An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

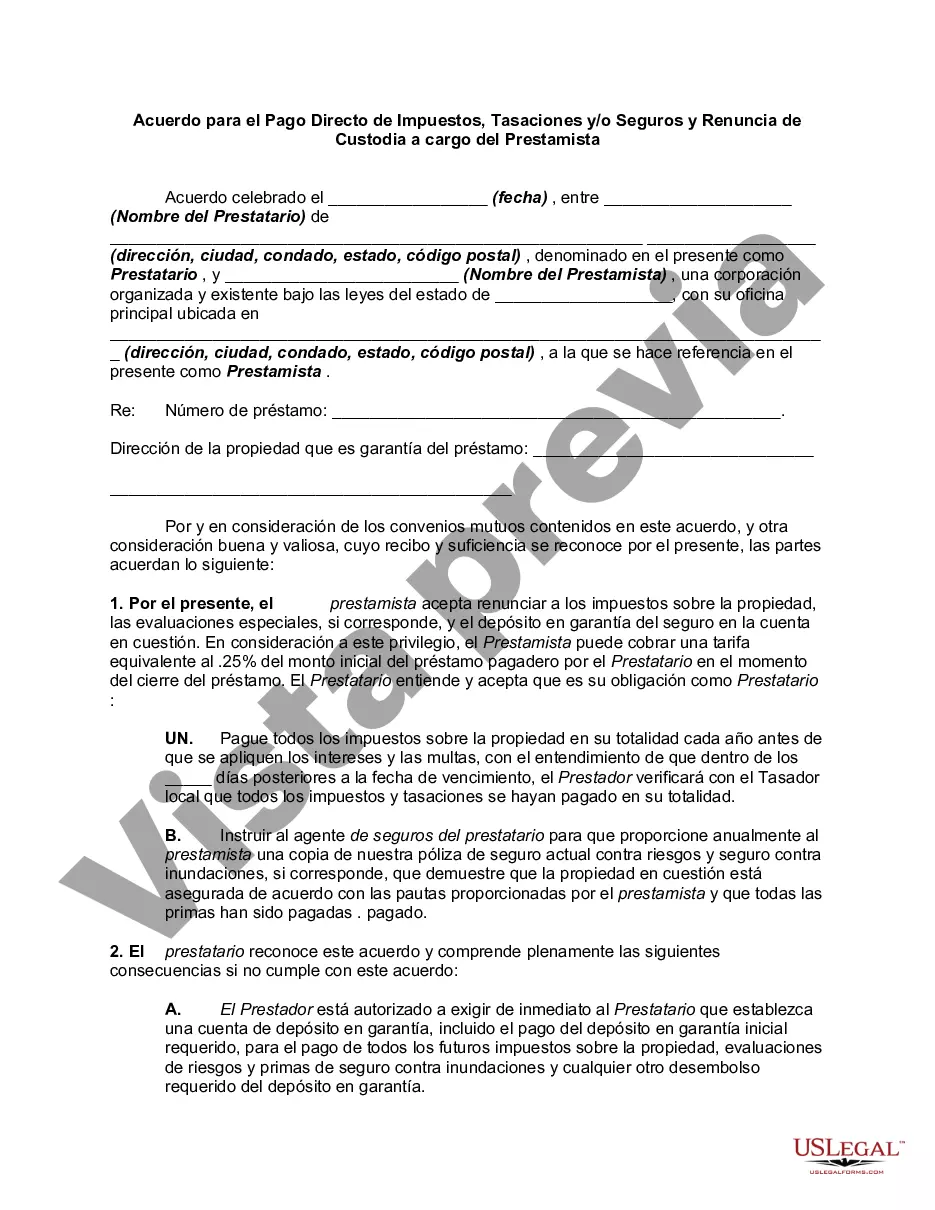

The Cook Illinois Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that serves as an agreement between a property owner and a lending institution. This agreement outlines the terms and conditions under which the property owner is responsible for directly paying their property taxes, assessments, and/or insurance premiums without the involvement of an escrow account. In this agreement, the property owner agrees to take on the responsibility of paying these expenses directly to the respective entities, ensuring that they are paid in a timely fashion. By waiving the escrow account, the property owner takes on the responsibility of managing and paying these expenses themselves. The Cook Illinois Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender recognizes that the property owner has the financial ability and willingness to handle these obligations independently. This agreement may be beneficial for property owners who prefer to maintain more direct control over their finances, as it allows them to have a greater say in managing their property-related expenses. It is important to note that there may be variations or different types of Cook Illinois Agreements for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, depending on the specific circumstances and the preferences of the parties involved. However, the essential purpose and provisions of this agreement remain similar across different types. Keywords: Cook Illinois Agreement, direct payment of taxes, assessments, insurance, waiver of escrow, lender, property owner, legal document, property taxes, insurance premiums, escrow account, financial responsibility, property-related expenses.The Cook Illinois Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that serves as an agreement between a property owner and a lending institution. This agreement outlines the terms and conditions under which the property owner is responsible for directly paying their property taxes, assessments, and/or insurance premiums without the involvement of an escrow account. In this agreement, the property owner agrees to take on the responsibility of paying these expenses directly to the respective entities, ensuring that they are paid in a timely fashion. By waiving the escrow account, the property owner takes on the responsibility of managing and paying these expenses themselves. The Cook Illinois Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender recognizes that the property owner has the financial ability and willingness to handle these obligations independently. This agreement may be beneficial for property owners who prefer to maintain more direct control over their finances, as it allows them to have a greater say in managing their property-related expenses. It is important to note that there may be variations or different types of Cook Illinois Agreements for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, depending on the specific circumstances and the preferences of the parties involved. However, the essential purpose and provisions of this agreement remain similar across different types. Keywords: Cook Illinois Agreement, direct payment of taxes, assessments, insurance, waiver of escrow, lender, property owner, legal document, property taxes, insurance premiums, escrow account, financial responsibility, property-related expenses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.