An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

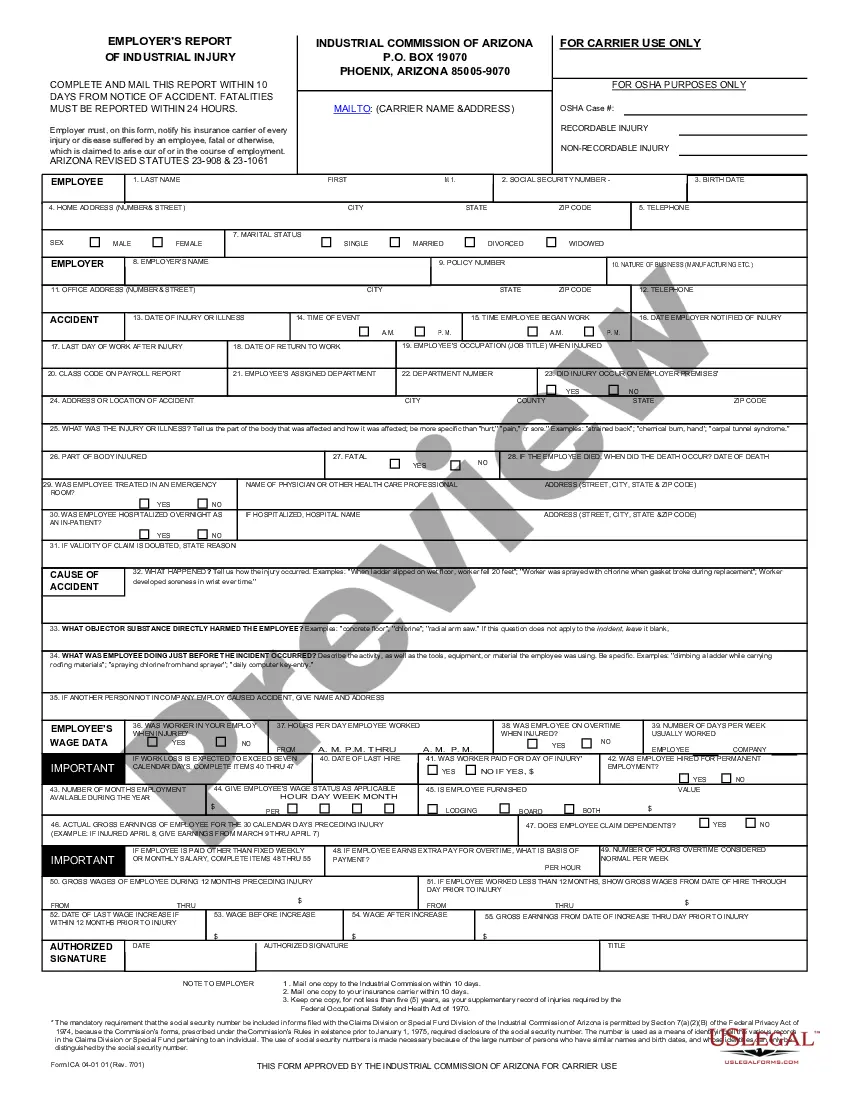

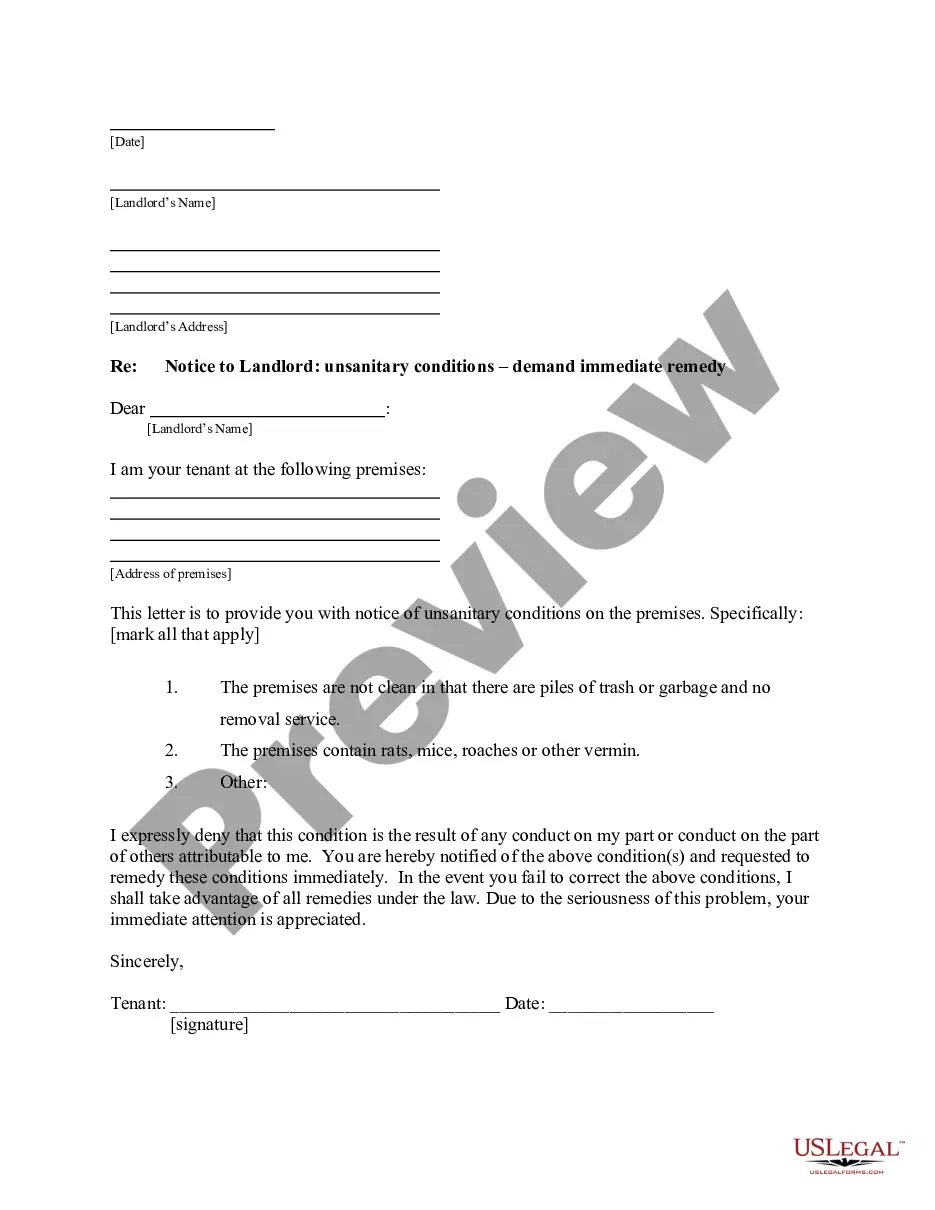

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The San Diego California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal contract that outlines the terms and conditions regarding the borrower's responsibility for direct payment of taxes, assessments, and/or insurance, thereby waiving the need for an escrow account with the lender. This agreement is relevant for homeowners in San Diego, California who wish to take control of their property-related expenses. One type of San Diego California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is the Property Tax Direct Payment Agreement. This agreement specifically addresses the borrower's obligation to make direct payments to the county tax collector for property taxes, rather than having them collected and distributed by the lender through an escrow account. Another type is the Assessments Direct Payment Agreement, which pertains to the borrower's responsibility for making direct payments to any local or special assessments that may be levied against the property. This could include assessments for public improvements, maintenance costs, or community fees. Furthermore, there is the Insurance Direct Payment Agreement, which outlines the borrower's duty to directly pay for hazard insurance coverage, flood insurance, or any other required insurance policies related to the property. By signing this agreement, the borrower assumes the responsibility for procuring and maintaining adequate insurance coverage. It is important to note that the San Diego California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender varies depending on the specific requirements of the lender and the borrower's individual circumstances. Therefore, it is crucial for both parties to carefully review and understand the terms discussed in the agreement before signing. By utilizing relevant keywords such as "San Diego California Agreement for Direct Payment of Taxes," "San Diego Agreement for Waiver of Escrow," or "Direct Payment of Assessments in San Diego," individuals seeking more information about these agreements will have a higher chance of finding relevant resources and legal documents specific to their needs.The San Diego California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal contract that outlines the terms and conditions regarding the borrower's responsibility for direct payment of taxes, assessments, and/or insurance, thereby waiving the need for an escrow account with the lender. This agreement is relevant for homeowners in San Diego, California who wish to take control of their property-related expenses. One type of San Diego California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is the Property Tax Direct Payment Agreement. This agreement specifically addresses the borrower's obligation to make direct payments to the county tax collector for property taxes, rather than having them collected and distributed by the lender through an escrow account. Another type is the Assessments Direct Payment Agreement, which pertains to the borrower's responsibility for making direct payments to any local or special assessments that may be levied against the property. This could include assessments for public improvements, maintenance costs, or community fees. Furthermore, there is the Insurance Direct Payment Agreement, which outlines the borrower's duty to directly pay for hazard insurance coverage, flood insurance, or any other required insurance policies related to the property. By signing this agreement, the borrower assumes the responsibility for procuring and maintaining adequate insurance coverage. It is important to note that the San Diego California Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender varies depending on the specific requirements of the lender and the borrower's individual circumstances. Therefore, it is crucial for both parties to carefully review and understand the terms discussed in the agreement before signing. By utilizing relevant keywords such as "San Diego California Agreement for Direct Payment of Taxes," "San Diego Agreement for Waiver of Escrow," or "Direct Payment of Assessments in San Diego," individuals seeking more information about these agreements will have a higher chance of finding relevant resources and legal documents specific to their needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.