The U.S. Bankruptcy Code also allows individual debtors who meet certain financial criteria to adopt extended time payment plans for the payment of debts. An individual debtor on a regular income may submit a plan for installment payment of outstanding debts. This is called a Chapter 13 Plan. This plan must be confirmed by the court. Once it is confirmed, debts are paid in the manner specified in the plan. After all payments called for by the plan are made, the debtor is given a discharge. The plan is, in effect, a budget of the debtor's future income with respect to outstanding debts. The plan must provide for the eventual payment in full of all claims entitled to priority under the Bankruptcy Code. The plan will be confirmed if it is submitted in good faith and is in the best interest of the creditors.

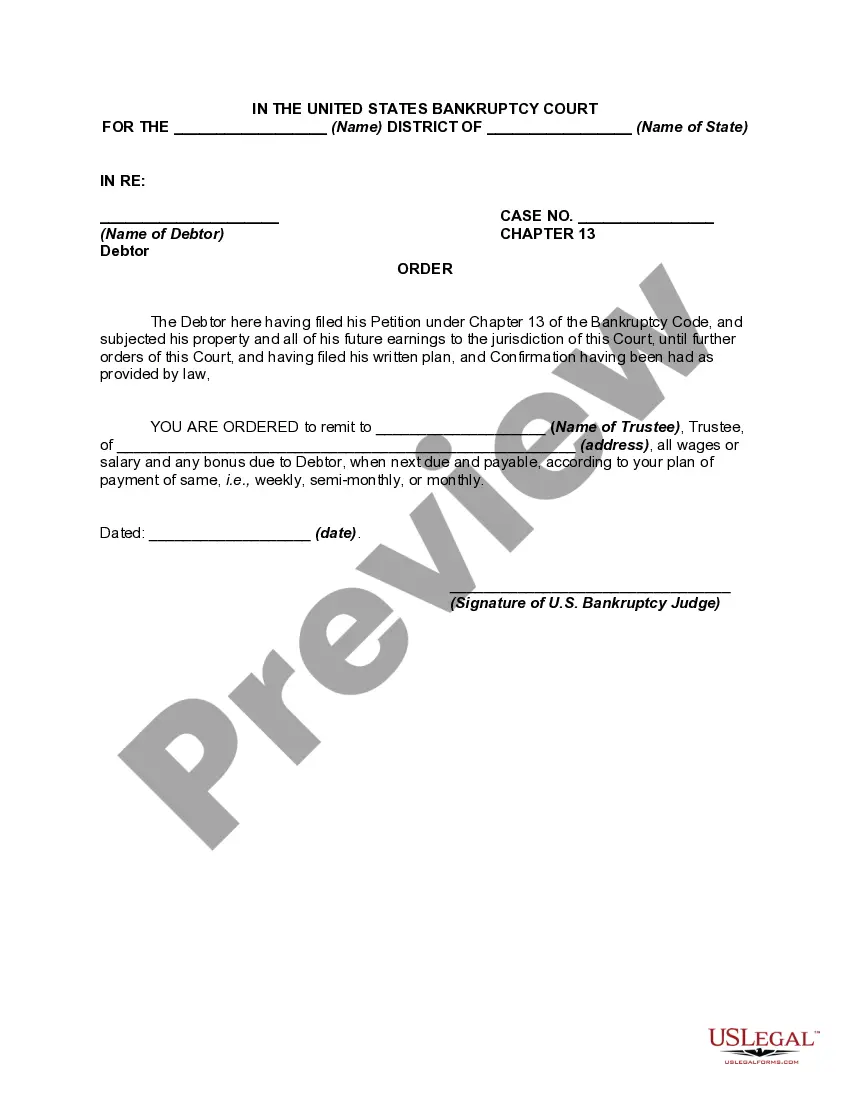

A Chapter 13 plan must provide for the submission of all or such portion of future earnings or other future income of the debtor to the supervision and control of the trustee as is necessary for the execution of the plan. After the confirmation of a Chapter 13 plan, the court may exercise its discretion and order any entity from whom the debtor receives income to pay all or part of such income to the trustee.

Maricopa County, Arizona, is the fourth-most populous county in the United States and home to the city of Phoenix. Within this jurisdiction, a Maricopa Arizona Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is an important legal document in bankruptcy cases. This order establishes the obligation of a debtor's employer to deduct a certain portion of the debtor's paycheck and remit those funds directly to the appointed trustee overseeing the bankruptcy proceedings. This type of order ensures that the debtor's income is properly distributed to cover outstanding debts and obligations as determined by the bankruptcy court. The purpose of such an order is to facilitate the debtor's compliance with their repayment plan, providing a structured means for debt resolution and creditor satisfaction. There are various types of Maricopa Arizona Orders Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee, each classified based on the specific legal framework they operate under: 1. Chapter 7 Order: This order is associated with Chapter 7 bankruptcy proceedings, also known as liquidation bankruptcy. In this scenario, the trustee is responsible for selling the debtor's non-exempt assets to repay creditors. The order mandates the employer to remit a certain portion of the debtor's wages to the trustee to facilitate orderly debt repayment. 2. Chapter 13 Order: In Chapter 13 bankruptcies, the debtor proposes a repayment plan to gradually settle their debts over a period of time, typically three to five years. The trustee supervises the implementation of this plan. A Maricopa Arizona Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee in this context ensures regular and consistent contributions to the repayment plan from the debtor's earned income. 3. Wage Garnishment Order: This type of order is typically issued when the debtor fails to adhere to bankruptcy repayment requirements or falls behind on their payment obligations. It allows the trustee to garnish the debtor's wages directly from their employer, often at a higher rate, to accelerate debt repayment. 4. Income Withholding Order: An Income Withholding Order is a Maricopa Arizona Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee issued for individuals who are subject to child support or alimony obligations. This order enables the trustee to withhold a portion of the debtor's income to fulfill their financial responsibilities towards their dependents. In summary, Maricopa Arizona Orders Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee play a crucial role in bankruptcy cases, providing legal mechanisms to ensure consistent debt repayment and fair distribution of the debtor's income. These orders vary based on the type of bankruptcy filing and aim to facilitate orderly debt resolution in compliance with the applicable laws and court-approved repayment plans.Maricopa County, Arizona, is the fourth-most populous county in the United States and home to the city of Phoenix. Within this jurisdiction, a Maricopa Arizona Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is an important legal document in bankruptcy cases. This order establishes the obligation of a debtor's employer to deduct a certain portion of the debtor's paycheck and remit those funds directly to the appointed trustee overseeing the bankruptcy proceedings. This type of order ensures that the debtor's income is properly distributed to cover outstanding debts and obligations as determined by the bankruptcy court. The purpose of such an order is to facilitate the debtor's compliance with their repayment plan, providing a structured means for debt resolution and creditor satisfaction. There are various types of Maricopa Arizona Orders Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee, each classified based on the specific legal framework they operate under: 1. Chapter 7 Order: This order is associated with Chapter 7 bankruptcy proceedings, also known as liquidation bankruptcy. In this scenario, the trustee is responsible for selling the debtor's non-exempt assets to repay creditors. The order mandates the employer to remit a certain portion of the debtor's wages to the trustee to facilitate orderly debt repayment. 2. Chapter 13 Order: In Chapter 13 bankruptcies, the debtor proposes a repayment plan to gradually settle their debts over a period of time, typically three to five years. The trustee supervises the implementation of this plan. A Maricopa Arizona Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee in this context ensures regular and consistent contributions to the repayment plan from the debtor's earned income. 3. Wage Garnishment Order: This type of order is typically issued when the debtor fails to adhere to bankruptcy repayment requirements or falls behind on their payment obligations. It allows the trustee to garnish the debtor's wages directly from their employer, often at a higher rate, to accelerate debt repayment. 4. Income Withholding Order: An Income Withholding Order is a Maricopa Arizona Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee issued for individuals who are subject to child support or alimony obligations. This order enables the trustee to withhold a portion of the debtor's income to fulfill their financial responsibilities towards their dependents. In summary, Maricopa Arizona Orders Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee play a crucial role in bankruptcy cases, providing legal mechanisms to ensure consistent debt repayment and fair distribution of the debtor's income. These orders vary based on the type of bankruptcy filing and aim to facilitate orderly debt resolution in compliance with the applicable laws and court-approved repayment plans.