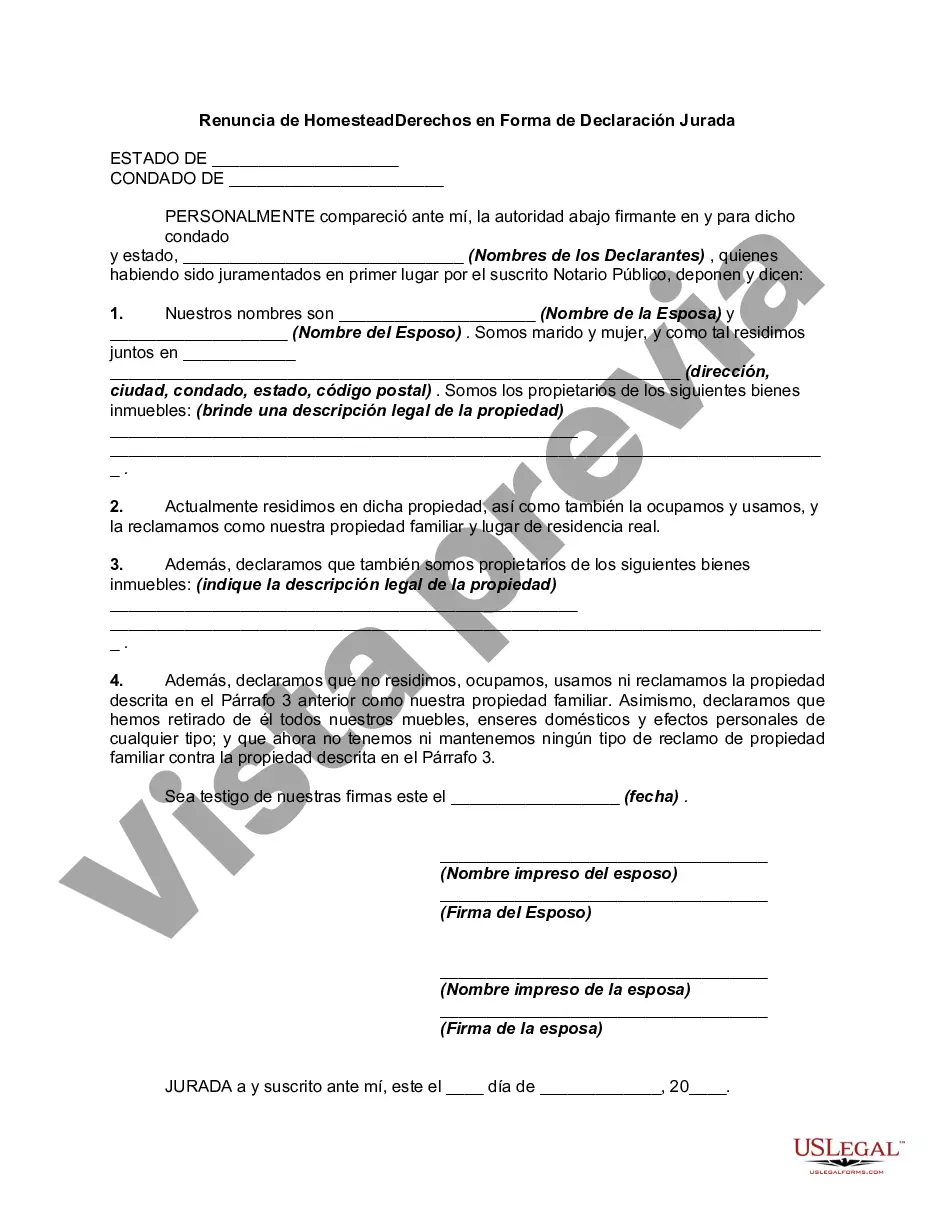

Where statutes specify the manner in which a homestead may be released or waived in a particular jurisdiction, such statutes must be strictly followed. In some jurisdictions, there can be no waiver except by deed. Other statutes require that the waiver be acknowledged or witnessed, recorded, or incorporated in an instrument that is independent of the agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Salt Lake Utah Waiver of Homestead Rights in Form of Affidavit is a legal document that allows homeowners in Salt Lake City, Utah, to waive or relinquish their homestead rights on their property. This type of waiver is used in certain situations and is essential for various reasons. Homestead rights typically provide homeowners with certain legal protections and exemptions, such as protection from creditors and a limitation on the amount of a property that can be seized in case of debts or bankruptcy. However, there are cases where homeowners voluntarily choose to waive these rights, either for financial or personal reasons. One common scenario where a Salt Lake Utah Waiver of Homestead Rights in Form of Affidavit is used is during the process of securing a loan or mortgage on a property. Lenders often require homeowners to waive their homestead rights as a way to mitigate risk and ensure that the property can be used as collateral in case of default. Another situation where this waiver may be necessary is when entering into certain business agreements or contracts that involve the transfer of property rights or transactions. By waiving homestead rights, homeowners can provide clearer and more comprehensive ownership rights to other parties involved. It is important to note that there are different types of Salt Lake Utah Waivers of Homestead Rights in Form of Affidavit that cater to specific circumstances. Some common variations may include: 1. Full Waiver: This type of waiver completely relinquishes all homestead rights, offering no legal protections for the property owner. Homeowners considering this option should thoroughly evaluate the potential risks and outcomes before making a decision. 2. Partial Waiver: In certain situations, homeowners may choose to waive homestead rights only to a limited extent or for specific purposes. This allows homeowners to maintain some level of protection while meeting the requirements of a particular transaction. 3. Temporary Waiver: This form of waiver is often used for a specific period, such as during the duration of a loan or mortgage agreement or for the duration of a business partnership. After the agreed-upon time, the homestead rights may be reinstated. When drafting a Salt Lake Utah Waiver of Homestead Rights in Form of Affidavit, it is vital to consult with a qualified attorney or legal professional familiar with Utah homestead laws. They can provide guidance and ensure that the document accurately reflects the homeowner's intentions while complying with all relevant legal requirements. Overall, a Salt Lake Utah Waiver of Homestead Rights in Form of Affidavit is an important legal tool that allows homeowners to voluntarily relinquish their homestead rights. Whether to pursue a full, partial, or temporary waiver, homeowners should carefully consider their specific situation and seek professional advice to ensure a well-informed decision is made.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.