An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

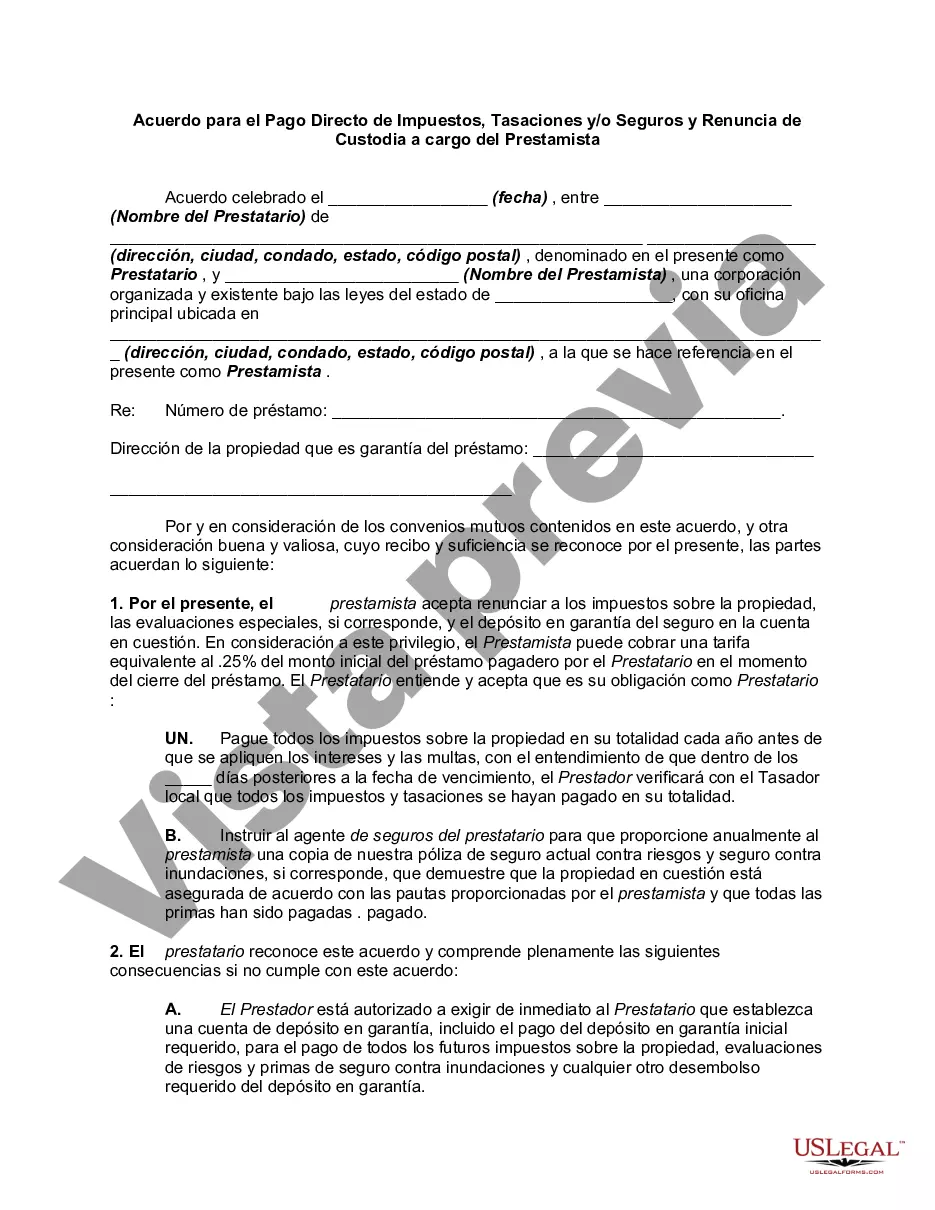

The Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a specialized legal document designed to outline the obligations and responsibilities between a borrower and a lender when it comes to the payment of taxes, assessments, and insurance related to a property located in Contra Costa County, California. This agreement serves as a binding contract between the borrower and the lender, detailing the specific terms and conditions under which the borrower agrees to directly pay these taxes, assessments, and insurance premiums, rather than having them held in an escrow account managed by the lender. By opting for this agreement, the borrower takes on the responsibility of ensuring timely payment of these financial obligations, as outlined by the taxing authorities, homeowner associations, or insurance providers. This arrangement eliminates the need to include these expenses in the borrower's monthly mortgage payments or to have the lender disburse funds on their behalf from an escrow account. One type of Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may focus specifically on property taxes. This agreement carefully outlines the borrower's responsibility to pay property taxes directly to the appropriate tax authority, ensuring compliance with local regulations and deadlines. Another variant of this agreement might relate to assessments imposed by homeowner associations. In such cases, the agreement spells out the borrower's duty to directly pay any assessments related to the property, such as common area maintenance fees, special assessments for capital improvements, or any mandatory contributions to the association's reserve fund. Additionally, a Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may include provisions regarding insurance premiums. This type of agreement highlights the borrower's obligation to maintain adequate insurance coverage for the property, such as homeowners insurance, and bear the responsibility for paying the premiums directly to the insurance provider. In conclusion, the Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legally binding document that outlines the terms and responsibilities associated with direct payment of taxes, assessments, and insurance premiums by the borrower. These agreements can encompass various aspects such as property taxes, homeowner association assessments, and insurance payments, depending on the specific needs and obligations of the borrower in relation to the property located in Contra Costa County, California.The Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a specialized legal document designed to outline the obligations and responsibilities between a borrower and a lender when it comes to the payment of taxes, assessments, and insurance related to a property located in Contra Costa County, California. This agreement serves as a binding contract between the borrower and the lender, detailing the specific terms and conditions under which the borrower agrees to directly pay these taxes, assessments, and insurance premiums, rather than having them held in an escrow account managed by the lender. By opting for this agreement, the borrower takes on the responsibility of ensuring timely payment of these financial obligations, as outlined by the taxing authorities, homeowner associations, or insurance providers. This arrangement eliminates the need to include these expenses in the borrower's monthly mortgage payments or to have the lender disburse funds on their behalf from an escrow account. One type of Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may focus specifically on property taxes. This agreement carefully outlines the borrower's responsibility to pay property taxes directly to the appropriate tax authority, ensuring compliance with local regulations and deadlines. Another variant of this agreement might relate to assessments imposed by homeowner associations. In such cases, the agreement spells out the borrower's duty to directly pay any assessments related to the property, such as common area maintenance fees, special assessments for capital improvements, or any mandatory contributions to the association's reserve fund. Additionally, a Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may include provisions regarding insurance premiums. This type of agreement highlights the borrower's obligation to maintain adequate insurance coverage for the property, such as homeowners insurance, and bear the responsibility for paying the premiums directly to the insurance provider. In conclusion, the Contra Costa California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legally binding document that outlines the terms and responsibilities associated with direct payment of taxes, assessments, and insurance premiums by the borrower. These agreements can encompass various aspects such as property taxes, homeowner association assessments, and insurance payments, depending on the specific needs and obligations of the borrower in relation to the property located in Contra Costa County, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.