A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

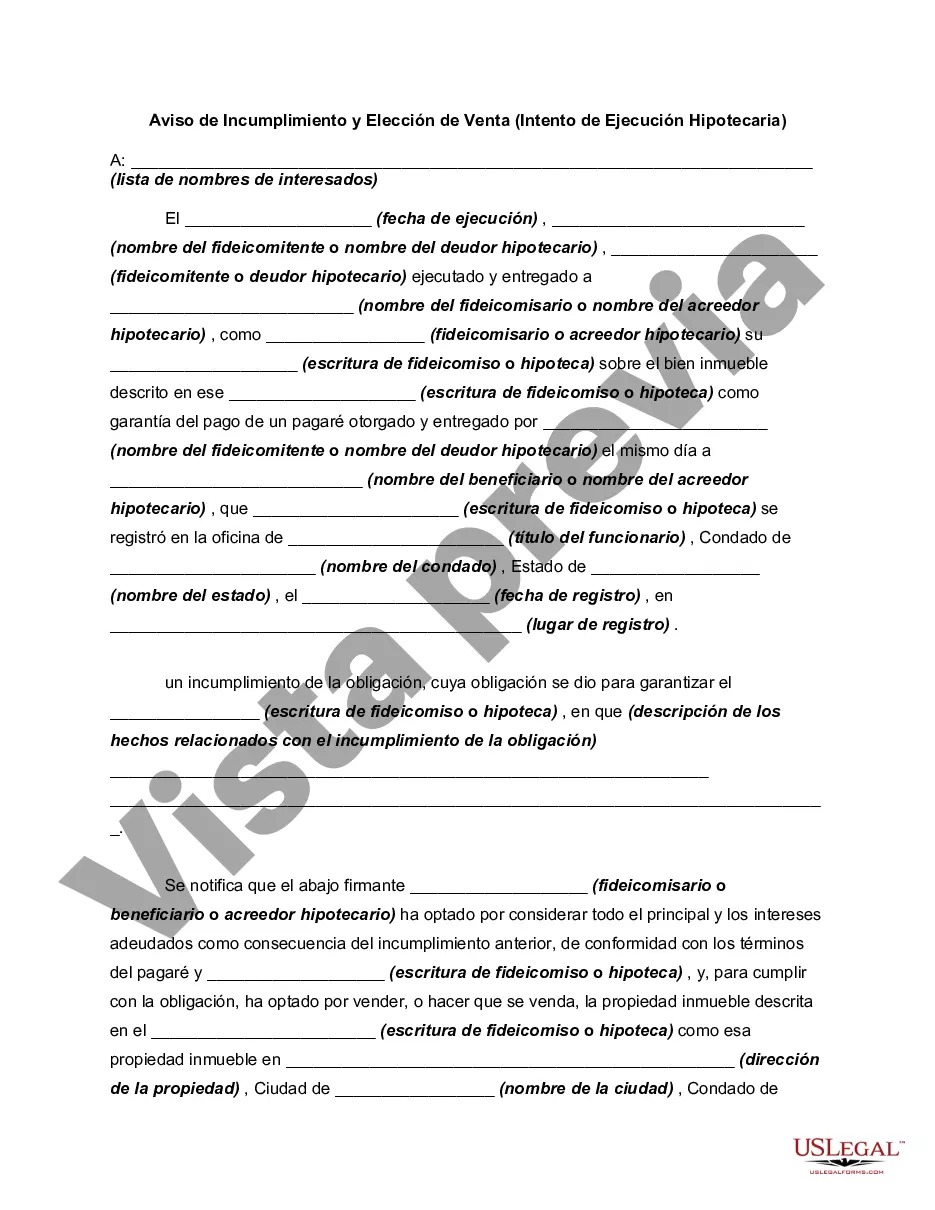

Collin Texas Notice of Default and Election to Sell — Intent To Foreclose is a legal document issued by a lender to a borrower who has defaulted on their mortgage payments in Collin County, Texas. This notice serves as a formal communication, indicating the lender's intention to foreclose on the property and sell it at a public auction to recoup the outstanding debt. The Collin Texas Notice of Default and Election to Sell — Intent To Foreclose includes important information such as the borrower's name, property address, loan details, and the specific amount of overdue payments. It also informs the borrower that they have a certain period, usually 30 days, to cure the default by paying the outstanding amount. Failure to comply within this timeframe will result in the initiation of foreclosure proceedings. Different types of Collin Texas Notice of Default and Election to Sell — Intent To Foreclose can vary depending on the lender and the specific circumstances of the default. Here are a few possible variations: 1. Residential foreclosure notice: This type of notice is issued when the defaulted property is a residential home or individual dwelling. It outlines the steps the borrower can take to prevent foreclosure and provides contact information for the lender or the lender's designated representative. 2. Commercial foreclosure notice: If the defaulted property is a commercial building or business premises, a commercial foreclosure notice will be issued. This notice may include additional information specific to commercial properties, such as details about ongoing leases, tenants, or any special considerations. 3. Judicial foreclosure notice: When the lender decides to initiate foreclosure through the court system, a judicial foreclosure notice will be issued. This type of notice will outline the legal process that will be followed and inform the borrower about their rights to contest the foreclosure in court. It is essential for borrowers who receive a Collin Texas Notice of Default and Election to Sell — Intent To Foreclose to take immediate action to address the default. They should consult with a qualified attorney or housing counselor to explore available options, such as loan modification, refinancing, or arranging a repayment plan with the lender. Taking proactive steps can potentially help borrowers save their properties from foreclosure and protect their credit rating.Collin Texas Notice of Default and Election to Sell — Intent To Foreclose is a legal document issued by a lender to a borrower who has defaulted on their mortgage payments in Collin County, Texas. This notice serves as a formal communication, indicating the lender's intention to foreclose on the property and sell it at a public auction to recoup the outstanding debt. The Collin Texas Notice of Default and Election to Sell — Intent To Foreclose includes important information such as the borrower's name, property address, loan details, and the specific amount of overdue payments. It also informs the borrower that they have a certain period, usually 30 days, to cure the default by paying the outstanding amount. Failure to comply within this timeframe will result in the initiation of foreclosure proceedings. Different types of Collin Texas Notice of Default and Election to Sell — Intent To Foreclose can vary depending on the lender and the specific circumstances of the default. Here are a few possible variations: 1. Residential foreclosure notice: This type of notice is issued when the defaulted property is a residential home or individual dwelling. It outlines the steps the borrower can take to prevent foreclosure and provides contact information for the lender or the lender's designated representative. 2. Commercial foreclosure notice: If the defaulted property is a commercial building or business premises, a commercial foreclosure notice will be issued. This notice may include additional information specific to commercial properties, such as details about ongoing leases, tenants, or any special considerations. 3. Judicial foreclosure notice: When the lender decides to initiate foreclosure through the court system, a judicial foreclosure notice will be issued. This type of notice will outline the legal process that will be followed and inform the borrower about their rights to contest the foreclosure in court. It is essential for borrowers who receive a Collin Texas Notice of Default and Election to Sell — Intent To Foreclose to take immediate action to address the default. They should consult with a qualified attorney or housing counselor to explore available options, such as loan modification, refinancing, or arranging a repayment plan with the lender. Taking proactive steps can potentially help borrowers save their properties from foreclosure and protect their credit rating.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.