An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

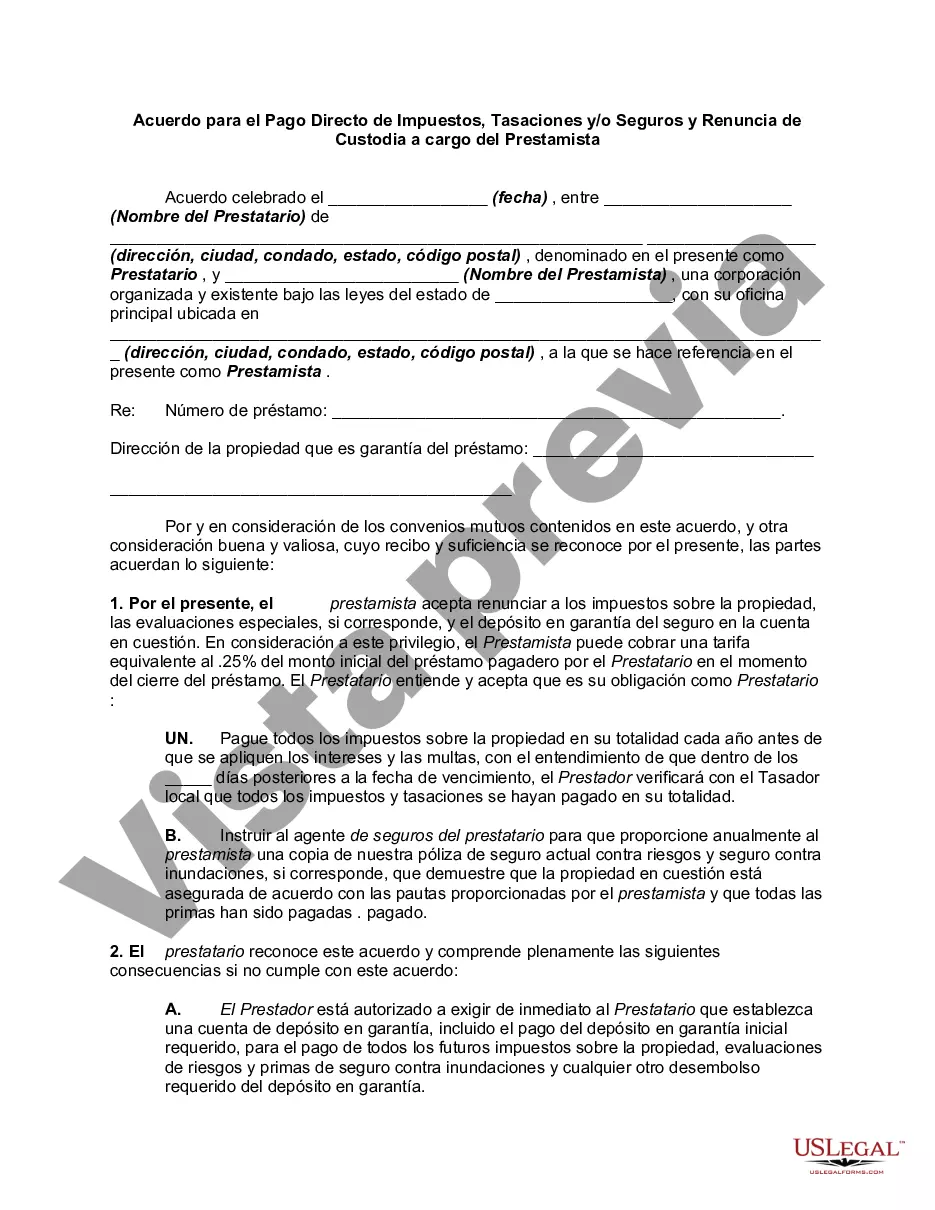

The Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the specific terms and conditions under which a property owner in Tarrant, Texas can opt to make direct payments for their taxes, assessments, and/or insurance, instead of having them placed into an escrow account held by the lender. This agreement eliminates the need for the lender to collect and manage these expenses on behalf of the property owner. By using keywords such as "Tarrant Texas Agreement," "direct payment," "taxes," "assessments," "insurance," "waiver of escrow," and "lender," it becomes evident that this document is specifically relevant to residents and property owners in Tarrant, Texas. Different types or variations of the Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may include specific provisions related to different assessments such as homeowner association fees or special assessments levied by local municipal authorities. The agreement may also vary based on the property type, such as residential, commercial, or industrial. The purpose of the Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is to allow property owners the flexibility to manage their own tax, assessment, and insurance payments. By waiving the escrow account requirement, property owners have more control over their finances and can make direct payments based on their own schedule and budget. This agreement also relieves the lender from the responsibility of collecting and paying these expenses on behalf of the property owner. It is important for any property owner considering this agreement to carefully review and understand the terms and conditions before opting for direct payment. This involves assessing the financial ability to make timely payments, ensuring the property owner is aware of the tax assessment and insurance payment deadlines, and maintaining adequate insurance coverage. Overall, the Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender provides property owners in Tarrant, Texas, with the flexibility and control over their tax, assessment, and insurance payments, while relieving the lender of the responsibility of managing an escrow account.The Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the specific terms and conditions under which a property owner in Tarrant, Texas can opt to make direct payments for their taxes, assessments, and/or insurance, instead of having them placed into an escrow account held by the lender. This agreement eliminates the need for the lender to collect and manage these expenses on behalf of the property owner. By using keywords such as "Tarrant Texas Agreement," "direct payment," "taxes," "assessments," "insurance," "waiver of escrow," and "lender," it becomes evident that this document is specifically relevant to residents and property owners in Tarrant, Texas. Different types or variations of the Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender may include specific provisions related to different assessments such as homeowner association fees or special assessments levied by local municipal authorities. The agreement may also vary based on the property type, such as residential, commercial, or industrial. The purpose of the Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is to allow property owners the flexibility to manage their own tax, assessment, and insurance payments. By waiving the escrow account requirement, property owners have more control over their finances and can make direct payments based on their own schedule and budget. This agreement also relieves the lender from the responsibility of collecting and paying these expenses on behalf of the property owner. It is important for any property owner considering this agreement to carefully review and understand the terms and conditions before opting for direct payment. This involves assessing the financial ability to make timely payments, ensuring the property owner is aware of the tax assessment and insurance payment deadlines, and maintaining adequate insurance coverage. Overall, the Tarrant Texas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender provides property owners in Tarrant, Texas, with the flexibility and control over their tax, assessment, and insurance payments, while relieving the lender of the responsibility of managing an escrow account.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.