An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

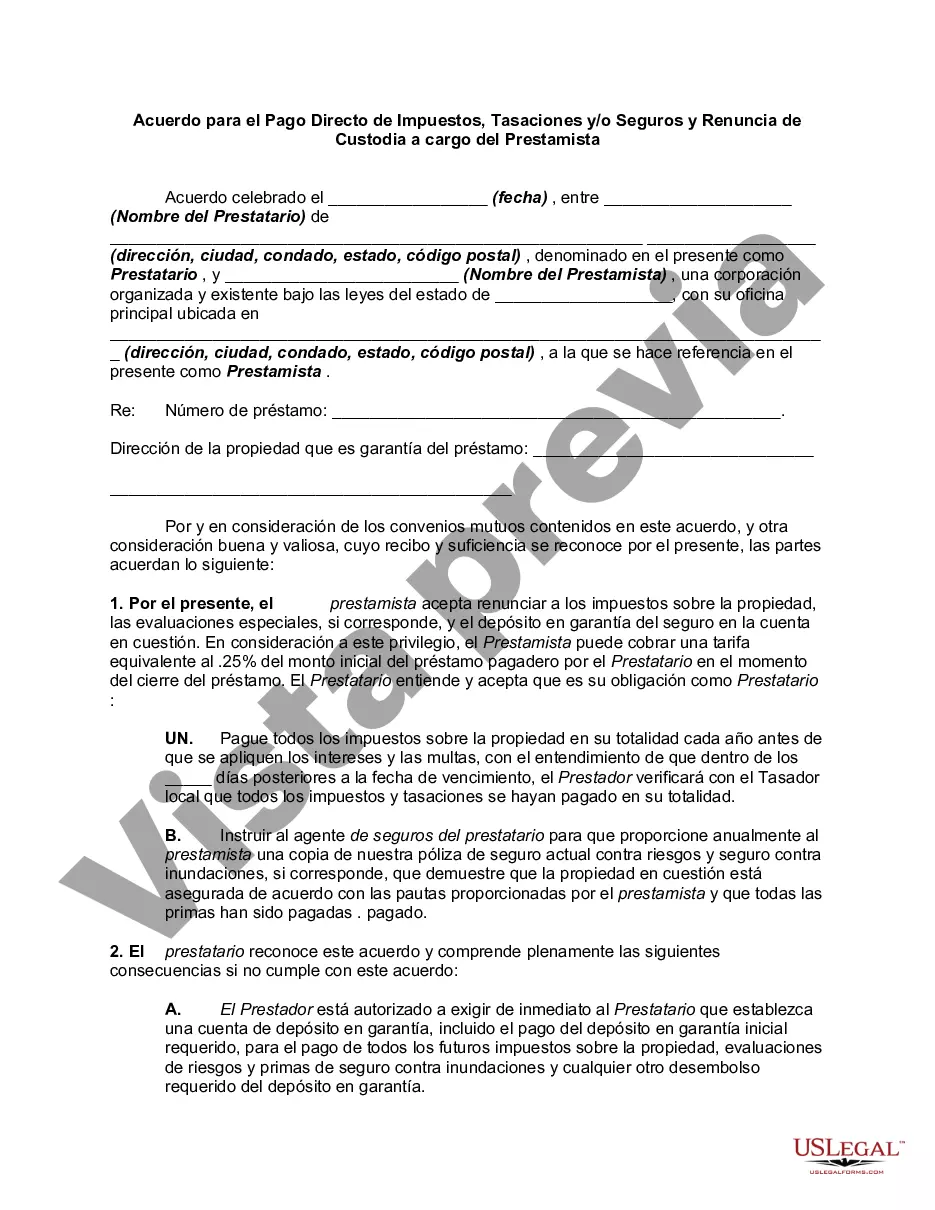

The Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that allows borrowers to directly pay their property taxes, assessments, and/or insurance premiums instead of having the mes crowed by the lender. This agreement provides flexibility for homeowners and streamlines the payment process. By opting for this agreement, borrowers take on the responsibility of paying these expenses on their own, eliminating the need for the lender to collect these funds in an escrow account. This can be beneficial for borrowers who prefer to manage these payments directly or have a good track record of handling them independently. The Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers several advantages. It allows homeowners to have more control over their budgeting and eliminates the possibility of any surplus funds being held by the lender unnecessarily. Additionally, borrowers may be eligible for cost savings as escrow accounts sometimes have increased fees or require a higher level of insurance coverage. It's important to note that there might be variations or types of this agreement specific to different locations or lenders. For example, some lenders may offer a partial waiver of escrow, where only certain expenses like property taxes are waived, while others may provide a full waiver encompassing taxes, assessments, and insurance. The Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is typically mutually agreed upon between the borrower and the lender. The agreement outlines the terms, responsibilities, and obligations of both parties, ensuring a clear understanding of the arrangement. In summary, the Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that grants homeowners the option to directly pay their property-related expenses without having them held in an escrow account. This agreement offers flexibility, control, and potential cost savings for borrowers, while still ensuring compliance with local laws and regulations.The Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that allows borrowers to directly pay their property taxes, assessments, and/or insurance premiums instead of having the mes crowed by the lender. This agreement provides flexibility for homeowners and streamlines the payment process. By opting for this agreement, borrowers take on the responsibility of paying these expenses on their own, eliminating the need for the lender to collect these funds in an escrow account. This can be beneficial for borrowers who prefer to manage these payments directly or have a good track record of handling them independently. The Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers several advantages. It allows homeowners to have more control over their budgeting and eliminates the possibility of any surplus funds being held by the lender unnecessarily. Additionally, borrowers may be eligible for cost savings as escrow accounts sometimes have increased fees or require a higher level of insurance coverage. It's important to note that there might be variations or types of this agreement specific to different locations or lenders. For example, some lenders may offer a partial waiver of escrow, where only certain expenses like property taxes are waived, while others may provide a full waiver encompassing taxes, assessments, and insurance. The Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is typically mutually agreed upon between the borrower and the lender. The agreement outlines the terms, responsibilities, and obligations of both parties, ensuring a clear understanding of the arrangement. In summary, the Hennepin Minnesota Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that grants homeowners the option to directly pay their property-related expenses without having them held in an escrow account. This agreement offers flexibility, control, and potential cost savings for borrowers, while still ensuring compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.