A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

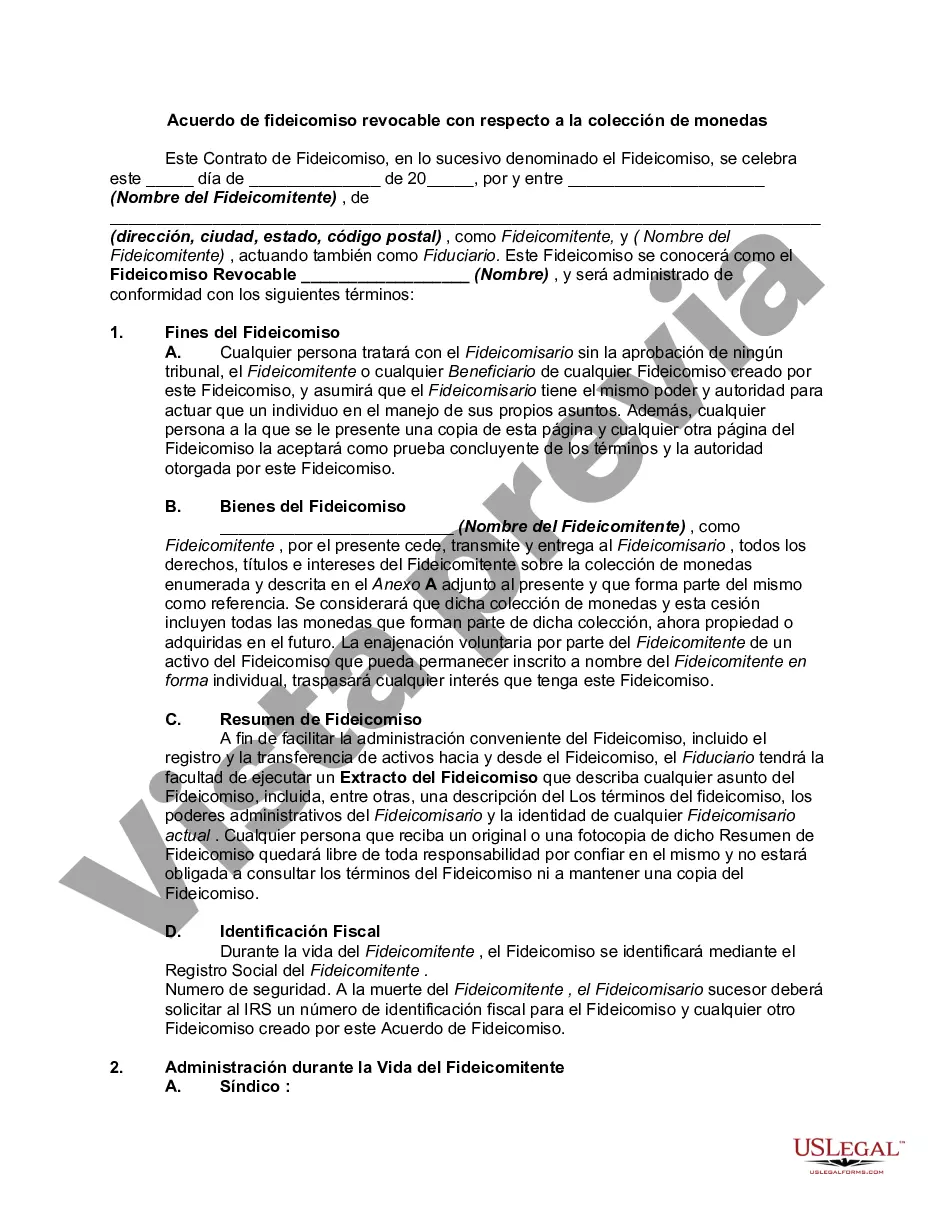

The Clark Nevada Revocable Trust Agreement Regarding Coin Collection is a legal document that outlines the terms and conditions of a trust specifically designed to manage a coin collection. This agreement allows an individual, known as the granter, to transfer ownership of their coin collection to a trust, which is then administered by a trustee for the benefit of beneficiaries. The primary purpose of this trust agreement is to ensure the proper care, management, and distribution of the coin collection according to the granter's wishes. By establishing a revocable trust, the granter retains the flexibility to modify or revoke the agreement during their lifetime. The Clark Nevada Revocable Trust Agreement Regarding Coin Collection typically includes various provisions to address specific aspects of the collection. These provisions may include guidelines for the acquisition and sale of coins, instructions for the evaluation and appraisal of the collection, protocols for protecting and preserving the collection's condition, and guidelines for the distribution of coins to beneficiaries. This trust agreement also outlines the roles and responsibilities of the trustee, who is appointed by the granter to manage the coin collection on their behalf. The trustee may be given discretionary powers to make decisions regarding the collection, such as engaging experts for appraisals or making strategic sales. There may be different types of Clark Nevada Revocable Trust Agreements Regarding Coin Collections, depending on the unique circumstances and preferences of the granter. Some variations may include provisions for specific coin types, such as rare or ancient coins, while others may specify conditions for the collection's display in a museum or educational institution. In conclusion, the Clark Nevada Revocable Trust Agreement Regarding Coin Collection is a comprehensive legal document that allows individuals to establish a trust to ensure the proper management, care, and distribution of their coin collection. This trust agreement is customizable and may include various provisions depending on the granter's specific requirements.The Clark Nevada Revocable Trust Agreement Regarding Coin Collection is a legal document that outlines the terms and conditions of a trust specifically designed to manage a coin collection. This agreement allows an individual, known as the granter, to transfer ownership of their coin collection to a trust, which is then administered by a trustee for the benefit of beneficiaries. The primary purpose of this trust agreement is to ensure the proper care, management, and distribution of the coin collection according to the granter's wishes. By establishing a revocable trust, the granter retains the flexibility to modify or revoke the agreement during their lifetime. The Clark Nevada Revocable Trust Agreement Regarding Coin Collection typically includes various provisions to address specific aspects of the collection. These provisions may include guidelines for the acquisition and sale of coins, instructions for the evaluation and appraisal of the collection, protocols for protecting and preserving the collection's condition, and guidelines for the distribution of coins to beneficiaries. This trust agreement also outlines the roles and responsibilities of the trustee, who is appointed by the granter to manage the coin collection on their behalf. The trustee may be given discretionary powers to make decisions regarding the collection, such as engaging experts for appraisals or making strategic sales. There may be different types of Clark Nevada Revocable Trust Agreements Regarding Coin Collections, depending on the unique circumstances and preferences of the granter. Some variations may include provisions for specific coin types, such as rare or ancient coins, while others may specify conditions for the collection's display in a museum or educational institution. In conclusion, the Clark Nevada Revocable Trust Agreement Regarding Coin Collection is a comprehensive legal document that allows individuals to establish a trust to ensure the proper management, care, and distribution of their coin collection. This trust agreement is customizable and may include various provisions depending on the granter's specific requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.