Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

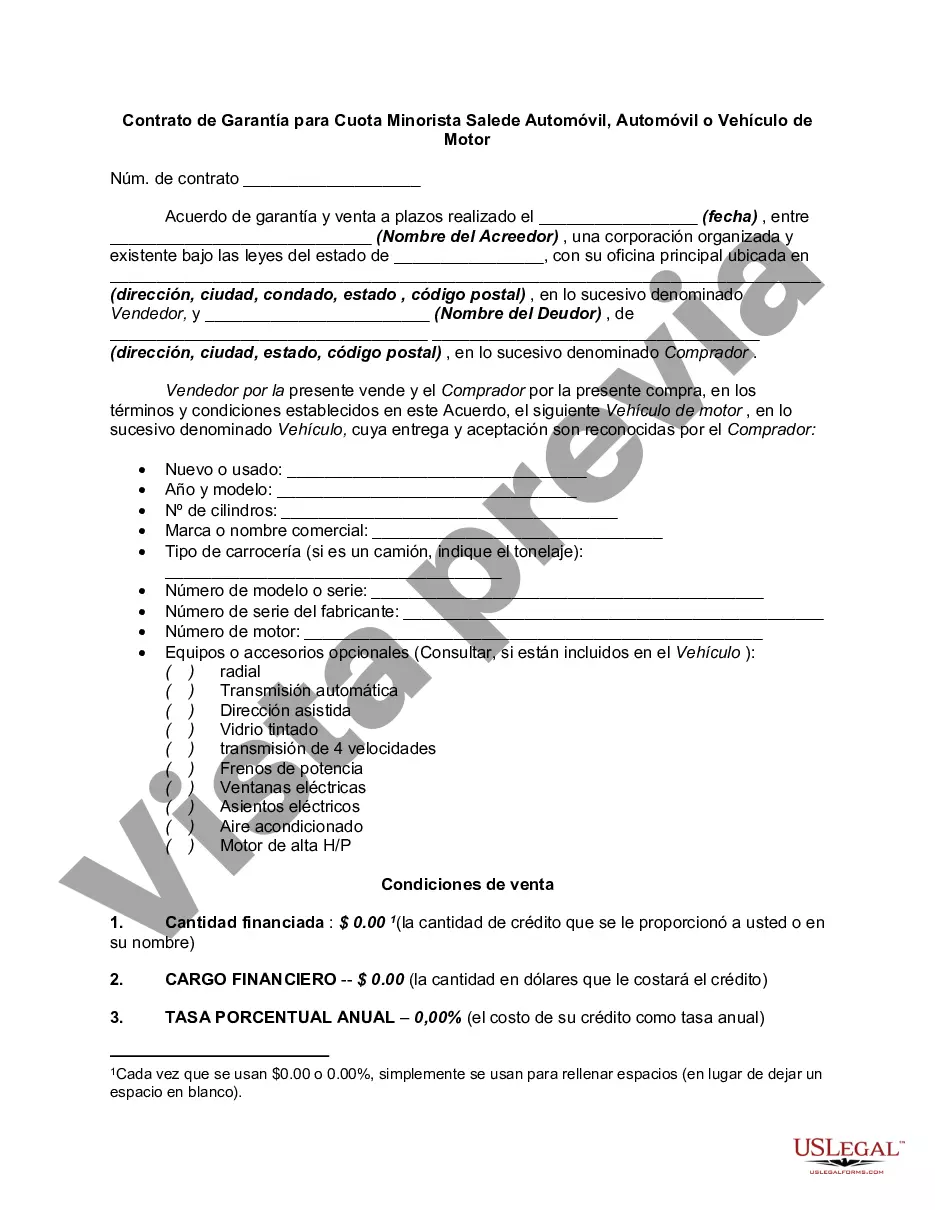

The Kings New York Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a legal document that outlines the terms and conditions regarding the financing of a vehicle purchase in Kings County, New York. This agreement serves to secure the creditor's interest in the vehicle being sold and provides protection to both the buyer and the seller. It is important to understand this agreement thoroughly before entering into a retail installment sale of an automobile. The Kings New York Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle contains several elements that must be comprehensively addressed. Firstly, it outlines the buyer's obligations, including the terms of repayment such as the loan amount, interest rate, and repayment schedule. The security agreement also specifies the consequences of defaulting on the loan, which may include repossession of the vehicle. Additionally, this agreement details the creditor's rights, such as the ability to inspect and repossess the vehicle if the buyer fails to meet their repayment obligations. It may also stipulate any additional charges and fees associated with late payments or defaults. The agreement may also include provisions regarding the buyer's responsibilities for insurance, maintenance, and repair of the vehicle. Furthermore, it is essential to note that there can be different types of Kings New York Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle tailored to specific situations. Some variations may exist based on factors such as the type of vehicle being financed, the length of the loan term, or specific conditions agreed upon by the buyer and the seller. It is crucial for all parties involved to carefully review and understand the exact terms of their agreement to ensure compliance and avoid any disputes in the future. In conclusion, the Kings New York Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a crucial legal document that safeguards the interests of both the buyer and the seller during a vehicle purchase. It is necessary to thoroughly understand the terms and obligations specified within the agreement to ensure a smooth transaction and mitigate any potential issues or disputes that may arise.The Kings New York Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a legal document that outlines the terms and conditions regarding the financing of a vehicle purchase in Kings County, New York. This agreement serves to secure the creditor's interest in the vehicle being sold and provides protection to both the buyer and the seller. It is important to understand this agreement thoroughly before entering into a retail installment sale of an automobile. The Kings New York Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle contains several elements that must be comprehensively addressed. Firstly, it outlines the buyer's obligations, including the terms of repayment such as the loan amount, interest rate, and repayment schedule. The security agreement also specifies the consequences of defaulting on the loan, which may include repossession of the vehicle. Additionally, this agreement details the creditor's rights, such as the ability to inspect and repossess the vehicle if the buyer fails to meet their repayment obligations. It may also stipulate any additional charges and fees associated with late payments or defaults. The agreement may also include provisions regarding the buyer's responsibilities for insurance, maintenance, and repair of the vehicle. Furthermore, it is essential to note that there can be different types of Kings New York Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle tailored to specific situations. Some variations may exist based on factors such as the type of vehicle being financed, the length of the loan term, or specific conditions agreed upon by the buyer and the seller. It is crucial for all parties involved to carefully review and understand the exact terms of their agreement to ensure compliance and avoid any disputes in the future. In conclusion, the Kings New York Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a crucial legal document that safeguards the interests of both the buyer and the seller during a vehicle purchase. It is necessary to thoroughly understand the terms and obligations specified within the agreement to ensure a smooth transaction and mitigate any potential issues or disputes that may arise.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.