An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

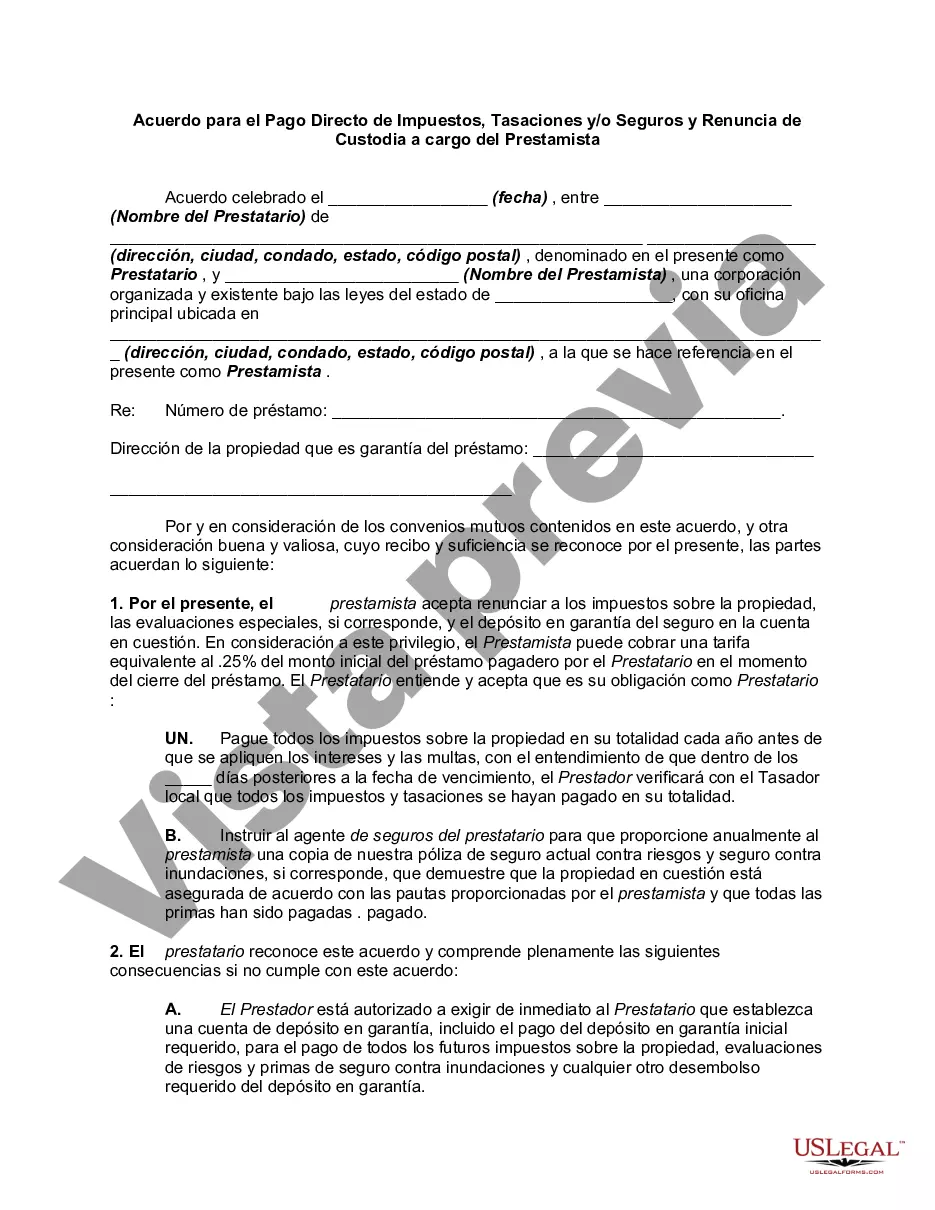

The Riverside California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal agreement that outlines the responsibilities and arrangements between the homeowner and the lender regarding the payment of taxes, assessments, and/or insurance. This agreement is typically used in real estate transactions where the homeowner has opted to handle and pay these expenses directly, rather than having them included in an escrow account held by the lender. It allows the homeowner to be in control of managing these financial obligations and ensures a clear understanding of the parties' roles and expectations. Under this agreement, the homeowner agrees to bear the responsibility for timely paying property taxes, assessments (such as homeowner association fees), and insurance premiums directly to the respective entities. The lender, on the other hand, agrees to waive the requirement for an escrow account to hold these funds. Instead, the homeowner retains the responsibility and obligation to pay these expenses on time. This arrangement can provide certain advantages for both parties. Homeowners may benefit from greater financial control and the ability to earn interest on their funds instead of having them held in an escrow account. Lenders may also benefit from reduced administrative costs associated with escrow accounting. It is important to note that there may be different types or variations of the Riverside California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow. However, these variations generally pertain to specific aspects or conditions included in the agreement. Some potential variations may include agreements that specify the frequency of payments (monthly, quarterly, annually), agreements that outline provisions for late payments or penalty fees, or agreements that address the disbursement of insurance claim proceeds. In conclusion, the Riverside California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow is a legal document that determines the responsibility for payment of taxes, assessments, and insurance premiums between the homeowner and the lender. It provides a framework for the homeowner to manage these financial obligations directly, while the lender waives the requirement for an escrow account. Various types or variations of this agreement may exist, addressing specific conditions or provisions related to payment frequency, penalties, or insurance claims.The Riverside California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal agreement that outlines the responsibilities and arrangements between the homeowner and the lender regarding the payment of taxes, assessments, and/or insurance. This agreement is typically used in real estate transactions where the homeowner has opted to handle and pay these expenses directly, rather than having them included in an escrow account held by the lender. It allows the homeowner to be in control of managing these financial obligations and ensures a clear understanding of the parties' roles and expectations. Under this agreement, the homeowner agrees to bear the responsibility for timely paying property taxes, assessments (such as homeowner association fees), and insurance premiums directly to the respective entities. The lender, on the other hand, agrees to waive the requirement for an escrow account to hold these funds. Instead, the homeowner retains the responsibility and obligation to pay these expenses on time. This arrangement can provide certain advantages for both parties. Homeowners may benefit from greater financial control and the ability to earn interest on their funds instead of having them held in an escrow account. Lenders may also benefit from reduced administrative costs associated with escrow accounting. It is important to note that there may be different types or variations of the Riverside California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow. However, these variations generally pertain to specific aspects or conditions included in the agreement. Some potential variations may include agreements that specify the frequency of payments (monthly, quarterly, annually), agreements that outline provisions for late payments or penalty fees, or agreements that address the disbursement of insurance claim proceeds. In conclusion, the Riverside California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow is a legal document that determines the responsibility for payment of taxes, assessments, and insurance premiums between the homeowner and the lender. It provides a framework for the homeowner to manage these financial obligations directly, while the lender waives the requirement for an escrow account. Various types or variations of this agreement may exist, addressing specific conditions or provisions related to payment frequency, penalties, or insurance claims.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.