A Real Estate Investment Trust or REIT is a tax designation for a corporation investing in real estate that reduces or eliminates corporate income taxes. In return, REITs are required to distribute 90% of their income, which may be taxable, into the hands of the investors. REITs invest in different kinds of real estate or real estate related assets. The REIT structure was designed to provide a similar structure for investment in real estate as mutual funds provide for investment in stocks. Like other corporations, REITs can be publicly or privately held. Public REITs may be listed on public stock exchanges like shares of common stock in other firms.

Dallas Texas Real Estate Investment Trust (REIT) is a type of investment vehicle that allows individuals, both small and large-scale investors, to invest and own properties in the Dallas, Texas area. Rests are companies that own and typically operate income-generating real estate. They pool investments from shareholders to invest in various types of properties, such as residential buildings, commercial properties, office spaces, shopping malls, hotels, and more. Dallas, Texas, with its thriving real estate market and economic growth, offers attractive opportunities for real estate investors. By investing in a Dallas Texas REIT, investors can diversify their portfolio, gain exposure to the local real estate market, and potentially earn regular income through rental profits and property appreciation. There are different types of Dallas Texas Rests, each specializing in a specific segment of the real estate market. These include: 1. Residential Rests: These Rests primarily invest in residential properties such as apartments, condos, and single-family homes. They earn income through rental payments from tenants. 2. Commercial Rests: Commercial Rests focus on investing in various types of commercial properties, including office buildings, shopping centers, industrial warehouses, and hotels. They generate income by leasing these properties to businesses. 3. Retail Rests: Retail Rests specialize in owning and operating shopping centers, malls, and other retail properties. They earn revenue through leasing space to retailers and collecting rent. 4. Hospitality Rests: These Rests invest in hotels, motels, resorts, and other hospitality-related properties. They generate income through room rentals and other services provided by these properties. Investing in a Dallas Texas REIT can bring several benefits to investors. Firstly, it offers a more accessible way to invest in real estate without the need to manage properties directly. Rests also provide diversification as they typically hold a portfolio of different properties, reducing the risk associated with holding a single property. Additionally, Rests are required by law to distribute a significant portion of their income to shareholders as dividends, making them an attractive option for income-focused investors. Overall, Dallas Texas Rests present an opportunity for individuals to participate in the lucrative real estate market of Dallas, Texas, and potentially earn regular income through property ownership and appreciation.Dallas Texas Real Estate Investment Trust (REIT) is a type of investment vehicle that allows individuals, both small and large-scale investors, to invest and own properties in the Dallas, Texas area. Rests are companies that own and typically operate income-generating real estate. They pool investments from shareholders to invest in various types of properties, such as residential buildings, commercial properties, office spaces, shopping malls, hotels, and more. Dallas, Texas, with its thriving real estate market and economic growth, offers attractive opportunities for real estate investors. By investing in a Dallas Texas REIT, investors can diversify their portfolio, gain exposure to the local real estate market, and potentially earn regular income through rental profits and property appreciation. There are different types of Dallas Texas Rests, each specializing in a specific segment of the real estate market. These include: 1. Residential Rests: These Rests primarily invest in residential properties such as apartments, condos, and single-family homes. They earn income through rental payments from tenants. 2. Commercial Rests: Commercial Rests focus on investing in various types of commercial properties, including office buildings, shopping centers, industrial warehouses, and hotels. They generate income by leasing these properties to businesses. 3. Retail Rests: Retail Rests specialize in owning and operating shopping centers, malls, and other retail properties. They earn revenue through leasing space to retailers and collecting rent. 4. Hospitality Rests: These Rests invest in hotels, motels, resorts, and other hospitality-related properties. They generate income through room rentals and other services provided by these properties. Investing in a Dallas Texas REIT can bring several benefits to investors. Firstly, it offers a more accessible way to invest in real estate without the need to manage properties directly. Rests also provide diversification as they typically hold a portfolio of different properties, reducing the risk associated with holding a single property. Additionally, Rests are required by law to distribute a significant portion of their income to shareholders as dividends, making them an attractive option for income-focused investors. Overall, Dallas Texas Rests present an opportunity for individuals to participate in the lucrative real estate market of Dallas, Texas, and potentially earn regular income through property ownership and appreciation.

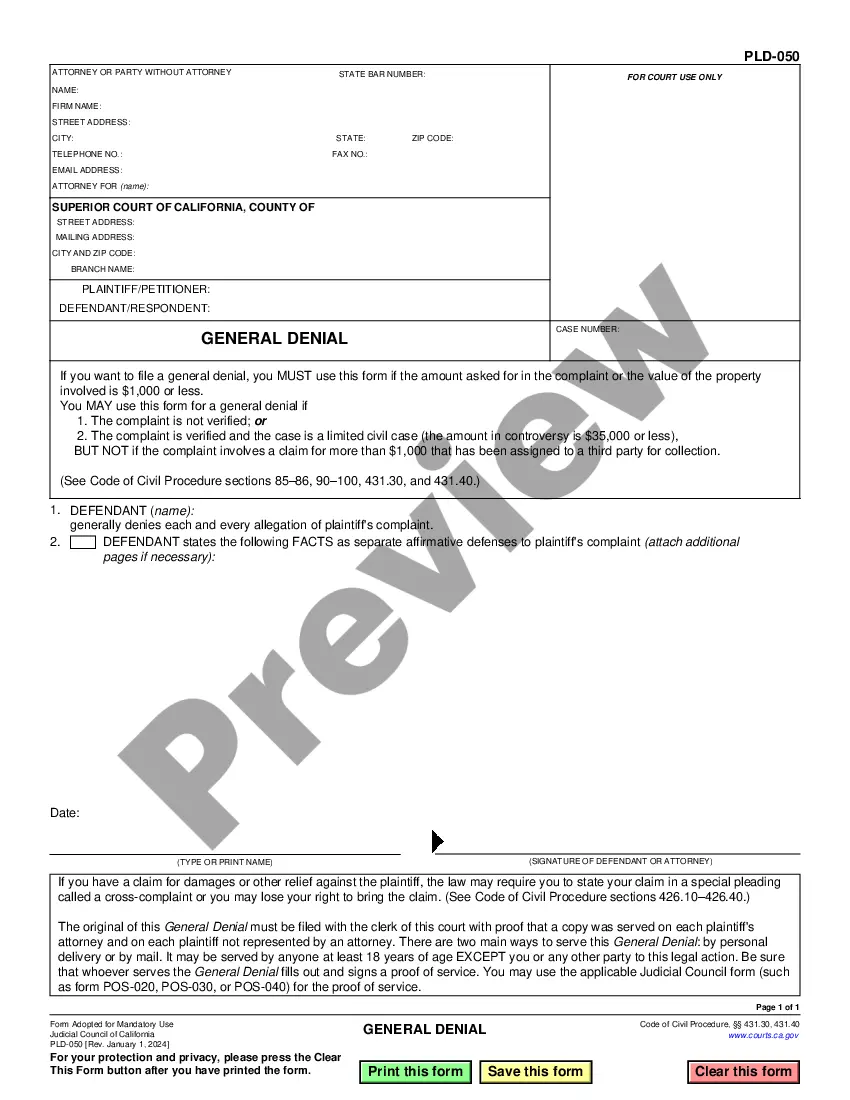

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.