A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

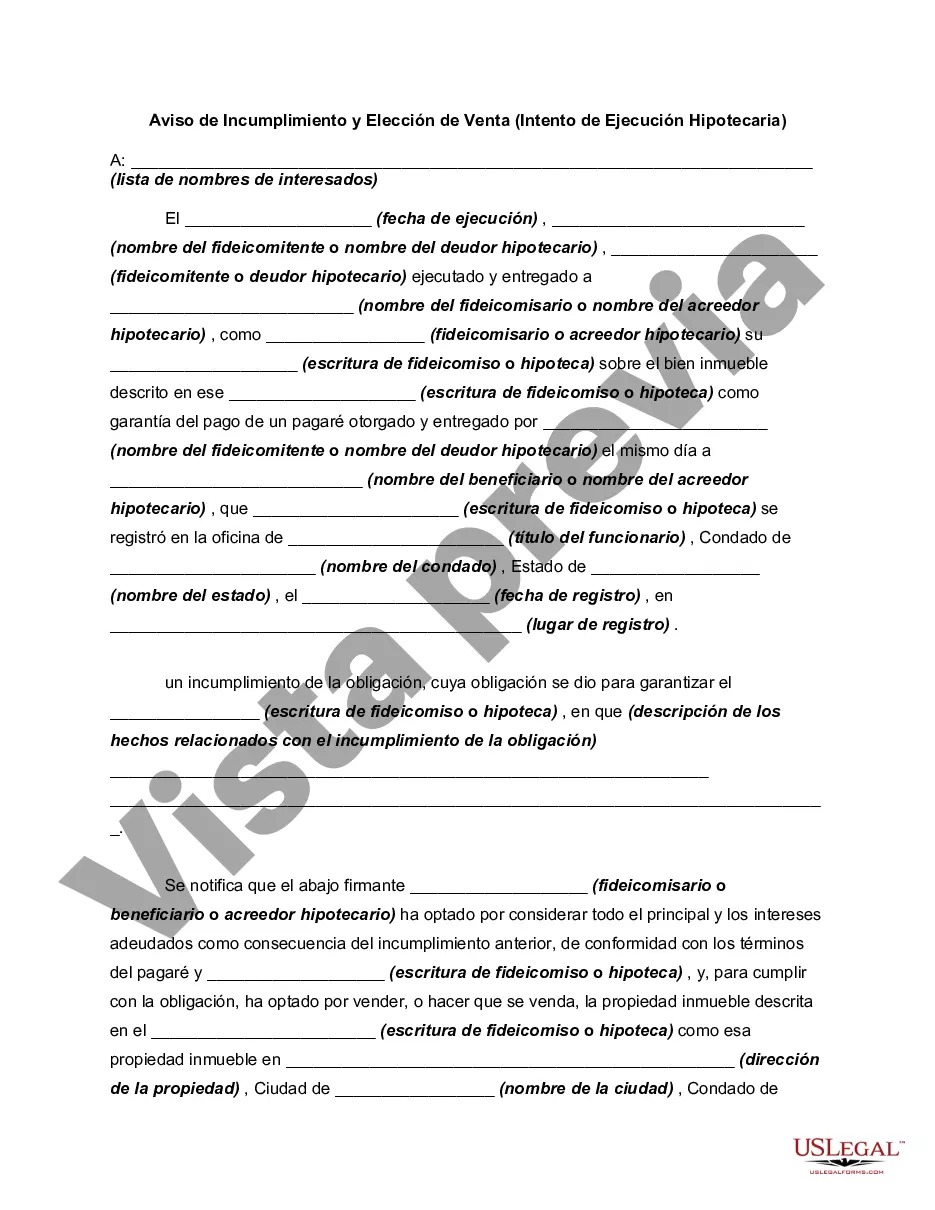

Franklin Ohio Notice of Default and Election to Sell — Intent To Foreclose is a legal document that homeowners in Franklin, Ohio may receive when they are facing a foreclosure on their property. This notice serves as a formal communication from the lender or mortgage company, informing the homeowner of their default on the mortgage payments and the intention to proceed with foreclosure proceedings. Keywords: Franklin Ohio, Notice of Default, Election to Sell, Intent To Foreclose, foreclosure proceedings, mortgage payments, lender, mortgage company. There are several types of Franklin Ohio Notice of Default and Election to Sell — Intent To Foreclose that homeowners may encounter, depending on their specific situation. Here are some common variations: 1. Residential Property Notice of Default: This notice is typically issued when a homeowner defaults on their mortgage payments for their residential property. It provides details regarding the amount owed, the timeframe for repayment, and the potential consequences if the default is not resolved. 2. Commercial Property Notice of Default: For owners of commercial properties, this notice is similar to the residential property notice but applies to non-residential buildings, such as offices, retail spaces, or industrial properties. It includes relevant information specific to commercial loans and foreclosure proceedings. 3. Second Mortgage Notice of Default: In cases where homeowners have a second mortgage or a home equity line of credit, this notice pertains to the default on the secondary loan. It outlines the steps the lender may take to foreclose on the property as a result of the delinquency on both the first and second mortgages. 4. Notice of Intent to Accelerate Loan: This variation of the notice is issued when the lender decides to accelerate the loan due to default. "Accelerating" the loan means that the full amount of the remaining balance becomes immediately due, rather than adhering to the original payment schedule. Receiving a Franklin Ohio Notice of Default and Election to Sell — Intent To Foreclose can be distressing for homeowners, but it is essential to take prompt action to explore alternatives, such as loan modification, refinancing, or seeking assistance from housing counseling agencies. It is advisable for homeowners to consult with legal professionals specializing in foreclosure defense to understand their rights and potential options. The specific terms and deadlines mentioned in the notice should be carefully reviewed, as failure to respond within the specified timeframes may result in the lender proceeding with the foreclosure process.Franklin Ohio Notice of Default and Election to Sell — Intent To Foreclose is a legal document that homeowners in Franklin, Ohio may receive when they are facing a foreclosure on their property. This notice serves as a formal communication from the lender or mortgage company, informing the homeowner of their default on the mortgage payments and the intention to proceed with foreclosure proceedings. Keywords: Franklin Ohio, Notice of Default, Election to Sell, Intent To Foreclose, foreclosure proceedings, mortgage payments, lender, mortgage company. There are several types of Franklin Ohio Notice of Default and Election to Sell — Intent To Foreclose that homeowners may encounter, depending on their specific situation. Here are some common variations: 1. Residential Property Notice of Default: This notice is typically issued when a homeowner defaults on their mortgage payments for their residential property. It provides details regarding the amount owed, the timeframe for repayment, and the potential consequences if the default is not resolved. 2. Commercial Property Notice of Default: For owners of commercial properties, this notice is similar to the residential property notice but applies to non-residential buildings, such as offices, retail spaces, or industrial properties. It includes relevant information specific to commercial loans and foreclosure proceedings. 3. Second Mortgage Notice of Default: In cases where homeowners have a second mortgage or a home equity line of credit, this notice pertains to the default on the secondary loan. It outlines the steps the lender may take to foreclose on the property as a result of the delinquency on both the first and second mortgages. 4. Notice of Intent to Accelerate Loan: This variation of the notice is issued when the lender decides to accelerate the loan due to default. "Accelerating" the loan means that the full amount of the remaining balance becomes immediately due, rather than adhering to the original payment schedule. Receiving a Franklin Ohio Notice of Default and Election to Sell — Intent To Foreclose can be distressing for homeowners, but it is essential to take prompt action to explore alternatives, such as loan modification, refinancing, or seeking assistance from housing counseling agencies. It is advisable for homeowners to consult with legal professionals specializing in foreclosure defense to understand their rights and potential options. The specific terms and deadlines mentioned in the notice should be carefully reviewed, as failure to respond within the specified timeframes may result in the lender proceeding with the foreclosure process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.