Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

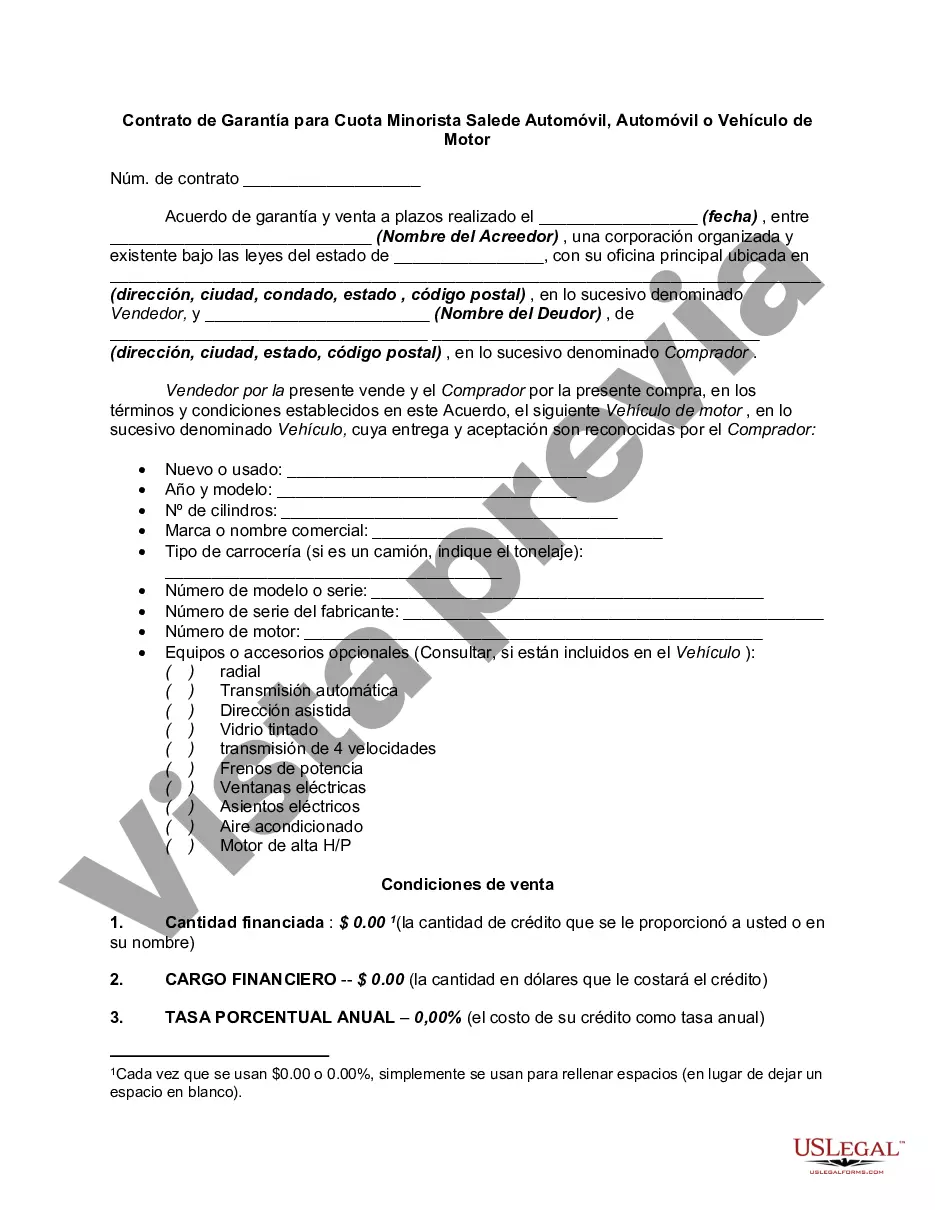

Miami-Dade Florida Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions of financing a vehicle purchase in Miami-Dade County. This agreement serves as a binding contract between the buyer and the seller, ensuring the rights and obligations of both parties are well-defined and protected. The purpose of the Miami-Dade Florida Security Agreement is to establish a security interest in the vehicle being sold. This means that the seller retains a legal right to repossess the vehicle if the buyer fails to meet their payment obligations. The agreement typically includes provisions related to the following: 1. Parties Involved: The agreement specifies the identities and contact information of both the buyer (debtor) and the seller (creditor). It is essential to accurately record this information to ensure all relevant parties are held accountable. 2. Vehicle Description: The agreement contains detailed information about the vehicle being sold, including the make, model, year, Vehicle Identification Number (VIN), and any other distinguishing features. Accurately describing the vehicle is crucial for identification and documentation purposes. 3. Purchase Price: The total purchase price of the vehicle is stated in the agreement. Additionally, it may outline any down payment made by the buyer or other terms related to the payment schedule. 4. Security Interest: The Miami-Dade Florida Security Agreement creates a security interest in the vehicle, which means the seller has the right to repossess the vehicle in case of default. This provision safeguards the seller's interests and serves as collateral for the loan. 5. Payment Terms: The agreement specifies the payment amount, frequency, and due date. It may also delineate consequences for late or missed payments, including potential penalties or the buyer's liability for repossession fees. 6. Insurance Requirements: The agreement generally requires the buyer to maintain specified insurance coverage (collision, liability, comprehensive) on the vehicle throughout the loan term. This is to protect the seller's interest in the vehicle in case of accidents or damage. 7. Default and Remedies: The agreement outlines the consequences of default, such as late payments or failure to maintain insurance. It may specify the seller's rights to repossess the vehicle, as well as any applicable repossession fees or additional charges. Different types of Miami-Dade Florida Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle may exist based on various factors such as the financing institution, specific terms of the loan, or the addendum of additional clauses. However, these variations typically address similar elements, focusing on creating a legal and binding agreement that protects the interests of both the buyer and the seller in the retail installment sale of an automobile.Miami-Dade Florida Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions of financing a vehicle purchase in Miami-Dade County. This agreement serves as a binding contract between the buyer and the seller, ensuring the rights and obligations of both parties are well-defined and protected. The purpose of the Miami-Dade Florida Security Agreement is to establish a security interest in the vehicle being sold. This means that the seller retains a legal right to repossess the vehicle if the buyer fails to meet their payment obligations. The agreement typically includes provisions related to the following: 1. Parties Involved: The agreement specifies the identities and contact information of both the buyer (debtor) and the seller (creditor). It is essential to accurately record this information to ensure all relevant parties are held accountable. 2. Vehicle Description: The agreement contains detailed information about the vehicle being sold, including the make, model, year, Vehicle Identification Number (VIN), and any other distinguishing features. Accurately describing the vehicle is crucial for identification and documentation purposes. 3. Purchase Price: The total purchase price of the vehicle is stated in the agreement. Additionally, it may outline any down payment made by the buyer or other terms related to the payment schedule. 4. Security Interest: The Miami-Dade Florida Security Agreement creates a security interest in the vehicle, which means the seller has the right to repossess the vehicle in case of default. This provision safeguards the seller's interests and serves as collateral for the loan. 5. Payment Terms: The agreement specifies the payment amount, frequency, and due date. It may also delineate consequences for late or missed payments, including potential penalties or the buyer's liability for repossession fees. 6. Insurance Requirements: The agreement generally requires the buyer to maintain specified insurance coverage (collision, liability, comprehensive) on the vehicle throughout the loan term. This is to protect the seller's interest in the vehicle in case of accidents or damage. 7. Default and Remedies: The agreement outlines the consequences of default, such as late payments or failure to maintain insurance. It may specify the seller's rights to repossess the vehicle, as well as any applicable repossession fees or additional charges. Different types of Miami-Dade Florida Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle may exist based on various factors such as the financing institution, specific terms of the loan, or the addendum of additional clauses. However, these variations typically address similar elements, focusing on creating a legal and binding agreement that protects the interests of both the buyer and the seller in the retail installment sale of an automobile.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.