A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

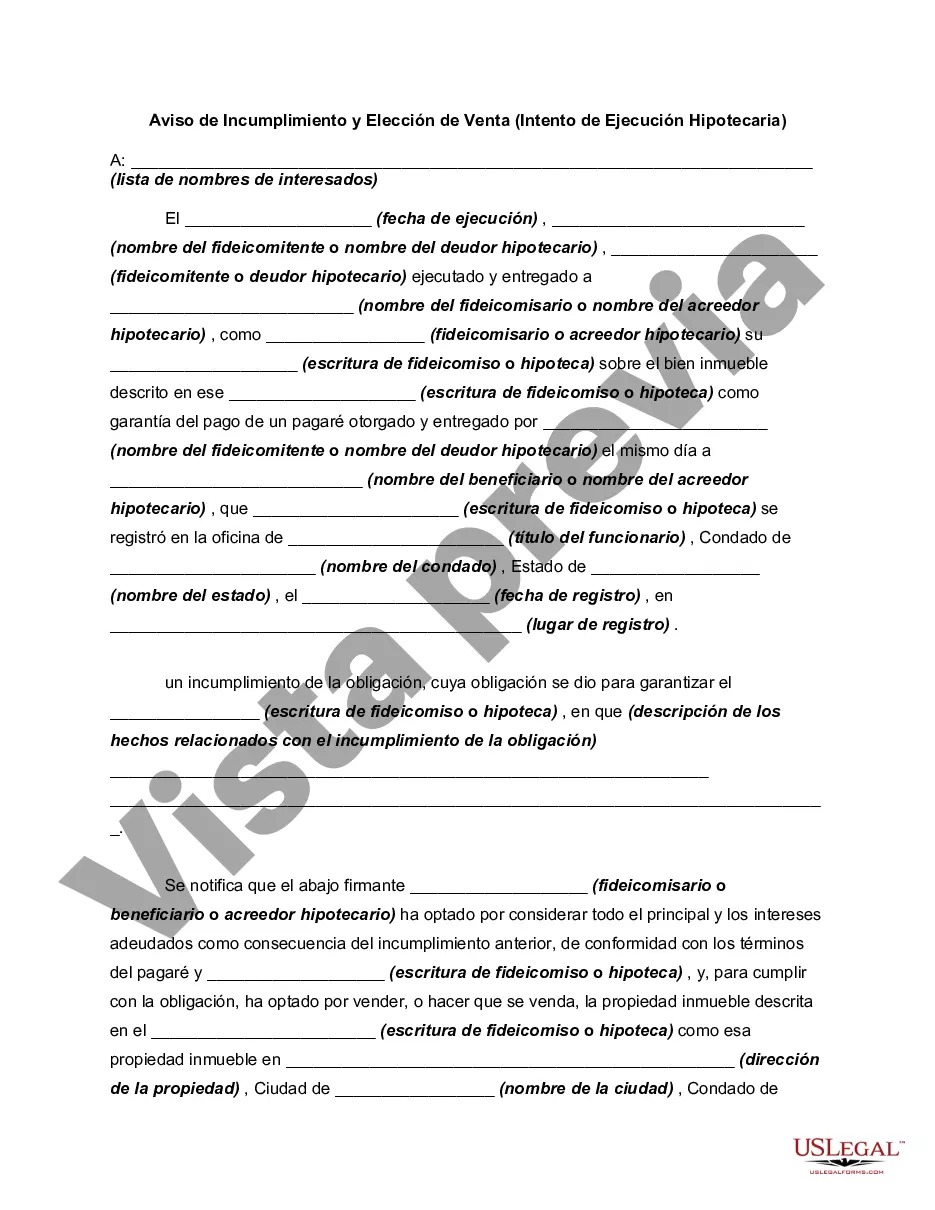

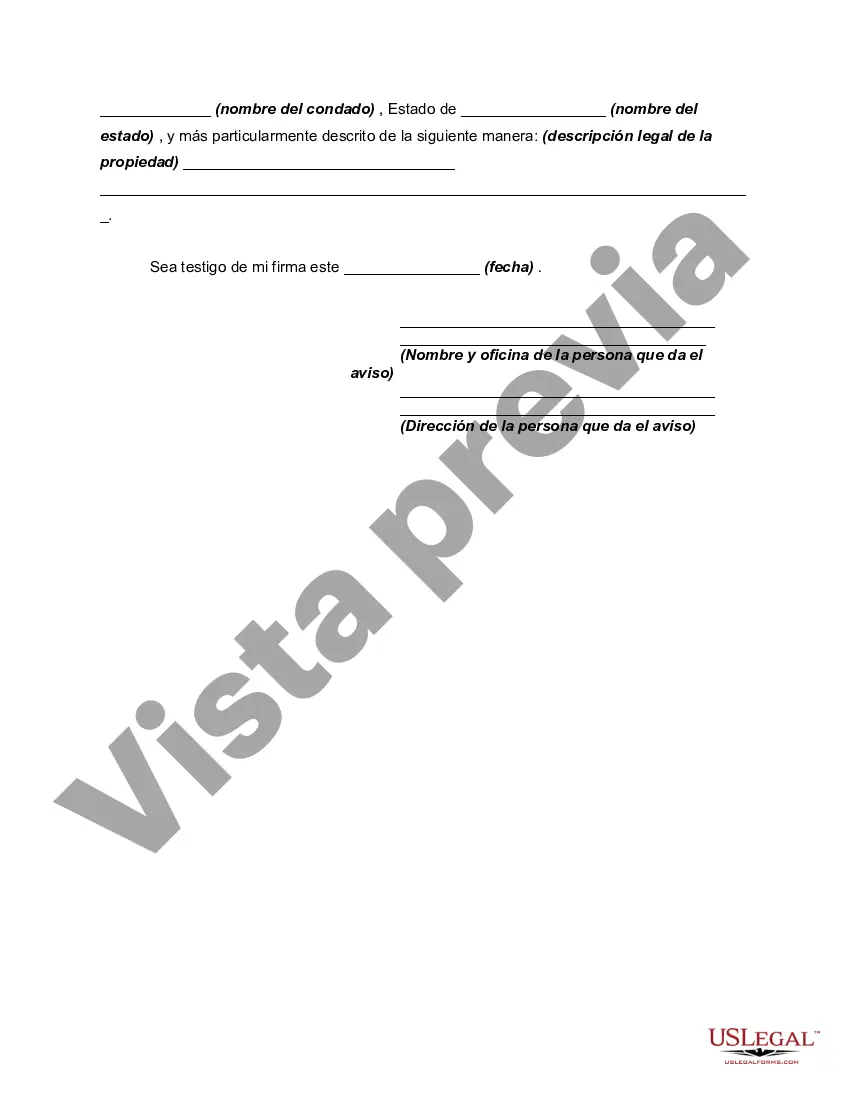

Philadelphia Pennsylvania A Philadelphia Pennsylvania Notice of Default and Election to Sell — Intent To Foreclose is a legal document issued to property owners in Philadelphia when they default on their mortgage payments, triggering the foreclosure process. This notice serves as a warning and provides information about the lender's intent to sell the property through foreclosure proceedings. It is important for property owners in Philadelphia to understand the implications of receiving a Notice of Default and Election to Sell, as it signifies that their property ownership is at risk. There are different types of Philadelphia Pennsylvania Notice of Default and Election to Sell, which vary depending on the specific circumstances of the foreclosure situation. Some common types include: 1. Residential Notice of Default and Election to Sell: This type of notice is issued when the property in question is a residential property, such as a family home or condominium. Homeowners who fail to make their mortgage payments may receive this notice, indicating that the lender intends to foreclose and sell the property to recover the outstanding balance. 2. Commercial Notice of Default and Election to Sell: This notice is specific to commercial properties, including office buildings, retail spaces, or warehouses. When commercial property owners default on their mortgage payments, they may receive this notice, alerting them to the impending foreclosure and the lender's intention to sell the property. 3. Vacant Land Notice of Default and Election to Sell: This type of notice is issued when the property involved is vacant land or undeveloped property. Property owners who fail to make their mortgage payments for such properties may receive this notice, signifying the lender's intent to foreclose and sell the land to recoup their losses. Receiving a Philadelphia Pennsylvania Notice of Default and Election to Sell is a serious matter, as it indicates that the property is on the path to foreclosure. Property owners who receive this notice should seek legal advice immediately to evaluate their options and potentially negotiate with the lender to prevent foreclosure or explore alternatives like loan modification or short sale. It is crucial for property owners to take swift action to protect their interests and understand the foreclosure process in Philadelphia.Philadelphia Pennsylvania A Philadelphia Pennsylvania Notice of Default and Election to Sell — Intent To Foreclose is a legal document issued to property owners in Philadelphia when they default on their mortgage payments, triggering the foreclosure process. This notice serves as a warning and provides information about the lender's intent to sell the property through foreclosure proceedings. It is important for property owners in Philadelphia to understand the implications of receiving a Notice of Default and Election to Sell, as it signifies that their property ownership is at risk. There are different types of Philadelphia Pennsylvania Notice of Default and Election to Sell, which vary depending on the specific circumstances of the foreclosure situation. Some common types include: 1. Residential Notice of Default and Election to Sell: This type of notice is issued when the property in question is a residential property, such as a family home or condominium. Homeowners who fail to make their mortgage payments may receive this notice, indicating that the lender intends to foreclose and sell the property to recover the outstanding balance. 2. Commercial Notice of Default and Election to Sell: This notice is specific to commercial properties, including office buildings, retail spaces, or warehouses. When commercial property owners default on their mortgage payments, they may receive this notice, alerting them to the impending foreclosure and the lender's intention to sell the property. 3. Vacant Land Notice of Default and Election to Sell: This type of notice is issued when the property involved is vacant land or undeveloped property. Property owners who fail to make their mortgage payments for such properties may receive this notice, signifying the lender's intent to foreclose and sell the land to recoup their losses. Receiving a Philadelphia Pennsylvania Notice of Default and Election to Sell is a serious matter, as it indicates that the property is on the path to foreclosure. Property owners who receive this notice should seek legal advice immediately to evaluate their options and potentially negotiate with the lender to prevent foreclosure or explore alternatives like loan modification or short sale. It is crucial for property owners to take swift action to protect their interests and understand the foreclosure process in Philadelphia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.