The term homestead embraces a variety of concepts with different meanings when applied to different factual situations. Generally, a homestead is deemed to be the dwelling house in which a family resides, with the usual and customary appurtenances, including outbuildings that are necessary and convenient for the family use, and lands that are devoted to the same use.

Local law must, of course, be checked to determine if a formal declaration of homestead is required by statute to be executed and recorded. In order that a claim of a declaration of homestead must be executed and filed exactly as provided in the law of the state where the property is located. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Queens, New York, is one of the five boroughs of New York City, located on the western portion of Long Island. It is known for its diverse culture, vibrant neighborhoods, and historical landmarks. The borough showcases a mix of residential, commercial, and recreational areas, making it an attractive place to call home. When it comes to claiming Homestead Rights in the form of an Affidavit in Queens, New York, there are two main types. These include: 1. Claim of Homestead Rights for Protection: This type of affidavit allows homeowners in Queens to assert their homestead rights and protect their primary residence from certain debts and judgments. By filing this claim, homeowners can secure a portion of their property's equity, which is exempt from being used to satisfy certain creditors. 2. Claim of Homestead Rights for Property Tax Exemption: In Queens, homeowners who meet certain eligibility criteria can file an affidavit to claim a property tax exemption under the Homestead Exemption Program. This program provides tax relief to qualified homeowners by reducing the assessed value of their primary residence and subsequently lowering their property taxes. To initiate the Queens New York Claim of Homestead Rights in Form of Affidavit, individuals must follow a specific process. Firstly, they should gather all the necessary documentation, such as proof of ownership, proof of residency, and identification documents. Next, they need to complete the appropriate claim form, which can be obtained from the Queens County Clerk's office or their official website. After completing the form, it must be notarized by a licensed notary public. The notarized affidavit should then be submitted to the Queens County Clerk's office, preferably in person or by mail, including any required fees or supporting documents. It's vital to ensure accuracy and completeness while submitting the claim to avoid any delays or complications. Overall, claiming Homestead Rights in Queens, New York, through the submission of a duly completed Affidavit, provides homeowners with various legal and financial protections. By taking advantage of these rights, residents can safeguard their primary residences from certain debts, judgments, and enjoy potential property tax exemptions to lighten their financial burdens.Queens, New York, is one of the five boroughs of New York City, located on the western portion of Long Island. It is known for its diverse culture, vibrant neighborhoods, and historical landmarks. The borough showcases a mix of residential, commercial, and recreational areas, making it an attractive place to call home. When it comes to claiming Homestead Rights in the form of an Affidavit in Queens, New York, there are two main types. These include: 1. Claim of Homestead Rights for Protection: This type of affidavit allows homeowners in Queens to assert their homestead rights and protect their primary residence from certain debts and judgments. By filing this claim, homeowners can secure a portion of their property's equity, which is exempt from being used to satisfy certain creditors. 2. Claim of Homestead Rights for Property Tax Exemption: In Queens, homeowners who meet certain eligibility criteria can file an affidavit to claim a property tax exemption under the Homestead Exemption Program. This program provides tax relief to qualified homeowners by reducing the assessed value of their primary residence and subsequently lowering their property taxes. To initiate the Queens New York Claim of Homestead Rights in Form of Affidavit, individuals must follow a specific process. Firstly, they should gather all the necessary documentation, such as proof of ownership, proof of residency, and identification documents. Next, they need to complete the appropriate claim form, which can be obtained from the Queens County Clerk's office or their official website. After completing the form, it must be notarized by a licensed notary public. The notarized affidavit should then be submitted to the Queens County Clerk's office, preferably in person or by mail, including any required fees or supporting documents. It's vital to ensure accuracy and completeness while submitting the claim to avoid any delays or complications. Overall, claiming Homestead Rights in Queens, New York, through the submission of a duly completed Affidavit, provides homeowners with various legal and financial protections. By taking advantage of these rights, residents can safeguard their primary residences from certain debts, judgments, and enjoy potential property tax exemptions to lighten their financial burdens.

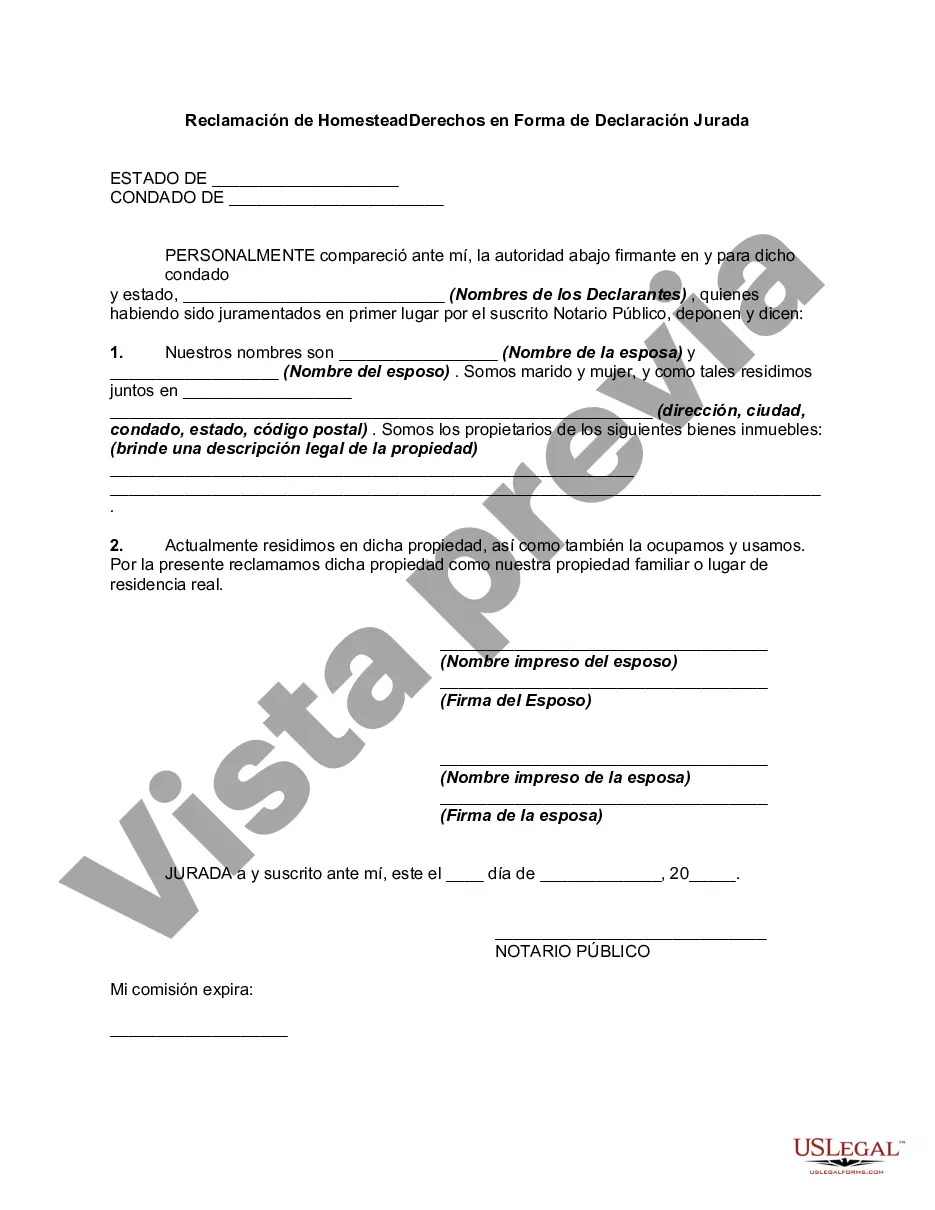

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.