Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

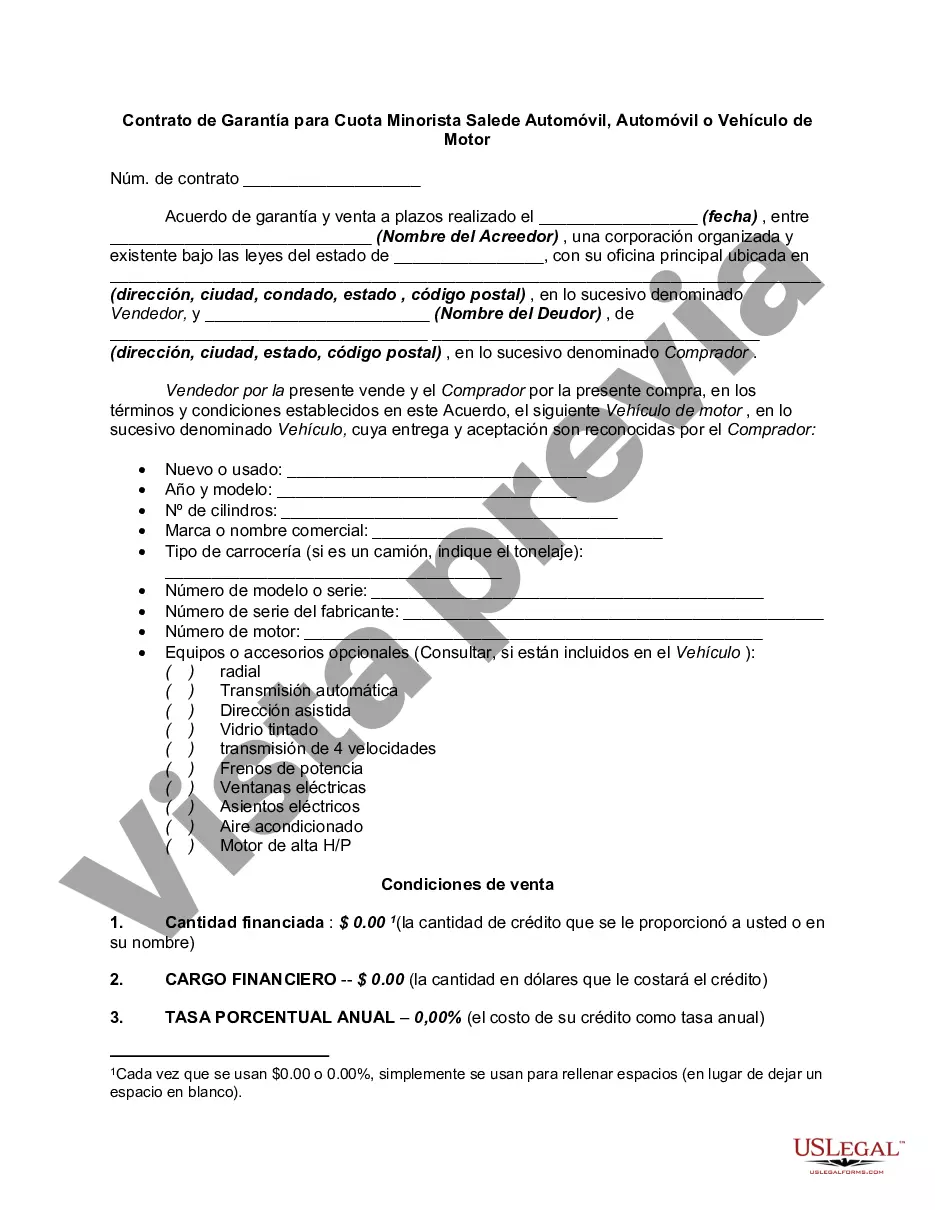

A Wayne Michigan Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a legal document that outlines the terms and conditions of a financial arrangement between a buyer and a seller regarding the purchase of a motor vehicle. This agreement ensures that the seller retains a security interest in the vehicle until the buyer has completed all payment obligations, thereby protecting the seller's investment in case of default. Keywords: Wayne Michigan, Security Agreement, Retail Installment Sale, Automobile, Car, Motor Vehicle. The Wayne Michigan Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a crucial document for both buyers and sellers as it establishes the rights and obligations of each party involved in the transaction. It serves as a binding contract that protects the interests of both parties and provides a clear framework for the sale. Different types of Wayne Michigan Security Agreements for Retail Installment Sale of Automobile, Car or Motor Vehicle may include: 1. Simple Security Agreement: This is the most basic type of agreement where the buyer agrees to pay the seller a certain amount of money in installments until the total purchase price of the vehicle is paid off. The agreement states the terms of payment, interest rates (if applicable), and consequences for defaulting on payments. 2. Conditional Sales Contract: In this type of agreement, the ownership of the vehicle remains with the seller until the buyer fulfills all financial obligations. The buyer has possession and use of the vehicle but does not hold legal ownership until the complete payment is made. The agreement outlines the conditions for transferring ownership upon completion of payment. 3. Lease Purchase Agreement: This type of agreement combines elements of a lease and a purchase agreement. The buyer leases the vehicle for a specified period with an option to purchase it at the end of the lease term. The agreement defines the lease terms, purchase price, and conditions for exercising the purchase option. 4. Promissory Note: While not technically a security agreement, a promissory note is often used in conjunction with retail installment sales of vehicles. It is a written promise by the buyer to pay a specified sum of money to the seller within a defined timeframe. The promissory note may be used as evidence of the buyer's commitment to repay the loan, securing the seller's financial interest. In conclusion, a Wayne Michigan Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a critical legal document that ensures a fair and lawful transaction between buyers and sellers. It protects the seller's investment while providing the buyer with a repayment plan and ownership rights upon completion of payment. It is important for both parties to carefully review and understand the terms of the agreement before signing.A Wayne Michigan Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a legal document that outlines the terms and conditions of a financial arrangement between a buyer and a seller regarding the purchase of a motor vehicle. This agreement ensures that the seller retains a security interest in the vehicle until the buyer has completed all payment obligations, thereby protecting the seller's investment in case of default. Keywords: Wayne Michigan, Security Agreement, Retail Installment Sale, Automobile, Car, Motor Vehicle. The Wayne Michigan Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a crucial document for both buyers and sellers as it establishes the rights and obligations of each party involved in the transaction. It serves as a binding contract that protects the interests of both parties and provides a clear framework for the sale. Different types of Wayne Michigan Security Agreements for Retail Installment Sale of Automobile, Car or Motor Vehicle may include: 1. Simple Security Agreement: This is the most basic type of agreement where the buyer agrees to pay the seller a certain amount of money in installments until the total purchase price of the vehicle is paid off. The agreement states the terms of payment, interest rates (if applicable), and consequences for defaulting on payments. 2. Conditional Sales Contract: In this type of agreement, the ownership of the vehicle remains with the seller until the buyer fulfills all financial obligations. The buyer has possession and use of the vehicle but does not hold legal ownership until the complete payment is made. The agreement outlines the conditions for transferring ownership upon completion of payment. 3. Lease Purchase Agreement: This type of agreement combines elements of a lease and a purchase agreement. The buyer leases the vehicle for a specified period with an option to purchase it at the end of the lease term. The agreement defines the lease terms, purchase price, and conditions for exercising the purchase option. 4. Promissory Note: While not technically a security agreement, a promissory note is often used in conjunction with retail installment sales of vehicles. It is a written promise by the buyer to pay a specified sum of money to the seller within a defined timeframe. The promissory note may be used as evidence of the buyer's commitment to repay the loan, securing the seller's financial interest. In conclusion, a Wayne Michigan Security Agreement for Retail Installment Sale of Automobile, Car or Motor Vehicle is a critical legal document that ensures a fair and lawful transaction between buyers and sellers. It protects the seller's investment while providing the buyer with a repayment plan and ownership rights upon completion of payment. It is important for both parties to carefully review and understand the terms of the agreement before signing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.