An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

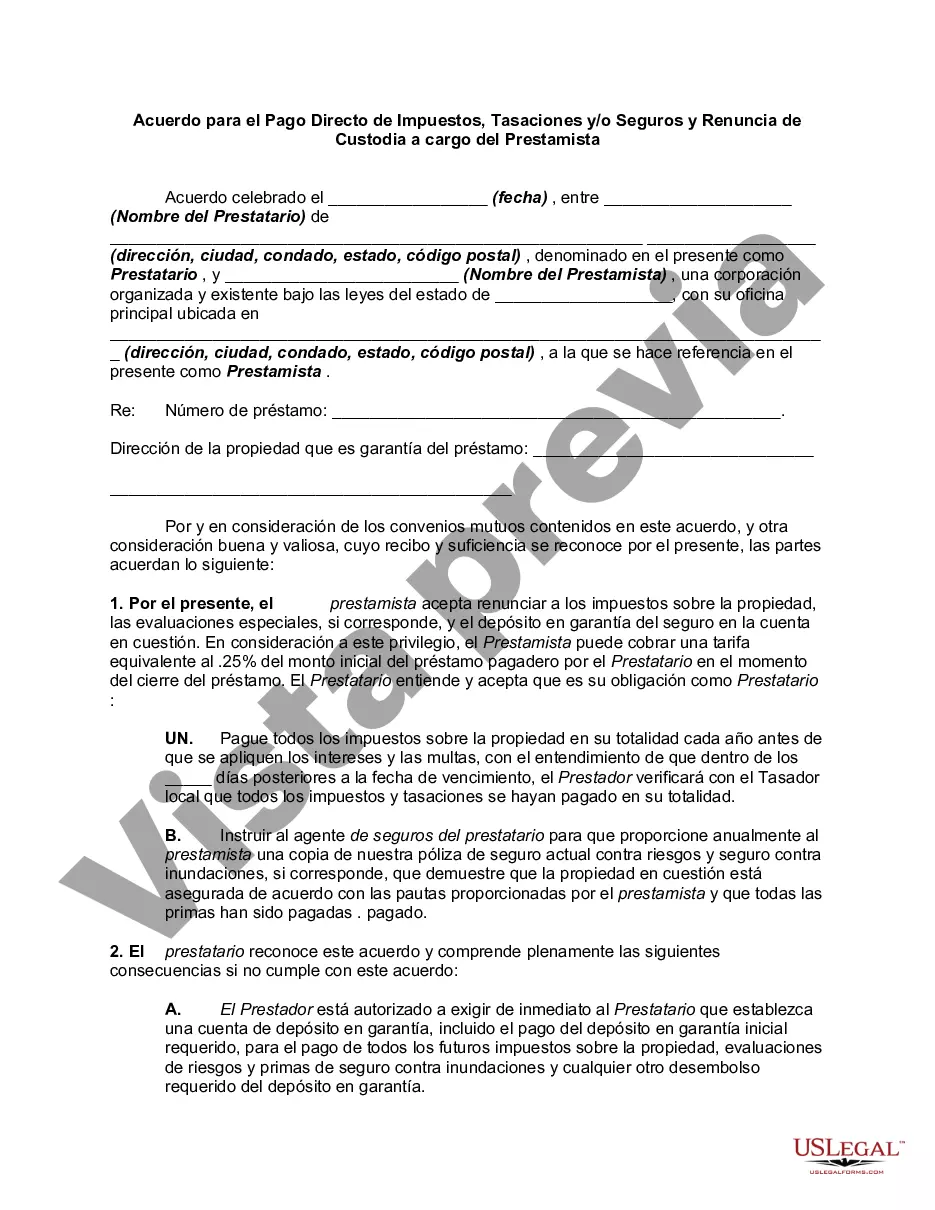

The Miami-Dade Florida Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the terms and conditions for the direct payment of taxes, assessments, and/or insurance by the borrower instead of using an escrow account. This agreement is specific to Miami-Dade County in Florida and is designed to provide flexibility to borrowers regarding their financial obligations. Keywords: Miami-Dade Florida, agreement, direct payment, taxes, assessments, insurance, waiver, escrow, lender, borrower, legal document, terms and conditions, flexibility, financial obligations. There are different types of agreements under this category based on the specific purposes they serve. Here are a few notable types: 1. Miami-Dade Florida Agreement for Direct Payment of Taxes: This type of agreement focuses solely on the direct payment of property taxes by the borrower, excluding assessments and insurance. It clearly outlines the responsibilities and obligations of both the borrower and the lender regarding tax payments. 2. Miami-Dade Florida Agreement for Direct Payment of Assessments: This agreement pertains to the direct payment of assessments, which are charges levied by the local government or homeowners' association for services or improvements in the community. It covers the procedures and arrangements for the borrower to directly manage these assessment payments. 3. Miami-Dade Florida Agreement for Direct Payment of Insurance: This specific type of agreement concentrates on the direct payment of insurance premiums by the borrower, including property insurance or flood insurance. It outlines the terms and conditions related to insurance coverage and the borrower's responsibility for timely payments. Each type of agreement typically includes a waiver of escrow, which means that the borrower will not be required to create or maintain an escrow account. Instead, they assume the responsibility for making timely payments directly to the respective entities for taxes, assessments, and/or insurance. It is important to consult with a legal professional or financial advisor to understand the specific terms and conditions of the Miami-Dade Florida Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, as they may vary in details and requirements depending on the specific circumstances and the lender involved.The Miami-Dade Florida Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the terms and conditions for the direct payment of taxes, assessments, and/or insurance by the borrower instead of using an escrow account. This agreement is specific to Miami-Dade County in Florida and is designed to provide flexibility to borrowers regarding their financial obligations. Keywords: Miami-Dade Florida, agreement, direct payment, taxes, assessments, insurance, waiver, escrow, lender, borrower, legal document, terms and conditions, flexibility, financial obligations. There are different types of agreements under this category based on the specific purposes they serve. Here are a few notable types: 1. Miami-Dade Florida Agreement for Direct Payment of Taxes: This type of agreement focuses solely on the direct payment of property taxes by the borrower, excluding assessments and insurance. It clearly outlines the responsibilities and obligations of both the borrower and the lender regarding tax payments. 2. Miami-Dade Florida Agreement for Direct Payment of Assessments: This agreement pertains to the direct payment of assessments, which are charges levied by the local government or homeowners' association for services or improvements in the community. It covers the procedures and arrangements for the borrower to directly manage these assessment payments. 3. Miami-Dade Florida Agreement for Direct Payment of Insurance: This specific type of agreement concentrates on the direct payment of insurance premiums by the borrower, including property insurance or flood insurance. It outlines the terms and conditions related to insurance coverage and the borrower's responsibility for timely payments. Each type of agreement typically includes a waiver of escrow, which means that the borrower will not be required to create or maintain an escrow account. Instead, they assume the responsibility for making timely payments directly to the respective entities for taxes, assessments, and/or insurance. It is important to consult with a legal professional or financial advisor to understand the specific terms and conditions of the Miami-Dade Florida Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, as they may vary in details and requirements depending on the specific circumstances and the lender involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.