legal compliance. 2. Property Description: A comprehensive description of the property subject to foreclosure is provided, including its address, legal description, and any unique identifiers. This ensures the homeowner is aware of which property is targeted for foreclosure. 3. Outstanding Debt Information: Details regarding the amount owed, outstanding interest, penalties, or fees are included in the notice. This helps the homeowner understand the total debt owed and the potential consequences of failing to address the situation. 4. Foreclosure Sale Date: The notice specifies the date, time, and location of the foreclosure sale. This information allows the homeowner to plan accordingly and potentially explore solutions to prevent the sale. 5. Redemption Period: In some cases, Maryland law may provide a redemption period during which the homeowner can redeem the property by paying off the outstanding balance. The notice should clearly inform the homeowner if such an option exists and outline the specific requirements for exercising this right. Conclusion: Understanding the Montgomery, Maryland Notice of Foreclosure Sale — Intent to Foreclose is crucial for homeowners facing imminent foreclosure. This legal document outlines important details related to the foreclosure sale and serves as a notice for borrowers to take appropriate action. Whether facing a judicial or non-judicial foreclosure, homeowners should carefully review the notice and seek professional advice to explore available options, such as loan modifications, repayment plans, or legal defenses, to potentially save their homes from foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.