A notice of default is a notice to a borrower with property as security under a mortgage or deed of trust that he/she is overdue in payments. If the amount owed, plus costs of preparing the legal papers for the default, are not paid within a certain time, foreclosure proceedings may be brought against the property. Other people with funds secured by the same property are usually entitled to receive copies of the notice of default. It is a formal written notice to a borrower that a default has occurred and that legal action may be taken.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Los Angeles, California is a bustling and diverse city located on the west coast of the United States. Known for its sunny weather, vibrant culture, and entertainment industry, this city offers a myriad of opportunities and attractions for residents and visitors alike. When it comes to foreclosure proceedings, property owners in Los Angeles can anticipate receiving a Request for Copy of Notice of Default and Sale — Intent to Foreclose. This crucial document serves as an official notice that their property is facing potential foreclosure, signaling a serious and time-sensitive situation. The Notice of Default and Sale typically contains pertinent information regarding the defaulting property, including the property address, the borrower's name, the outstanding loan amount, and the lender's contact details. It outlines important deadlines for the property owner to respond and take appropriate action to prevent the foreclosure from proceeding. In Los Angeles, various types of Request for Copy of Notice of Default and Sale — Intent to Foreclose may exist, depending on the specific circumstances and legal requirements. These may include: 1. Judicial Foreclosure Notice: This type of notice is typically issued when a court oversees the foreclosure process. It ensures that the property owner is aware of the legal proceedings against them and provides an opportunity to respond or negotiate. 2. Non-Judicial Foreclosure Notice: A non-judicial foreclosure occurs when the lender follows specific procedures outlined in the loan agreement to foreclose on the property without court involvement. This notice informs the property owner about the impending sale of their property and additional steps they can take to halt the process. 3. Foreclosure Notice from Government Agencies: In certain situations, government agencies such as tax authorities or homeowners' associations may issue foreclosure notices due to unpaid taxes or association fees. These notices outline the steps needed to resolve the outstanding debt and avoid foreclosure. Property owners who receive a Request for Copy of Notice of Default and Sale — Intent to Foreclose in Los Angeles should promptly seek legal advice or consult with a foreclosure specialist. They must fully understand their rights and options, which may involve negotiating with the lender, applying for loan modifications, or exploring alternative solutions to avoid losing their property. It is crucial for property owners to read the notice carefully, respond within the specified timeframe, and gather all relevant documents and evidence to support their case. Failing to address the foreclosure notice may result in the loss of the property and potentially significant financial consequences. In conclusion, Los Angeles, California is a vibrant city that unfortunately also faces foreclosure proceedings. Property owners in this area should be aware of the different types of requests for a copy of the Notice of Default and Sale — Intent to Foreclose that they may receive. These notices serve as critical warnings and indicate the need for immediate action to avoid foreclosure and protect their property.Los Angeles, California is a bustling and diverse city located on the west coast of the United States. Known for its sunny weather, vibrant culture, and entertainment industry, this city offers a myriad of opportunities and attractions for residents and visitors alike. When it comes to foreclosure proceedings, property owners in Los Angeles can anticipate receiving a Request for Copy of Notice of Default and Sale — Intent to Foreclose. This crucial document serves as an official notice that their property is facing potential foreclosure, signaling a serious and time-sensitive situation. The Notice of Default and Sale typically contains pertinent information regarding the defaulting property, including the property address, the borrower's name, the outstanding loan amount, and the lender's contact details. It outlines important deadlines for the property owner to respond and take appropriate action to prevent the foreclosure from proceeding. In Los Angeles, various types of Request for Copy of Notice of Default and Sale — Intent to Foreclose may exist, depending on the specific circumstances and legal requirements. These may include: 1. Judicial Foreclosure Notice: This type of notice is typically issued when a court oversees the foreclosure process. It ensures that the property owner is aware of the legal proceedings against them and provides an opportunity to respond or negotiate. 2. Non-Judicial Foreclosure Notice: A non-judicial foreclosure occurs when the lender follows specific procedures outlined in the loan agreement to foreclose on the property without court involvement. This notice informs the property owner about the impending sale of their property and additional steps they can take to halt the process. 3. Foreclosure Notice from Government Agencies: In certain situations, government agencies such as tax authorities or homeowners' associations may issue foreclosure notices due to unpaid taxes or association fees. These notices outline the steps needed to resolve the outstanding debt and avoid foreclosure. Property owners who receive a Request for Copy of Notice of Default and Sale — Intent to Foreclose in Los Angeles should promptly seek legal advice or consult with a foreclosure specialist. They must fully understand their rights and options, which may involve negotiating with the lender, applying for loan modifications, or exploring alternative solutions to avoid losing their property. It is crucial for property owners to read the notice carefully, respond within the specified timeframe, and gather all relevant documents and evidence to support their case. Failing to address the foreclosure notice may result in the loss of the property and potentially significant financial consequences. In conclusion, Los Angeles, California is a vibrant city that unfortunately also faces foreclosure proceedings. Property owners in this area should be aware of the different types of requests for a copy of the Notice of Default and Sale — Intent to Foreclose that they may receive. These notices serve as critical warnings and indicate the need for immediate action to avoid foreclosure and protect their property.

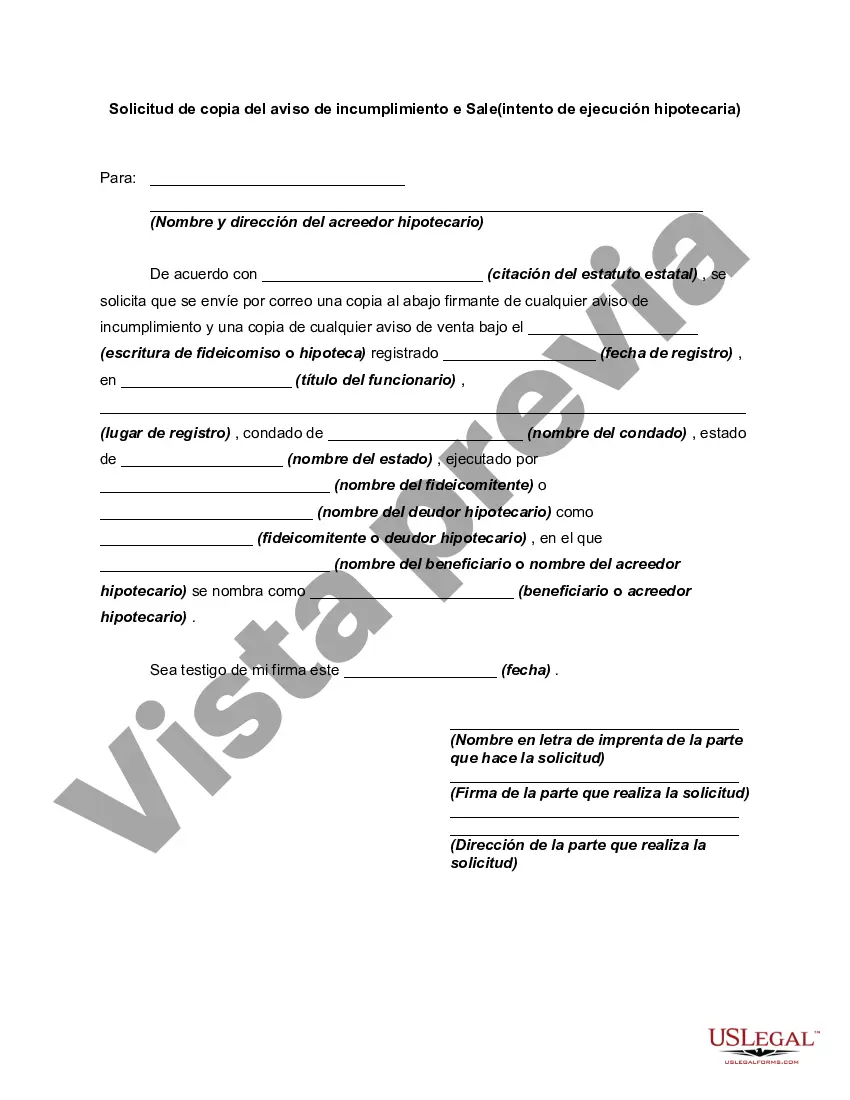

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.