An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

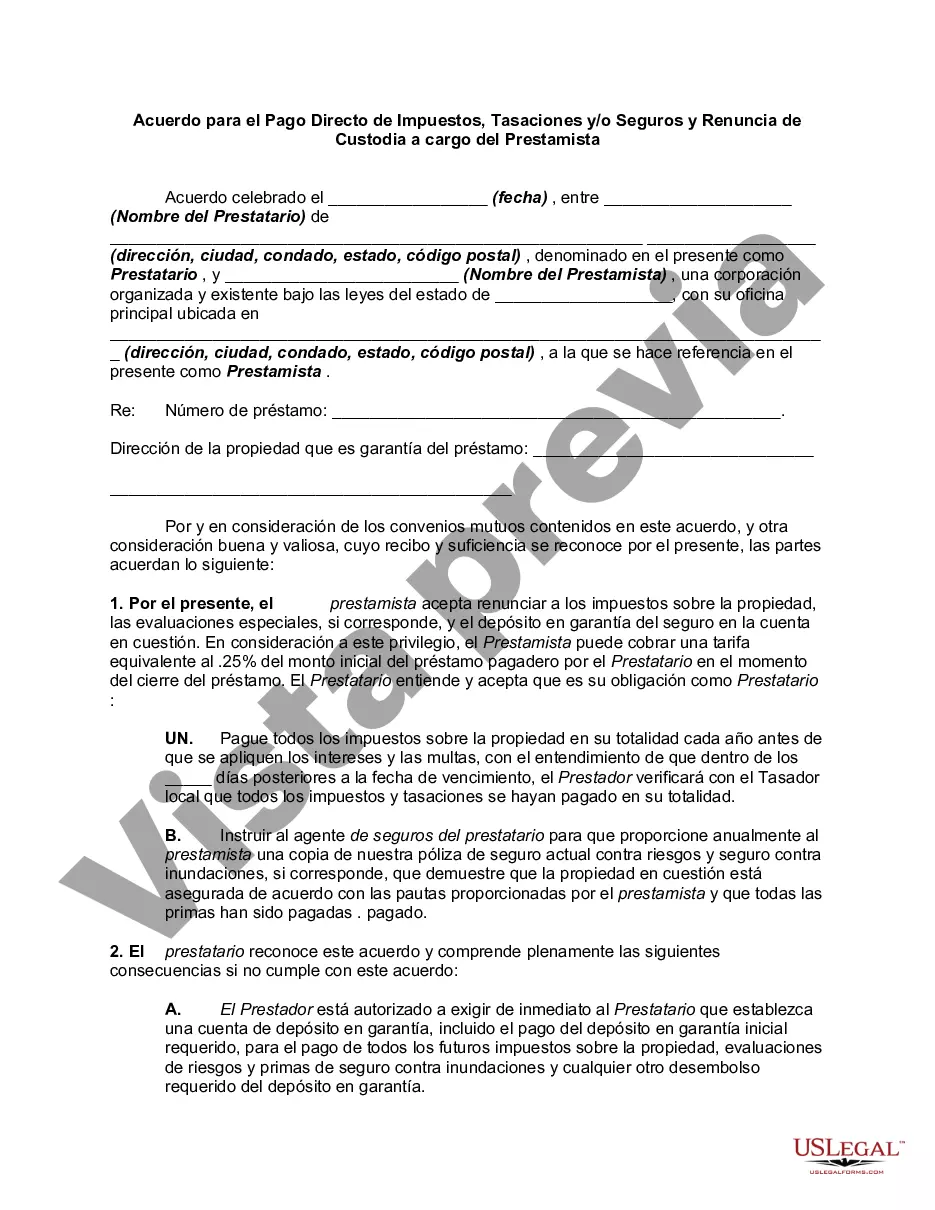

The Kings New York Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the terms and conditions for homeowners to directly pay their property taxes, assessments, and/or insurance premiums without using an escrow account. This agreement is commonly used in Kings County, New York, and provides homeowners with the option to manage these expenses on their own rather than having them included in their monthly mortgage payments. By opting for the Kings New York Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, homeowners gain more control over their finances and can potentially save money. Instead of paying a fixed amount every month that includes impounds for these expenses, homeowners can allocate their funds as they see fit and potentially earn interest on the money they would have otherwise paid into an escrow account. This agreement is particularly beneficial for homeowners who prefer to handle their own property tax, assessment, and insurance obligations. It allows them to directly pay these expenses, ensuring timely and accurate payments, while maintaining a closer connection with their tax authorities and insurance providers. There may be variations or additional types of Kings New York Agreements for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, depending on the specific circumstances of the homeowner or the lender's policies. Some possible variations may include agreements for specific types of taxes or assessments, such as school district taxes or special assessments for community improvement projects. Overall, the Kings New York Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers homeowners in Kings County the flexibility and freedom to manage their property expenses while maintaining compliance with local regulations. By understanding the terms and potential variations of this agreement, homeowners can make informed decisions that align with their financial goals and responsibilities.The Kings New York Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the terms and conditions for homeowners to directly pay their property taxes, assessments, and/or insurance premiums without using an escrow account. This agreement is commonly used in Kings County, New York, and provides homeowners with the option to manage these expenses on their own rather than having them included in their monthly mortgage payments. By opting for the Kings New York Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, homeowners gain more control over their finances and can potentially save money. Instead of paying a fixed amount every month that includes impounds for these expenses, homeowners can allocate their funds as they see fit and potentially earn interest on the money they would have otherwise paid into an escrow account. This agreement is particularly beneficial for homeowners who prefer to handle their own property tax, assessment, and insurance obligations. It allows them to directly pay these expenses, ensuring timely and accurate payments, while maintaining a closer connection with their tax authorities and insurance providers. There may be variations or additional types of Kings New York Agreements for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, depending on the specific circumstances of the homeowner or the lender's policies. Some possible variations may include agreements for specific types of taxes or assessments, such as school district taxes or special assessments for community improvement projects. Overall, the Kings New York Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers homeowners in Kings County the flexibility and freedom to manage their property expenses while maintaining compliance with local regulations. By understanding the terms and potential variations of this agreement, homeowners can make informed decisions that align with their financial goals and responsibilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.