Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

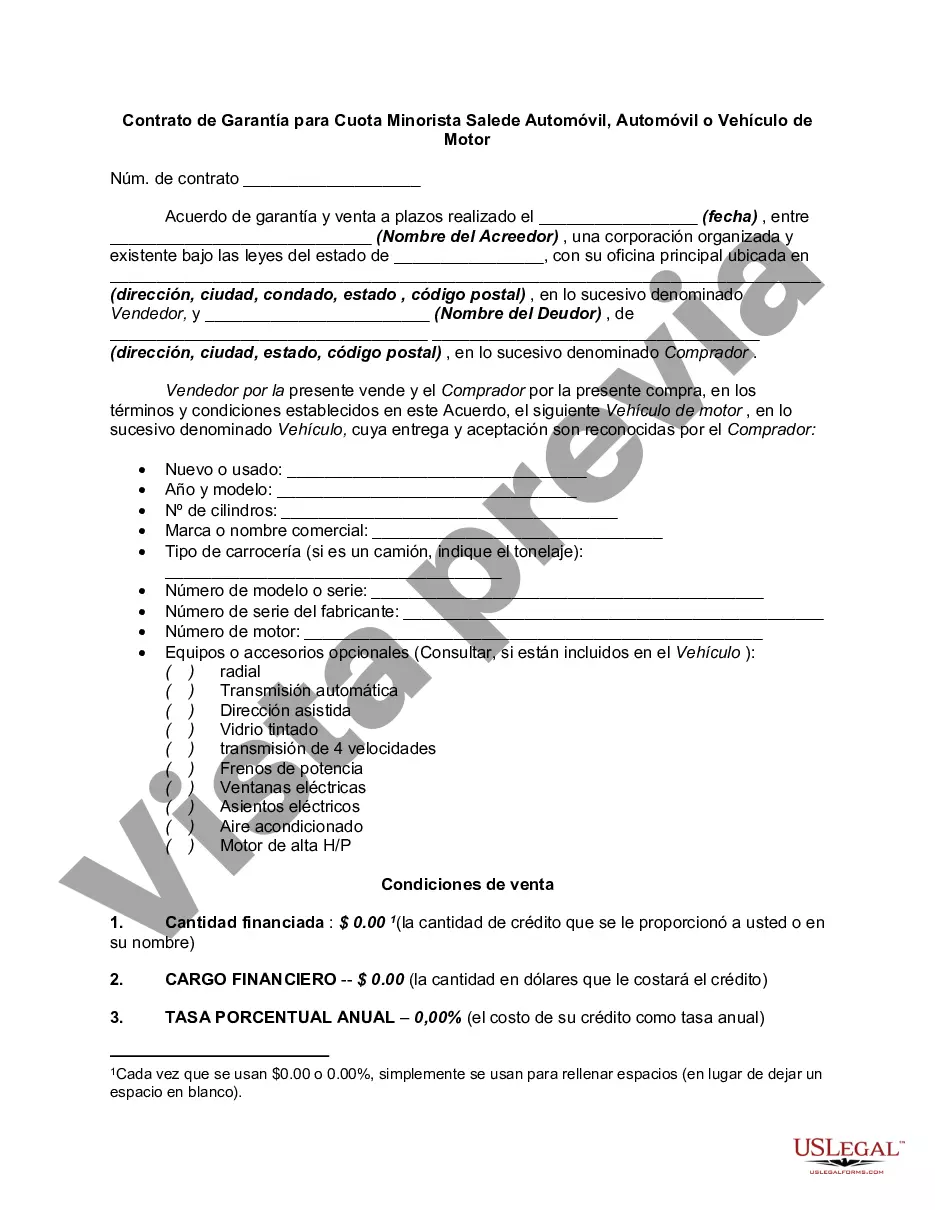

Oakland Michigan Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions between a buyer and a seller in a retail installment sale of a vehicle in the Oakland County, Michigan area. This agreement ensures that the seller has a security interest in the vehicle until the buyer completes their payments. The Oakland Michigan Security Agreement includes various important details to protect both parties involved in the transaction. Key elements typically included in this agreement are: 1. Parties Involved: The agreement clearly identifies the buyer and the seller. The buyer is the individual seeking to purchase the vehicle, while the seller is the entity or person selling the vehicle. 2. Vehicle Information: The agreement contains detailed information about the vehicle, including the make, model, year, identification number (VIN), and any other relevant details that uniquely identify the vehicle being sold. 3. Terms of Sale: This section outlines the terms of the sale, including the purchase price, down payment, and the total amount financed. It also specifies the interest rate or APR (Annual Percentage Rate) applied to the installment payments. 4. Installment Payments: The agreement specifies the number of installment payments, their frequency, and the due dates. It usually provides a breakdown of the payment amount applied towards the principal and the interest. 5. Security Interest: The seller retains a security interest in the vehicle until the buyer completes all the installment payments. This means that if the buyer fails to make their payments, the seller has the right to repossess the vehicle to recover their losses. 6. Default and Repossession: The agreement outlines the conditions under which the seller can declare the buyer in default (such as missed payments or breach of other obligations). It also describes the process of repossession, including the right to enter the buyer's premises to repossess the vehicle if necessary. 7. Insurance Requirements: The agreement may include clauses requiring the buyer to maintain comprehensive and collision insurance coverage for the duration of the installment sale. This protects both parties in case of accidents or damages to the vehicle. Different types of Oakland Michigan Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle may exist, such as variations specific to individual banks, credit unions, or financial institutions. Additionally, the agreement may have different provisions depending on whether it is a new or used vehicle sale. To ensure the legality and enforceability of the agreement, it is recommended to consult with an attorney or legal professional familiar with the regulations and requirements of Oakland County, Michigan.Oakland Michigan Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions between a buyer and a seller in a retail installment sale of a vehicle in the Oakland County, Michigan area. This agreement ensures that the seller has a security interest in the vehicle until the buyer completes their payments. The Oakland Michigan Security Agreement includes various important details to protect both parties involved in the transaction. Key elements typically included in this agreement are: 1. Parties Involved: The agreement clearly identifies the buyer and the seller. The buyer is the individual seeking to purchase the vehicle, while the seller is the entity or person selling the vehicle. 2. Vehicle Information: The agreement contains detailed information about the vehicle, including the make, model, year, identification number (VIN), and any other relevant details that uniquely identify the vehicle being sold. 3. Terms of Sale: This section outlines the terms of the sale, including the purchase price, down payment, and the total amount financed. It also specifies the interest rate or APR (Annual Percentage Rate) applied to the installment payments. 4. Installment Payments: The agreement specifies the number of installment payments, their frequency, and the due dates. It usually provides a breakdown of the payment amount applied towards the principal and the interest. 5. Security Interest: The seller retains a security interest in the vehicle until the buyer completes all the installment payments. This means that if the buyer fails to make their payments, the seller has the right to repossess the vehicle to recover their losses. 6. Default and Repossession: The agreement outlines the conditions under which the seller can declare the buyer in default (such as missed payments or breach of other obligations). It also describes the process of repossession, including the right to enter the buyer's premises to repossess the vehicle if necessary. 7. Insurance Requirements: The agreement may include clauses requiring the buyer to maintain comprehensive and collision insurance coverage for the duration of the installment sale. This protects both parties in case of accidents or damages to the vehicle. Different types of Oakland Michigan Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle may exist, such as variations specific to individual banks, credit unions, or financial institutions. Additionally, the agreement may have different provisions depending on whether it is a new or used vehicle sale. To ensure the legality and enforceability of the agreement, it is recommended to consult with an attorney or legal professional familiar with the regulations and requirements of Oakland County, Michigan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.