The term homestead embraces a variety of concepts with different meanings when applied to different factual situations. Generally, a homestead is deemed to be the dwelling house in which a family resides, with the usual and customary appurtenances, including outbuildings that are necessary and convenient for the family use, and lands that are devoted to the same use.

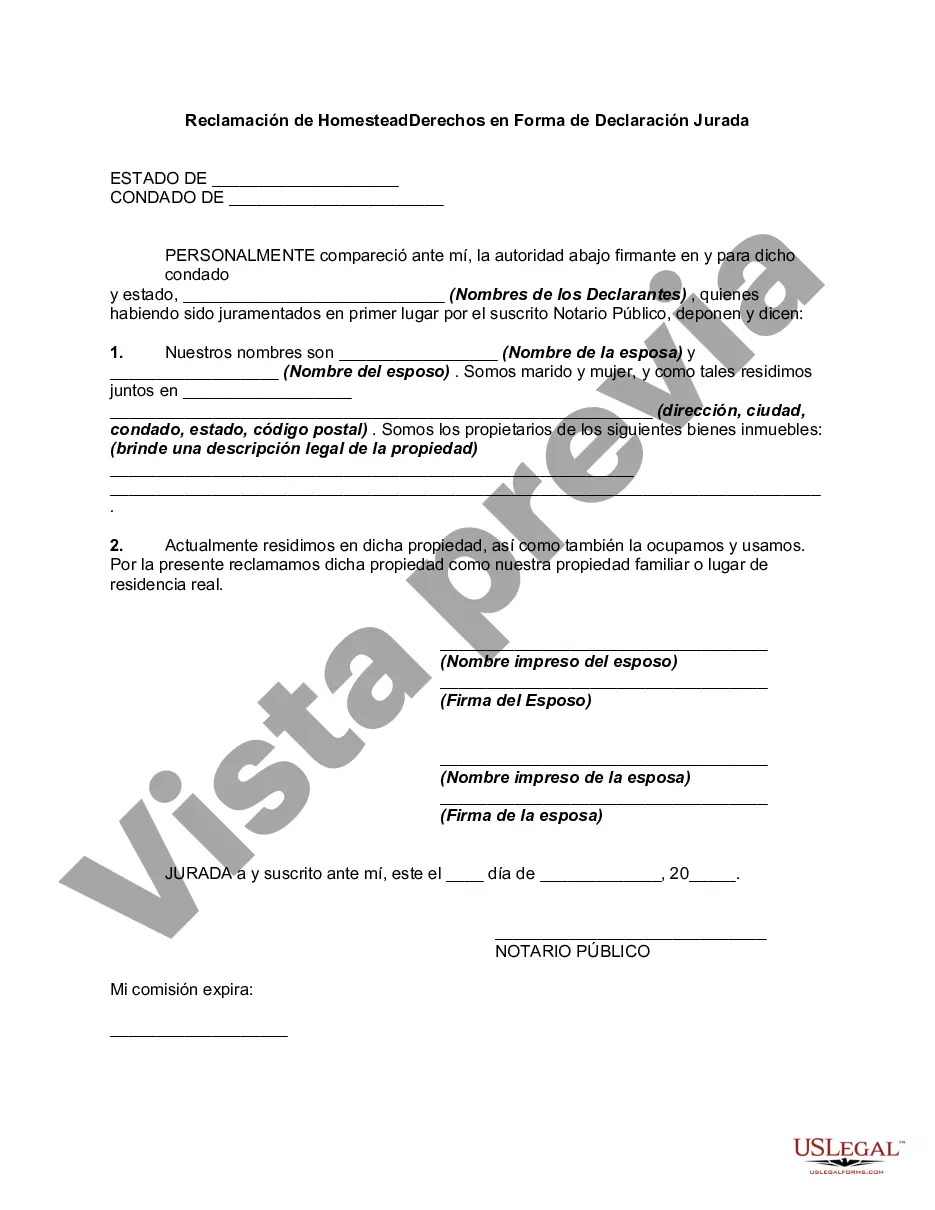

Local law must, of course, be checked to determine if a formal declaration of homestead is required by statute to be executed and recorded. In order that a claim of a declaration of homestead must be executed and filed exactly as provided in the law of the state where the property is located. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chicago Illinois offers residents the opportunity to protect their homestead rights through the Claim of Homestead Rights in the Form of Affidavit. This legal document serves as a declaration of a person's primary residence as their homestead and provides certain protections and benefits. The Chicago Illinois Claim of Homestead Rights in the Form of Affidavit is available to homeowners who meet the eligibility criteria. By filing this affidavit, homeowners can safeguard their property from certain creditors and potential claims, ensuring the preservation of their primary residence. This action can be particularly useful in times of financial hardship or when facing legal disputes. There are different types of Claim of Homestead Rights in the Form of Affidavit that can be filed in Chicago Illinois, including: 1. Standard Homestead Exemption: This is the most common type of homestead exemption available in Chicago Illinois. It protects a portion of a homeowner's equity from creditors, providing a safeguard against potential foreclosures or forced sales. 2. Automatic Renewal Homestead Exemption: Once a homeowner files the Claim of Homestead Rights in the Form of Affidavit and is approved for the exemption, it is automatically renewed each year without the need for reapplication. 3. Senior Citizen Homestead Exemption: Designed to benefit eligible senior citizens, this exemption provides additional property tax relief to those above a certain age. It reduces the taxable value of a senior citizen's property, resulting in lower property tax liabilities. 4. Disabled Persons Homestead Exemption: This exemption is specifically tailored for disabled individuals, offering property tax relief for those who qualify. It helps alleviate financial burdens by reducing the taxable value of the property. 5. Homeowner Property Tax Rebate: A separate program provided by Chicago Illinois, this rebate is available to homeowners who meet certain income requirements. It aims to alleviate the burden of property taxes for low-income households. To benefit from these various forms of the Claim of Homestead Rights in the Form of Affidavit, homeowners in Chicago Illinois are encouraged to consult with their local government or tax assessor's office. By doing so, they can obtain the necessary information, eligibility guidelines, and any required forms related to their specific circumstances. Overall, the Claim of Homestead Rights in the Form of Affidavit offers valuable protections to homeowners in Chicago Illinois, allowing them to safeguard their primary residence and potentially benefit from tax relief programs tailored for specific demographics.Chicago Illinois offers residents the opportunity to protect their homestead rights through the Claim of Homestead Rights in the Form of Affidavit. This legal document serves as a declaration of a person's primary residence as their homestead and provides certain protections and benefits. The Chicago Illinois Claim of Homestead Rights in the Form of Affidavit is available to homeowners who meet the eligibility criteria. By filing this affidavit, homeowners can safeguard their property from certain creditors and potential claims, ensuring the preservation of their primary residence. This action can be particularly useful in times of financial hardship or when facing legal disputes. There are different types of Claim of Homestead Rights in the Form of Affidavit that can be filed in Chicago Illinois, including: 1. Standard Homestead Exemption: This is the most common type of homestead exemption available in Chicago Illinois. It protects a portion of a homeowner's equity from creditors, providing a safeguard against potential foreclosures or forced sales. 2. Automatic Renewal Homestead Exemption: Once a homeowner files the Claim of Homestead Rights in the Form of Affidavit and is approved for the exemption, it is automatically renewed each year without the need for reapplication. 3. Senior Citizen Homestead Exemption: Designed to benefit eligible senior citizens, this exemption provides additional property tax relief to those above a certain age. It reduces the taxable value of a senior citizen's property, resulting in lower property tax liabilities. 4. Disabled Persons Homestead Exemption: This exemption is specifically tailored for disabled individuals, offering property tax relief for those who qualify. It helps alleviate financial burdens by reducing the taxable value of the property. 5. Homeowner Property Tax Rebate: A separate program provided by Chicago Illinois, this rebate is available to homeowners who meet certain income requirements. It aims to alleviate the burden of property taxes for low-income households. To benefit from these various forms of the Claim of Homestead Rights in the Form of Affidavit, homeowners in Chicago Illinois are encouraged to consult with their local government or tax assessor's office. By doing so, they can obtain the necessary information, eligibility guidelines, and any required forms related to their specific circumstances. Overall, the Claim of Homestead Rights in the Form of Affidavit offers valuable protections to homeowners in Chicago Illinois, allowing them to safeguard their primary residence and potentially benefit from tax relief programs tailored for specific demographics.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.