An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

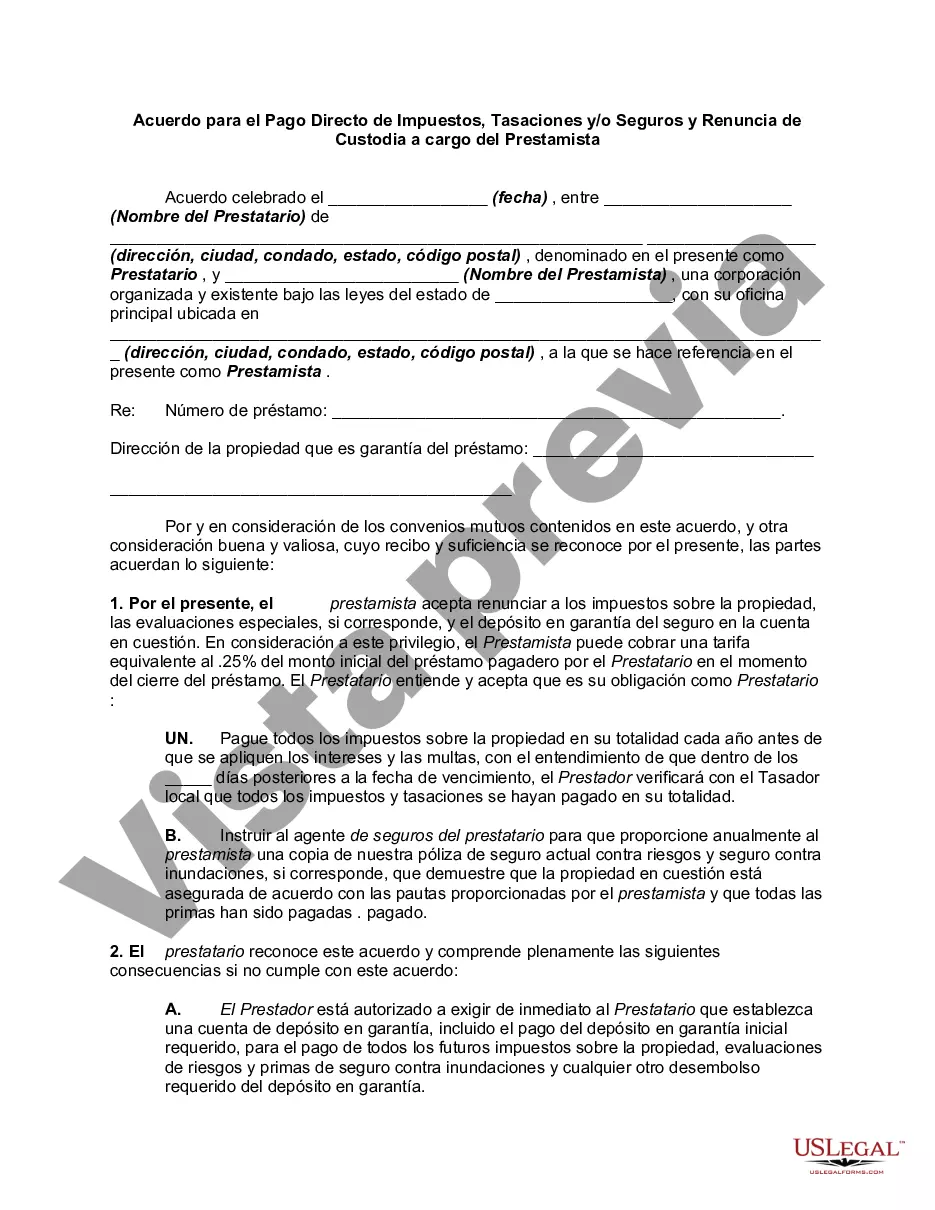

The Harris Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that establishes an agreement between a borrower and a lender in the state of Texas. This agreement pertains to the direct payment of taxes, assessments, and insurance by the borrower, while also waiving the requirement of an escrow account typically held by the lender. In this agreement, the borrower assumes the responsibility of directly paying property taxes, assessments, and insurance premium payments instead of having these funds held in escrow by the lender. This arrangement can be advantageous for certain borrowers who prefer to manage their own tax and insurance payments and have more control over their finances. Harris County, located in Texas, is the primary county where this agreement is applicable. However, it is worth noting that similar agreements may exist in other counties or states with different names, but the basic premise remains the same. Some different types of agreements similar to the Harris Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may have different names, such as: 1. [Insert County Name] Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender: This agreement would be specific to another county in Texas, indicating the local jurisdiction where it is applicable. 2. [Insert State Name] Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender: This agreement would be applicable statewide and would have variations based on the specific laws and regulations governing escrow requirements in different states. 3. [Insert Mortgage Provider Name] Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender: This agreement could be tailored to a specific mortgage provider who offers this option to their borrowers, regardless of the location. 4. Independent Escrow Waiver Agreement: This may not specifically mention any county or state but could be a generic term to describe an agreement between a borrower and a lender where the escrow requirement is waived, and the borrower assumes direct responsibility for tax and insurance payments. It's crucial to consult with legal professionals and review the specific terms and conditions of your agreement to ensure compliance with local laws and regulations.The Harris Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that establishes an agreement between a borrower and a lender in the state of Texas. This agreement pertains to the direct payment of taxes, assessments, and insurance by the borrower, while also waiving the requirement of an escrow account typically held by the lender. In this agreement, the borrower assumes the responsibility of directly paying property taxes, assessments, and insurance premium payments instead of having these funds held in escrow by the lender. This arrangement can be advantageous for certain borrowers who prefer to manage their own tax and insurance payments and have more control over their finances. Harris County, located in Texas, is the primary county where this agreement is applicable. However, it is worth noting that similar agreements may exist in other counties or states with different names, but the basic premise remains the same. Some different types of agreements similar to the Harris Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may have different names, such as: 1. [Insert County Name] Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender: This agreement would be specific to another county in Texas, indicating the local jurisdiction where it is applicable. 2. [Insert State Name] Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender: This agreement would be applicable statewide and would have variations based on the specific laws and regulations governing escrow requirements in different states. 3. [Insert Mortgage Provider Name] Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender: This agreement could be tailored to a specific mortgage provider who offers this option to their borrowers, regardless of the location. 4. Independent Escrow Waiver Agreement: This may not specifically mention any county or state but could be a generic term to describe an agreement between a borrower and a lender where the escrow requirement is waived, and the borrower assumes direct responsibility for tax and insurance payments. It's crucial to consult with legal professionals and review the specific terms and conditions of your agreement to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.