Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

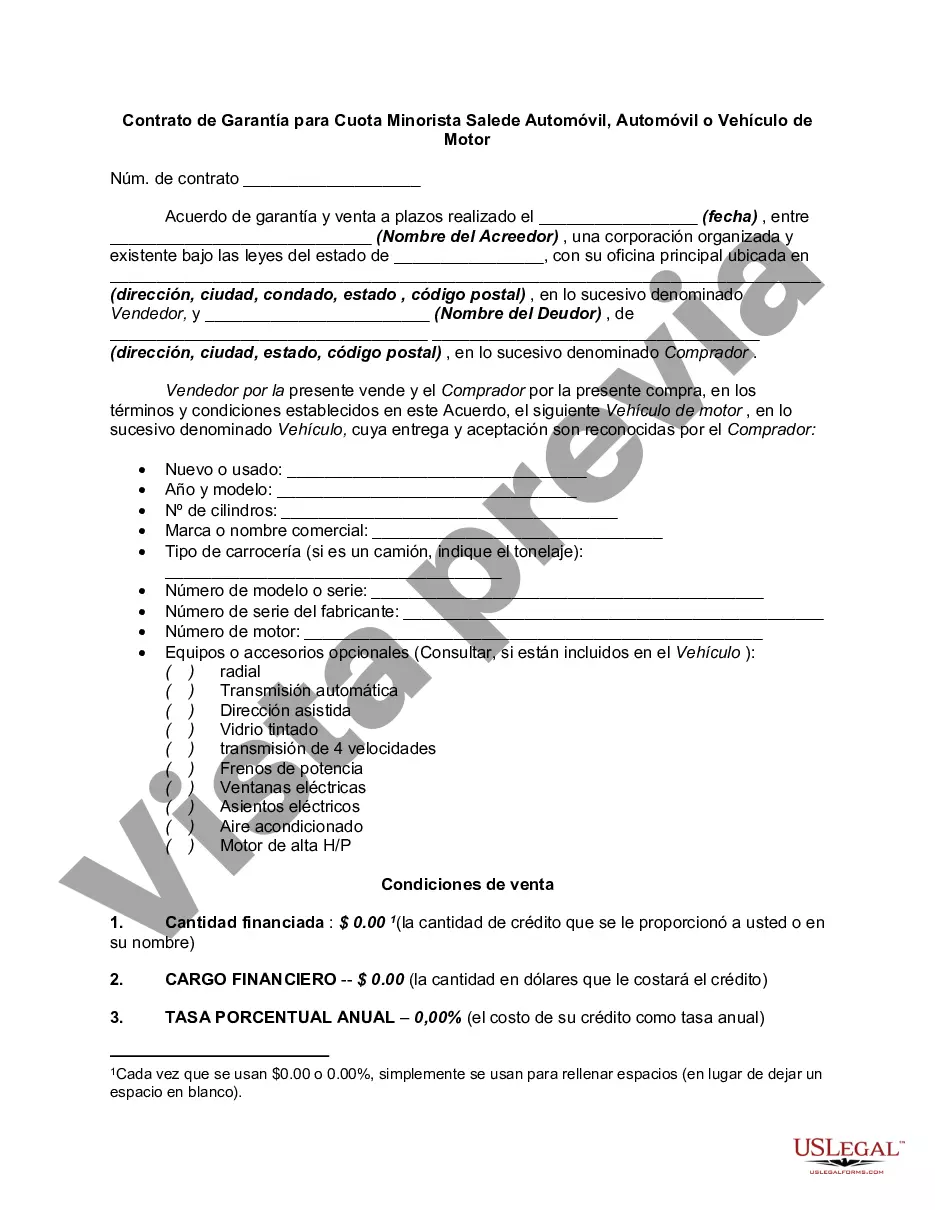

The Hennepin Minnesota Security Agreement for Retail Installment Sale of an Automobile, Car, or Motor Vehicle is a legal document used during vehicle purchases in Hennepin County, Minnesota that serves to establish a security interest in the vehicle being purchased. This agreement outlines the terms and conditions of the sale, including the rights and responsibilities of both the buyer and the seller. In Hennepin County, there are a few different types of Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle that can be named: 1. Traditional Security Agreement: This is the most common type of agreement used in Hennepin County. It specifies the terms of the sale, including the purchase price, down payment, interest rate, and repayment schedule. It also outlines the consequences of default, repossession rights, and any fees or penalties that may apply. 2. Balloon Payment Security Agreement: Some buyers opt for a balloon payment agreement, where a larger final payment is due at the end of the loan term. This type of agreement may be attractive to buyers who wish to have lower monthly payments throughout the loan term. 3. Lease Agreement with Option to Purchase: This type of agreement is commonly used for car leasing, where the buyer has the option to purchase the vehicle at the end of the lease term. The agreement specifies the lease payments, rights and responsibilities of both parties, and the terms for exercising the purchase option. 4. Conditional Sales Contract: A conditional sales contract is typically used when the buyer needs financing to purchase the vehicle. It outlines the details of the sale, including the installment payments, interest rate, and any other conditions or requirements set forth by the lender. 5. Subordination Agreement: In some cases, a buyer may already have an existing loan on another vehicle or property. A subordination agreement allows the new vehicle loan to take priority over the previous loan, ensuring proper security interests are established. It is crucial for both buyers and sellers in Hennepin County to carefully review and understand the terms of the Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle before signing. Seeking legal advice or assistance is advisable to ensure compliance with local laws and regulations, and to protect the rights and interests of both parties involved.The Hennepin Minnesota Security Agreement for Retail Installment Sale of an Automobile, Car, or Motor Vehicle is a legal document used during vehicle purchases in Hennepin County, Minnesota that serves to establish a security interest in the vehicle being purchased. This agreement outlines the terms and conditions of the sale, including the rights and responsibilities of both the buyer and the seller. In Hennepin County, there are a few different types of Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle that can be named: 1. Traditional Security Agreement: This is the most common type of agreement used in Hennepin County. It specifies the terms of the sale, including the purchase price, down payment, interest rate, and repayment schedule. It also outlines the consequences of default, repossession rights, and any fees or penalties that may apply. 2. Balloon Payment Security Agreement: Some buyers opt for a balloon payment agreement, where a larger final payment is due at the end of the loan term. This type of agreement may be attractive to buyers who wish to have lower monthly payments throughout the loan term. 3. Lease Agreement with Option to Purchase: This type of agreement is commonly used for car leasing, where the buyer has the option to purchase the vehicle at the end of the lease term. The agreement specifies the lease payments, rights and responsibilities of both parties, and the terms for exercising the purchase option. 4. Conditional Sales Contract: A conditional sales contract is typically used when the buyer needs financing to purchase the vehicle. It outlines the details of the sale, including the installment payments, interest rate, and any other conditions or requirements set forth by the lender. 5. Subordination Agreement: In some cases, a buyer may already have an existing loan on another vehicle or property. A subordination agreement allows the new vehicle loan to take priority over the previous loan, ensuring proper security interests are established. It is crucial for both buyers and sellers in Hennepin County to carefully review and understand the terms of the Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle before signing. Seeking legal advice or assistance is advisable to ensure compliance with local laws and regulations, and to protect the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.