The term homestead embraces a variety of concepts with different meanings when applied to different factual situations. Generally, a homestead is deemed to be the dwelling house in which a family resides, with the usual and customary appurtenances, including outbuildings that are necessary and convenient for the family use, and lands that are devoted to the same use.

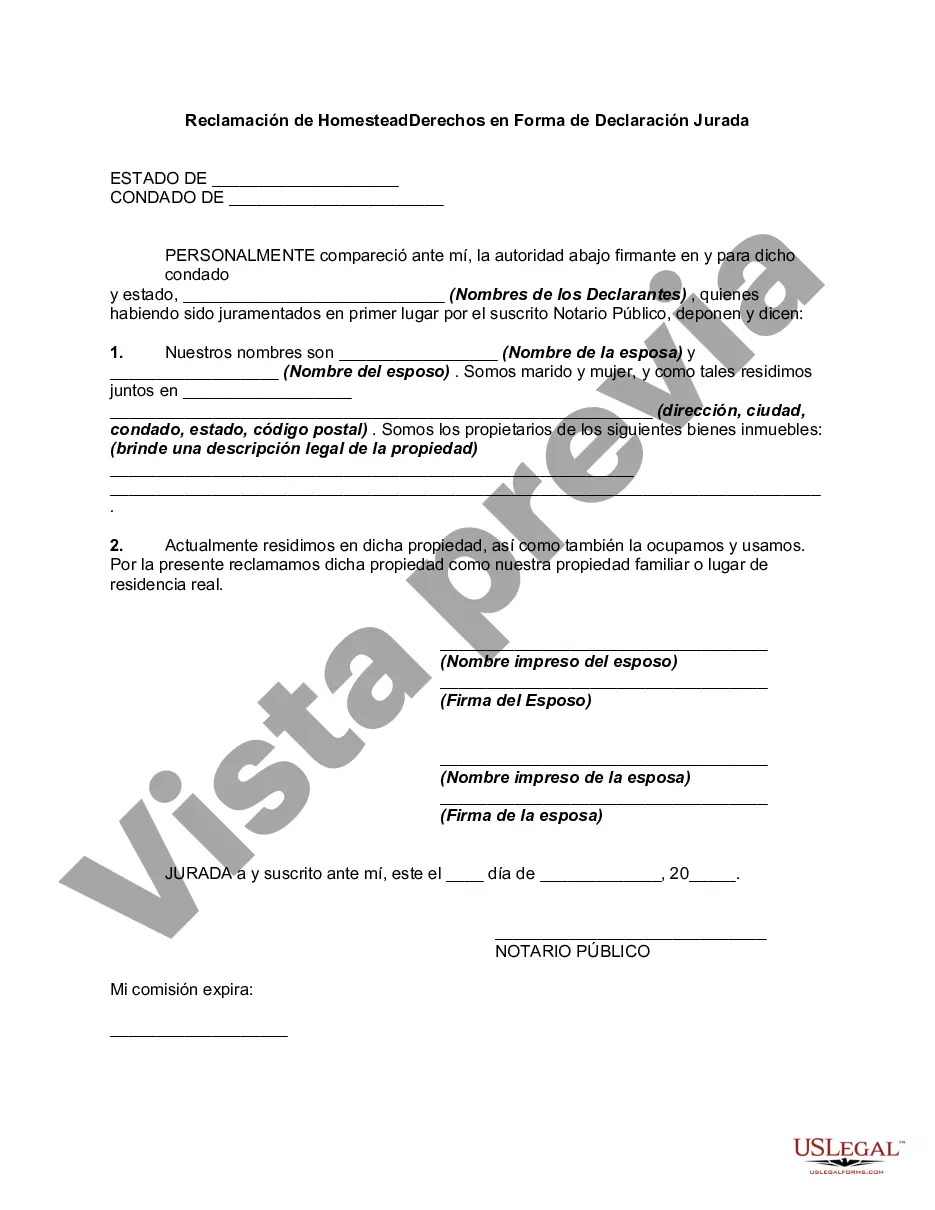

Local law must, of course, be checked to determine if a formal declaration of homestead is required by statute to be executed and recorded. In order that a claim of a declaration of homestead must be executed and filed exactly as provided in the law of the state where the property is located. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Broward County, Florida Claim of Homestead Rights in Form of Affidavit is a legal document that individuals can use to assert their right to homestead exemption. Homestead exemption is a property tax reduction available to homeowners who make their property their primary residence. There are different types of Claim of Homestead Rights in Form of Affidavit that a person may use depending on their specific situation: 1. Regular Homestead Exemption: This is the most common type of homestead exemption where homeowners can apply for a reduction in their property taxes if they meet certain criteria, such as using the property as their primary residence. 2. Additional Homestead Exemption: This type of exemption is available to homeowners who are 65 years or older and have a household income below a certain threshold. It provides an additional tax reduction on top of the regular homestead exemption. 3. Disabled Veterans Homestead Exemption: This exemption is specifically for disabled veterans who were honorably discharged and have a service-connected disability. It provides additional property tax benefits for those who qualify. To claim these homestead rights, individuals must complete a Broward County Claim of Homestead Rights in Form of Affidavit. The affidavit serves as a sworn statement, declaring that the property in question meets the requirements for homestead exemption. It is essential to provide accurate and truthful information in the affidavit to avoid any legal consequences. The affidavit will typically ask for details such as the property address, the homeowner's name, social security number, and a declaration stating that the property is the primary residence. The form may also require supporting documentation, such as proof of residency or a copy of the homeowner's driver's license. Once completed, the Claim of Homestead Rights in Form of Affidavit should be submitted to the Broward County Property Appraiser's Office or any other designated authority responsible for processing homestead exemption applications. It is crucial to file the affidavit before the deadline specified by the county to ensure eligibility for the homestead exemption. By properly completing the Broward County Claim of Homestead Rights in Form of Affidavit and meeting the eligibility requirements, homeowners can benefit from reduced property taxes and protect their primary residence in Broward County, Florida.The Broward County, Florida Claim of Homestead Rights in Form of Affidavit is a legal document that individuals can use to assert their right to homestead exemption. Homestead exemption is a property tax reduction available to homeowners who make their property their primary residence. There are different types of Claim of Homestead Rights in Form of Affidavit that a person may use depending on their specific situation: 1. Regular Homestead Exemption: This is the most common type of homestead exemption where homeowners can apply for a reduction in their property taxes if they meet certain criteria, such as using the property as their primary residence. 2. Additional Homestead Exemption: This type of exemption is available to homeowners who are 65 years or older and have a household income below a certain threshold. It provides an additional tax reduction on top of the regular homestead exemption. 3. Disabled Veterans Homestead Exemption: This exemption is specifically for disabled veterans who were honorably discharged and have a service-connected disability. It provides additional property tax benefits for those who qualify. To claim these homestead rights, individuals must complete a Broward County Claim of Homestead Rights in Form of Affidavit. The affidavit serves as a sworn statement, declaring that the property in question meets the requirements for homestead exemption. It is essential to provide accurate and truthful information in the affidavit to avoid any legal consequences. The affidavit will typically ask for details such as the property address, the homeowner's name, social security number, and a declaration stating that the property is the primary residence. The form may also require supporting documentation, such as proof of residency or a copy of the homeowner's driver's license. Once completed, the Claim of Homestead Rights in Form of Affidavit should be submitted to the Broward County Property Appraiser's Office or any other designated authority responsible for processing homestead exemption applications. It is crucial to file the affidavit before the deadline specified by the county to ensure eligibility for the homestead exemption. By properly completing the Broward County Claim of Homestead Rights in Form of Affidavit and meeting the eligibility requirements, homeowners can benefit from reduced property taxes and protect their primary residence in Broward County, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.