Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

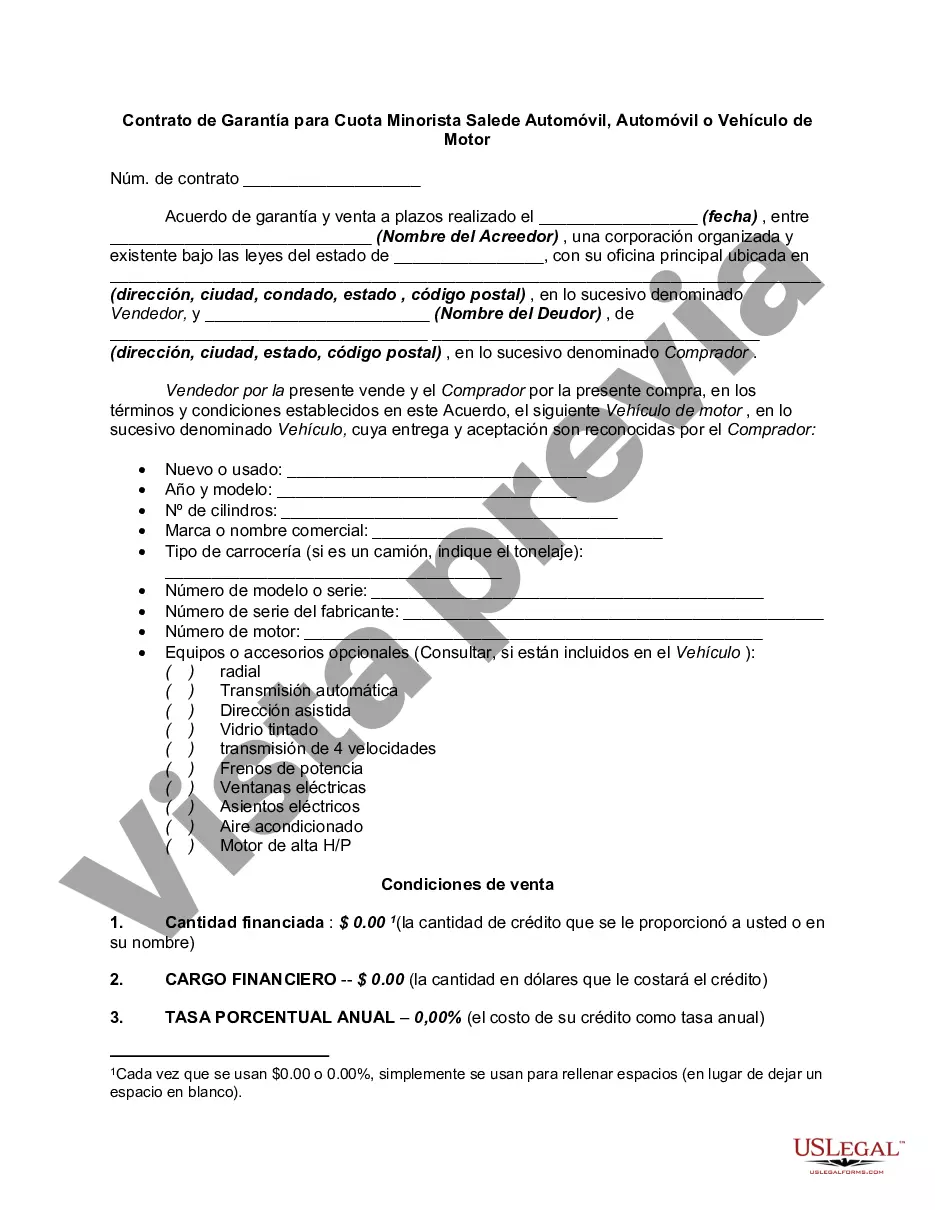

Allegheny Pennsylvania Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions for financing the purchase of a vehicle in Allegheny County, Pennsylvania. This agreement serves to protect both the buyer and the seller, ensuring that all parties involved understand their rights and responsibilities. The agreement details various aspects of the transaction, including the vehicle information, purchase price, down payment, finance charges, interest rates, payment schedule, and other relevant terms. It establishes a legally binding agreement between the buyer and the seller, providing security for the lender in case of default or non-payment. The purpose of the security agreement is to grant the seller a security interest or lien on the vehicle being purchased. This means that the seller retains the right to repossess the vehicle if the buyer fails to meet their payment obligations. The agreement also establishes that the vehicle acts as collateral for the loan, allowing the seller to recover their losses in case of default. In Allegheny County, Pennsylvania, there are different types of security agreements for retail installment sales of automobiles, cars, or motor vehicles based on various factors such as the type of vehicle being financed or the specific terms agreed upon by the buyer and seller. Some possible variations may include: 1. New Vehicle Security Agreement: This type of agreement is used when purchasing a brand-new vehicle from a dealership in Allegheny County. 2. Used Vehicle Security Agreement: If the buyer is purchasing a pre-owned vehicle, this agreement would be used to outline the terms of the transaction. 3. Lease-to-Own Security Agreement: Some buyers may opt for a lease-to-own arrangement, where they agree to make regular payments and eventually own the vehicle. This type of security agreement would detail the specific terms of the lease-to-own arrangement. 4. Commercial Vehicle Security Agreement: In cases where the vehicle being financed is intended for commercial use, such as delivery trucks or company vehicles, a specialized security agreement may be used to address the unique considerations associated with commercial vehicle financing. It is important for both buyers and sellers to carefully review and understand the Allegheny Pennsylvania Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle before signing. Seeking legal advice and conducting thorough due diligence can help ensure that all parties involved are protected and fully aware of their obligations under the agreement.Allegheny Pennsylvania Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions for financing the purchase of a vehicle in Allegheny County, Pennsylvania. This agreement serves to protect both the buyer and the seller, ensuring that all parties involved understand their rights and responsibilities. The agreement details various aspects of the transaction, including the vehicle information, purchase price, down payment, finance charges, interest rates, payment schedule, and other relevant terms. It establishes a legally binding agreement between the buyer and the seller, providing security for the lender in case of default or non-payment. The purpose of the security agreement is to grant the seller a security interest or lien on the vehicle being purchased. This means that the seller retains the right to repossess the vehicle if the buyer fails to meet their payment obligations. The agreement also establishes that the vehicle acts as collateral for the loan, allowing the seller to recover their losses in case of default. In Allegheny County, Pennsylvania, there are different types of security agreements for retail installment sales of automobiles, cars, or motor vehicles based on various factors such as the type of vehicle being financed or the specific terms agreed upon by the buyer and seller. Some possible variations may include: 1. New Vehicle Security Agreement: This type of agreement is used when purchasing a brand-new vehicle from a dealership in Allegheny County. 2. Used Vehicle Security Agreement: If the buyer is purchasing a pre-owned vehicle, this agreement would be used to outline the terms of the transaction. 3. Lease-to-Own Security Agreement: Some buyers may opt for a lease-to-own arrangement, where they agree to make regular payments and eventually own the vehicle. This type of security agreement would detail the specific terms of the lease-to-own arrangement. 4. Commercial Vehicle Security Agreement: In cases where the vehicle being financed is intended for commercial use, such as delivery trucks or company vehicles, a specialized security agreement may be used to address the unique considerations associated with commercial vehicle financing. It is important for both buyers and sellers to carefully review and understand the Allegheny Pennsylvania Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle before signing. Seeking legal advice and conducting thorough due diligence can help ensure that all parties involved are protected and fully aware of their obligations under the agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.