A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

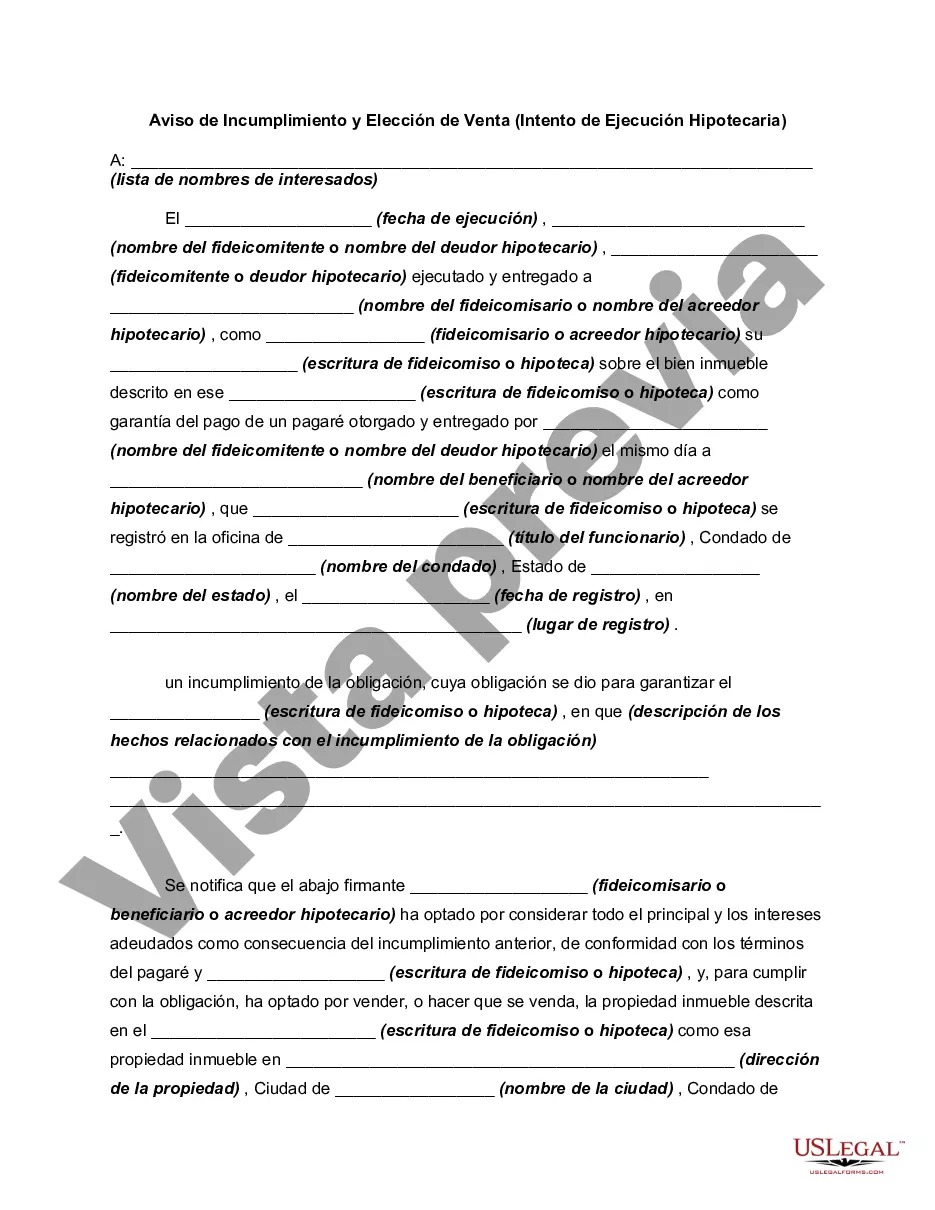

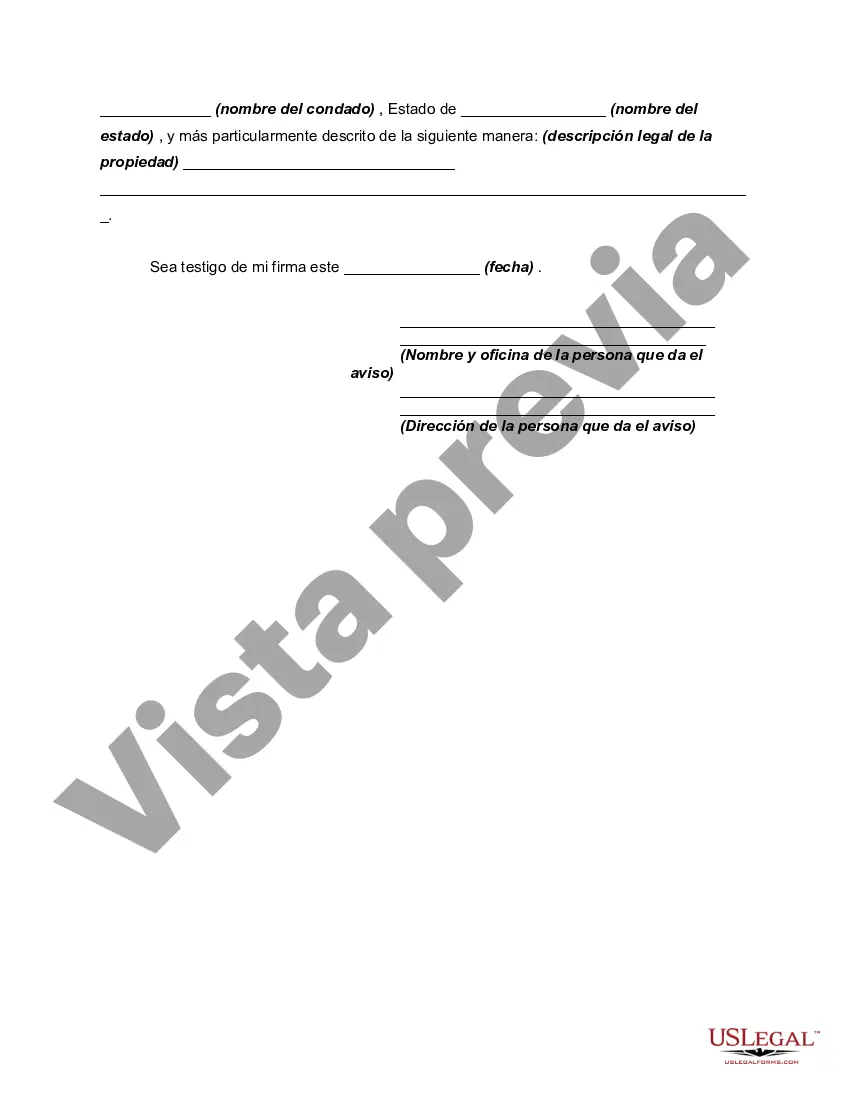

Miami-Dade Florida Notice of Default and Election to Sell — Intent To Foreclose: An Overview In Miami-Dade County, Florida, homeowners who fall behind on their mortgage payments may receive a Notice of Default and Election to Sell, also known as the Intent to Foreclose. This document serves as a formal notification from the lender to the borrower, outlining the impending foreclosure proceedings if the outstanding debt is not resolved. The Notice of Default and Election to Sell is a crucial step in the foreclosure process, as it provides a legal notice to the borrower, informing them of their rights and options to prevent the foreclosure. It is essential for homeowners to understand the implications of receiving such a notice and take appropriate action promptly. Various Types of Miami-Dade Florida Notice of Default and Election to Sell — Intent To Foreclose: 1. Judicial Foreclosure: In Miami-Dade County, if a lender chooses to pursue a judicial foreclosure, the Notice of Default and Election to Sell is typically issued by the court. This process involves filing a lawsuit against the borrower, seeking a court order to foreclose and sell the property. 2. Non-Judicial Foreclosure: Alternatively, some mortgages in Miami-Dade County may include a provision that allows for non-judicial foreclosure. In this case, the lender can proceed with foreclosure without involving the court system. The Notice of Default and Election to Sell, in a non-judicial foreclosure, is typically sent by the lender directly to the borrower. 3. Timeframe and Requirements: The Notice of Default and Election to Sell must meet specific legal requirements, including providing the borrower with a specific number of days to cure the default or pay the outstanding debt. The timeframe varies depending on the terms of the mortgage and relevant state laws. 4. Right to Reinstate or Redeem: The notice should also inform the borrower of their right to reinstate the loan by making all overdue payments, including any associated fees and costs. Additionally, in certain circumstances, borrowers may have the option to redeem the property by paying off the entire loan balance before the foreclosure sale. 5. Foreclosure Sale: If the borrower fails to cure the default within the specified timeframe, the lender may proceed with a foreclosure sale. This sale is typically conducted by an auction, where the property is sold to the highest bidder. The Notice of Default and Election to Sell also includes information regarding the date, time, and location of the foreclosure sale. It is important for homeowners who receive a Miami-Dade Florida Notice of Default and Election to Sell — Intent To Foreclose to seek legal guidance promptly to understand their rights, explore alternative options, and potentially negotiate with the lender. Taking swift action can help mitigate the consequences of foreclosure and possibly preserve homeownership or mitigate financial losses. Keywords: Miami-Dade Florida, Notice of Default and Election to Sell — Intent To Foreclose, foreclosure, mortgage, homeownership, judicial foreclosure, non-judicial foreclosure, legal notice, borrower rights, foreclosure sale, auction.Miami-Dade Florida Notice of Default and Election to Sell — Intent To Foreclose: An Overview In Miami-Dade County, Florida, homeowners who fall behind on their mortgage payments may receive a Notice of Default and Election to Sell, also known as the Intent to Foreclose. This document serves as a formal notification from the lender to the borrower, outlining the impending foreclosure proceedings if the outstanding debt is not resolved. The Notice of Default and Election to Sell is a crucial step in the foreclosure process, as it provides a legal notice to the borrower, informing them of their rights and options to prevent the foreclosure. It is essential for homeowners to understand the implications of receiving such a notice and take appropriate action promptly. Various Types of Miami-Dade Florida Notice of Default and Election to Sell — Intent To Foreclose: 1. Judicial Foreclosure: In Miami-Dade County, if a lender chooses to pursue a judicial foreclosure, the Notice of Default and Election to Sell is typically issued by the court. This process involves filing a lawsuit against the borrower, seeking a court order to foreclose and sell the property. 2. Non-Judicial Foreclosure: Alternatively, some mortgages in Miami-Dade County may include a provision that allows for non-judicial foreclosure. In this case, the lender can proceed with foreclosure without involving the court system. The Notice of Default and Election to Sell, in a non-judicial foreclosure, is typically sent by the lender directly to the borrower. 3. Timeframe and Requirements: The Notice of Default and Election to Sell must meet specific legal requirements, including providing the borrower with a specific number of days to cure the default or pay the outstanding debt. The timeframe varies depending on the terms of the mortgage and relevant state laws. 4. Right to Reinstate or Redeem: The notice should also inform the borrower of their right to reinstate the loan by making all overdue payments, including any associated fees and costs. Additionally, in certain circumstances, borrowers may have the option to redeem the property by paying off the entire loan balance before the foreclosure sale. 5. Foreclosure Sale: If the borrower fails to cure the default within the specified timeframe, the lender may proceed with a foreclosure sale. This sale is typically conducted by an auction, where the property is sold to the highest bidder. The Notice of Default and Election to Sell also includes information regarding the date, time, and location of the foreclosure sale. It is important for homeowners who receive a Miami-Dade Florida Notice of Default and Election to Sell — Intent To Foreclose to seek legal guidance promptly to understand their rights, explore alternative options, and potentially negotiate with the lender. Taking swift action can help mitigate the consequences of foreclosure and possibly preserve homeownership or mitigate financial losses. Keywords: Miami-Dade Florida, Notice of Default and Election to Sell — Intent To Foreclose, foreclosure, mortgage, homeownership, judicial foreclosure, non-judicial foreclosure, legal notice, borrower rights, foreclosure sale, auction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.