An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

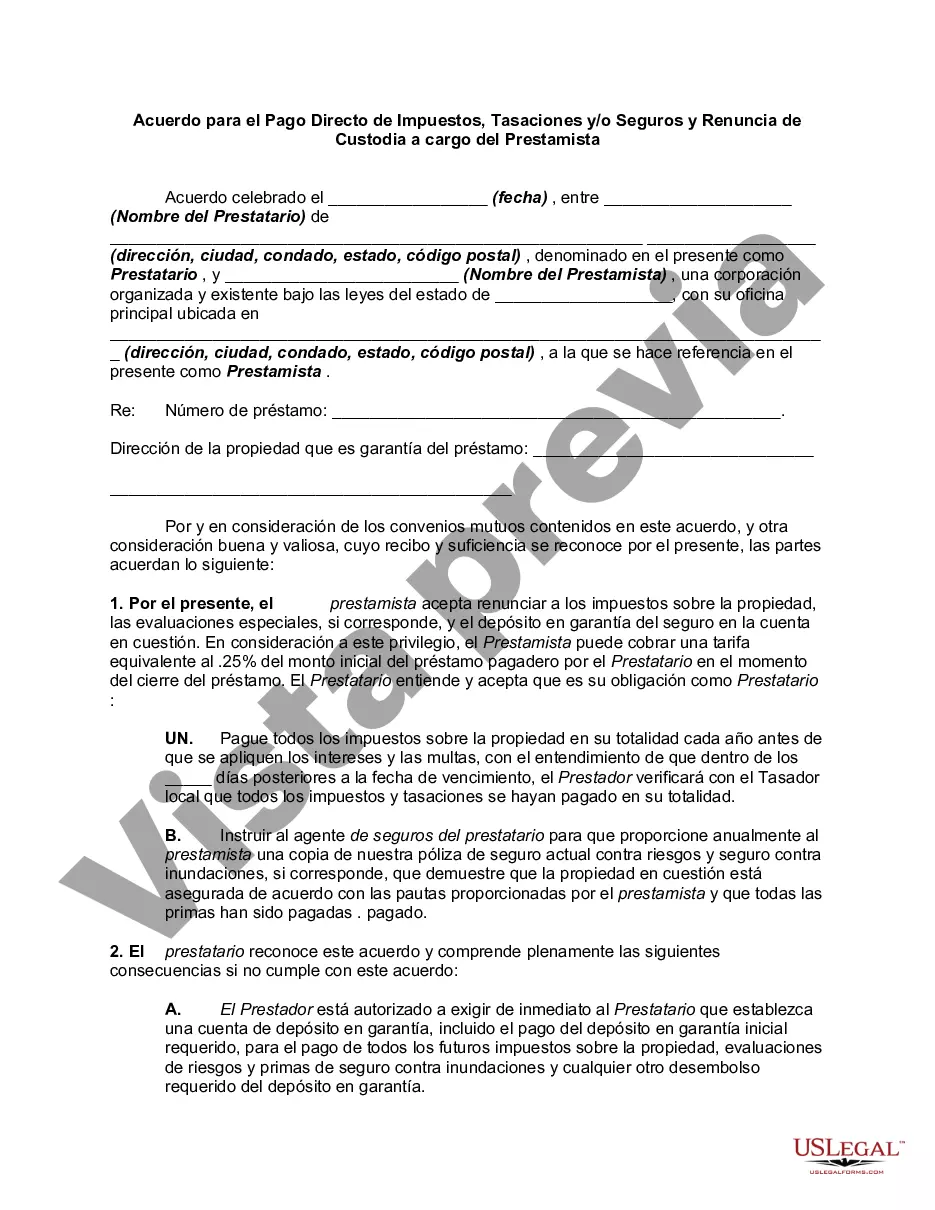

The Middlesex Massachusetts Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legally binding contract between a borrower and a lender. This agreement allows the borrower to directly pay their property taxes, assessments, and/or insurance premiums without the involvement of an escrow account. In Middlesex County, Massachusetts, there are two common types of agreements for direct payment of taxes, assessments, and/or insurance: 1. Middlesex Massachusetts Agreement for Direct Payment of Taxes and Assessments: This agreement enables the borrower to directly pay their property taxes and assessments. It stipulates that the borrower will be responsible for making timely payments directly to the relevant tax authority and/or assessing agency. The lender, in this case, waives the requirement to collect funds and hold them in an escrow account for the purpose of paying these expenses. 2. Middlesex Massachusetts Agreement for Direct Payment of Insurance: This agreement allows the borrower to directly pay their insurance premiums. It specifies that the borrower will be responsible for promptly paying the insurance company the required premiums relating to their property's insurance coverage. The lender, under this agreement, waives the need for an escrow account to be established to manage these insurance payments. These agreements often fit within the broader context of a mortgage loan. By removing the necessity of an escrow account, borrowers gain more control over their tax, assessment, and insurance payments. It's important to note that these agreements are subject to state and local laws and regulations, and potential borrowers should consult with legal professionals or mortgage experts to ensure compliance with specific requirements in Middlesex County.The Middlesex Massachusetts Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legally binding contract between a borrower and a lender. This agreement allows the borrower to directly pay their property taxes, assessments, and/or insurance premiums without the involvement of an escrow account. In Middlesex County, Massachusetts, there are two common types of agreements for direct payment of taxes, assessments, and/or insurance: 1. Middlesex Massachusetts Agreement for Direct Payment of Taxes and Assessments: This agreement enables the borrower to directly pay their property taxes and assessments. It stipulates that the borrower will be responsible for making timely payments directly to the relevant tax authority and/or assessing agency. The lender, in this case, waives the requirement to collect funds and hold them in an escrow account for the purpose of paying these expenses. 2. Middlesex Massachusetts Agreement for Direct Payment of Insurance: This agreement allows the borrower to directly pay their insurance premiums. It specifies that the borrower will be responsible for promptly paying the insurance company the required premiums relating to their property's insurance coverage. The lender, under this agreement, waives the need for an escrow account to be established to manage these insurance payments. These agreements often fit within the broader context of a mortgage loan. By removing the necessity of an escrow account, borrowers gain more control over their tax, assessment, and insurance payments. It's important to note that these agreements are subject to state and local laws and regulations, and potential borrowers should consult with legal professionals or mortgage experts to ensure compliance with specific requirements in Middlesex County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.