An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

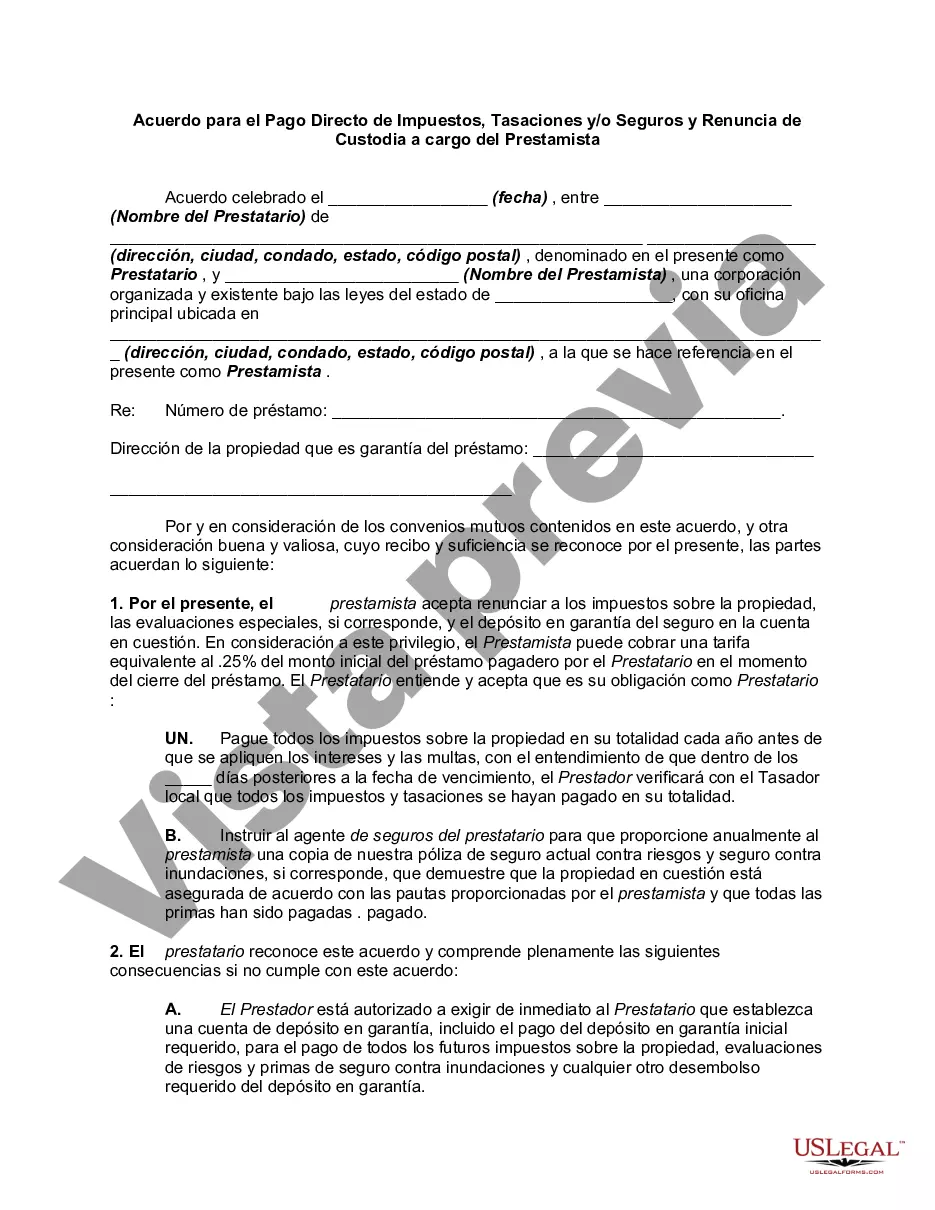

Los Angeles, California is the second largest city in the United States, famous for its glitz and glamour, diverse culture, and iconic landmarks such as the Hollywood sign, Walk of Fame, and Universal Studios. Beyond its celebrity-filled allure, Los Angeles is home to a bustling economy, world-class universities, and a thriving arts and entertainment scene. Within this vibrant city, the Los Angeles California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender plays a crucial role in property ownership. This agreement outlines the financial responsibilities of property owners in terms of paying property taxes, assessments, and insurance directly, while waiving the traditional escrow account held by the lender. The key purpose of this agreement is to provide property owners with increased control and flexibility over their financial obligations. By eliminating escrow accounts, borrowers can manage their own tax and insurance payments, ensuring their compliance with local regulations and securing their property investment. There are different types of Los Angeles California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, tailored to specific circumstances and property types. These may include: 1. Residential Agreement: This agreement is designed for individual homeowners who take full responsibility for the payment of property taxes, assessments, and insurance directly, without involving an escrow account. It empowers homeowners to proactively manage their finances and avoid potential escrow-related costs. 2. Commercial Agreement: Commercial property owners, including businesses and real estate investors, often opt for this type of agreement. It allows them to have direct control over their tax, assessment, and insurance payments, ensuring transparency and financial efficiency in managing their commercial properties. 3. Condominium Agreement: Condominium owners in Los Angeles may also enter into their own customized agreement, enabling them to handle tax, assessment, and insurance payments directly. This type of agreement is essential for ensuring accurate and timely payments specific to the unique requirements of the condominium association. The Los Angeles California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender serves as a crucial legal document, outlining the responsibilities and rights of both the lender and property owner. It brings financial autonomy to property owners, allowing them to meet their obligations while having full control over their finances, strengthening their investment in the vibrant city of Los Angeles.Los Angeles, California is the second largest city in the United States, famous for its glitz and glamour, diverse culture, and iconic landmarks such as the Hollywood sign, Walk of Fame, and Universal Studios. Beyond its celebrity-filled allure, Los Angeles is home to a bustling economy, world-class universities, and a thriving arts and entertainment scene. Within this vibrant city, the Los Angeles California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender plays a crucial role in property ownership. This agreement outlines the financial responsibilities of property owners in terms of paying property taxes, assessments, and insurance directly, while waiving the traditional escrow account held by the lender. The key purpose of this agreement is to provide property owners with increased control and flexibility over their financial obligations. By eliminating escrow accounts, borrowers can manage their own tax and insurance payments, ensuring their compliance with local regulations and securing their property investment. There are different types of Los Angeles California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, tailored to specific circumstances and property types. These may include: 1. Residential Agreement: This agreement is designed for individual homeowners who take full responsibility for the payment of property taxes, assessments, and insurance directly, without involving an escrow account. It empowers homeowners to proactively manage their finances and avoid potential escrow-related costs. 2. Commercial Agreement: Commercial property owners, including businesses and real estate investors, often opt for this type of agreement. It allows them to have direct control over their tax, assessment, and insurance payments, ensuring transparency and financial efficiency in managing their commercial properties. 3. Condominium Agreement: Condominium owners in Los Angeles may also enter into their own customized agreement, enabling them to handle tax, assessment, and insurance payments directly. This type of agreement is essential for ensuring accurate and timely payments specific to the unique requirements of the condominium association. The Los Angeles California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender serves as a crucial legal document, outlining the responsibilities and rights of both the lender and property owner. It brings financial autonomy to property owners, allowing them to meet their obligations while having full control over their finances, strengthening their investment in the vibrant city of Los Angeles.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.